Bitcoin (BTC) remains resilient near $93,628 as of April 25, easing just 0.5% during the Asian session. Despite minor intraday softness, the broader trend remains intact, supported by intensifying institutional interest.

BlackRock, the world’s largest asset manager, recently increased its Bitcoin holdings by 12,500 BTC, valued at $327.3 million, bringing its total exposure to approximately $1.16 billion. This move underscores growing confidence in Bitcoin as a treasury asset and macro hedge.

Meanwhile, Bitcoin’s current price still trades about 40% below its estimated intrinsic value of $130,000, according to the Energy Value model by Capriole’s Charles Edwards—suggesting long-term upside remains.

Polkadot ETF Postponed as SEC Reviews 70+ Crypto Funds

Elsewhere, the SEC has delayed its decision on Grayscale’s Polkadot (DOT) ETF, now scheduled for June 11, 2025. This is part of a broader review involving more than 70 crypto fund proposals, including ETFs tied to XRP, Solana, and Dogecoin.

While delays continue, the policy tone is softening. Institutional interest and political pressure are mounting—hinting that a more constructive ETF landscape may be approaching.

Regulatory Shifts: Green Light for U.S. Banks on Crypto

The regulatory tide appears to be turning. In a coordinated move, the Federal Reserve, FDIC, and OCC have withdrawn prior guidance that required banks to seek pre-approval before engaging in crypto-related activities.

This reversal eliminates four key warnings issued in 2022 and 2023, which had cast a chilling effect on bank participation. Going forward, banks will rely on internal risk frameworks, while regulators shift to standard supervisory monitoring—a model that promotes innovation while managing systemic risk.

What It Means for Bitcoin:

Looser banking oversight reduces institutional friction. With fewer barriers to entry, crypto-native and traditional firms alike may accelerate their integration of Bitcoin—supporting long-term demand and price stability.

ARK Invest’s $2.4 Million Bitcoin Forecast: What’s Behind It?

In its latest research update, ARK Invest projected Bitcoin could reach $2.4 million by 2030 under a bullish scenario. The base and bear case forecasts were adjusted to $1.2 million and $500,000, respectively. The bold outlook is driven by three central themes:

- Institutional Allocation: Rising participation from asset managers and corporate treasuries.

- Digital Gold Narrative: Potential for BTC to capture a significant share of gold’s $18 trillion market cap.

- Emerging Market Demand: Bitcoin’s growing role as a store of value in inflation-prone economies.

If realized, ARK’s top-end projection would imply a $49 trillion Bitcoin market cap—larger than the combined GDP of the U.S. and China.

Bitcoin Technical Outlook: Breakout or Bull Trap Near $94.7K?

Bitcoin is consolidating just below a major resistance zone at $94,750, the 0% Fibonacci level from the recent $88,461–$94,758 rally. Price action remains within a steep ascending channel, with the 50-period EMA at $91,398 acting as dynamic support.

However, the MACD histogram has begun to fade, signaling potential momentum fatigue.

Bitcoin Trade Setup:

- Buy Entry: Above $94,750 on strong bullish volume

- Targets: $96,150 and $97,500

- Stop Loss: Below $92,800

Pro Tip: This is a classic “pullback and retest” structure—wait for candle and volume confirmation before entering. Avoid chasing weak breakouts.

Bottom Line

Bitcoin continues to find firm footing above $93,000, bolstered by institutional inflows and loosening regulatory constraints. While ARK Invest’s $2.4M price target may appear ambitious, the underlying thesis—scarcity, adoption, and macro alignment—remains compelling.

As the crypto market matures, the coming months could determine whether Bitcoin enters a new paradigm—or stalls below psychological ceilings. Either way, the setup demands attention from both bulls and skeptics alike.

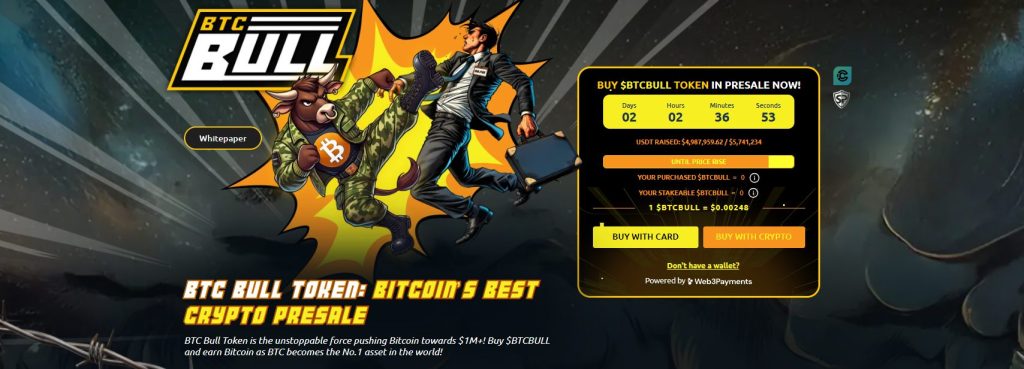

BTC Bull Token Nears $5M Mark as 83% Yield Drives Staking Momentum

Investor participation in BTC Bull Token ($BTCBULL) continues to accelerate, with the Ethereum-based project approaching a key funding milestone. As of Thursday, the presale has raised $4,987,959.62, moving closer to its next pricing threshold set at $5,741,234.

The token is currently priced at $0.00248, giving prospective buyers a narrow window to enter before the next price adjustment.

Yield-Driven Utility Meets Flexible Access

What differentiates BTCBULL from typical meme assets is its utility-focused design. The project offers a staking mechanism that delivers a projected 83% annual yield, alongside Bitcoin-based distribution rewards. Importantly, stakers can access their tokens at any time—no fixed lockups or withdrawal delays.

Latest Staking Stats:

- Total Tokens Staked: 1,268,011,229 BTCBULL

- Annual Yield: 83% APY

- Unstaking: Anytime access

This structure appeals to both passive income seekers and users looking to capitalize on potential token appreciation—without sacrificing liquidity.

Presale Snapshot and Market Positioning

The presale is entering its final stretch before the token price increases. With less than $754,000 remaining until the next tier, current buyers are securing positions ahead of anticipated upward repricing.

Presale Metrics (as of today):

- Token Price: $0.00248

- USDT Raised: $4.98M out of $5.74M target

BTCBULL blends yield-generation with upside exposure, offering a unique entry point for those navigating the evolving meme token landscape. As the funding target nears completion, the next pricing phase may arrive sooner than expected.

The post $2.4M Bitcoin by 2030? ARK Invest’s Bold Forecast Shakes Crypto Markets appeared first on Cryptonews.

Credit: Source link

U.S. Regulators Roll Back Crypto Caution Memos in Shift Toward Industry-Friendly Stance

U.S. Regulators Roll Back Crypto Caution Memos in Shift Toward Industry-Friendly Stance Summary:

Summary: