After starting the week with a sharp selloff, stocks recovered most of their losses on Tuesday as the S&P 500 rose by 2.5%, driven by gains for blue-chip tech companies like Apple, Amazon, and Meta.

The rally was triggered in part by remarks that Treasury Secretary Scott Bessent delivered at a closed-door investor summit hosted by JP Morgan in Washington, D.C. As first reported by Bloomberg, Bessent told the audience that he expected the tariff situation with China to de-escalate while characterizing the ongoing standoff as unsustainable.

Investors eager for good news after weeks of volatility leaped at the Bloomberg report, which was published midday, with stock prices jumping after steadily creeping up throughout the morning.

The faltering dollar

While investors usually move out of risky assets and into the U.S. dollar during times of economic uncertainty, strengthening its price, the opposite has proven true amid President Trump’s tariff war. Fears of the U.S. government’s shifting policies have weakened the dollar against other fiat currencies, though the dollar stabilized on Tuesday as the market ticked back up. 61% of participants in Bank of America’s most recent Global Fund Manager Survey anticipated the dollar to decline in value over the next year.

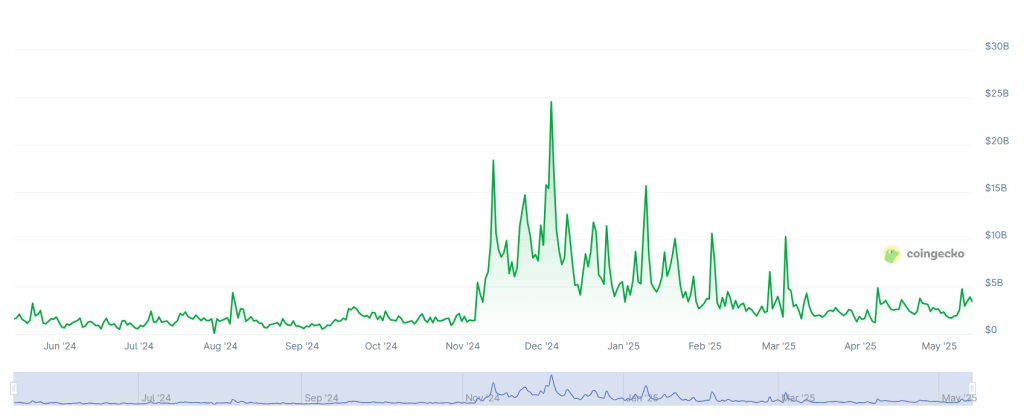

That didn’t stop alternative investment vehicles from continuing their rallies. Bitcoin, which supporters argue can serve as a hedge against government-backed assets, rose above $90,000 on Tuesday for the first time in more than a month, with some analysts arguing that it has decoupled from traditional equity markets. Gold, long viewed by investors as a safe haven amid volatility, briefly rose above $3,500 an ounce on Tuesday for the first time.

Despite Tuesday’s reprieve from the downturn, bearish signals continue to hang over the markets, including Trump’s threats to fire Federal Reserve chair Jerome Powell. In a report published on Monday, Bank of America Securities downgraded its global economic growth prediction by 0.3%, driven in part by Trump’s volatile tariff plan. “We expect a significant slowdown but not a recession,” the analysts wrote, putting the odds of a recession at 35%.

The White House continues to push the narrative that trade deals are close with partners, including Japan and India, though the reality is likely murkier. On Tuesday, Politico reported that rather than full-fledged trade deals, any agreements will likely be sketched out as “memorandums of understanding,” with negotiations continuing for months.

With earnings season in full force, market choppiness is likely to continue. The Elon Musk-led Tesla released its first-quarter results on Tuesday evening after its stock price had dropped nearly 15% over the past month. The company reported that its net income slid 71% in the first quarter amid competitive pressure from overseas and uncertainty around Musk’s role.

This story was originally featured on Fortune.com

Credit: Source link