Receive free Mergers & Acquisitions updates

We’ll send you a myFT Daily Digest email rounding up the latest Mergers & Acquisitions news every morning.

3D printing promised to revolutionise production of everything from toys to biomedical implants through “additive manufacturing”. Now the hype has worn off and four leading manufacturers are in the middle of merger machinations that could slice them down to two or three.

Stratasys, 3D Systems, Nano Dimension and Desktop Metal rode a wave of investor interest in 3D printing, in which machines controlled by software build up products layer by layer. Among those buying their shares was an exchange traded fund run by high-profile tech stockpicker Cathie Wood’s Ark Investment Management — ticker symbol PRNT.

But their valuations have plummeted since early 2021 as they confront stubborn barriers to using the technology for mass-produced goods. Losing money and struggling to raise cash, they are pursuing tie-ups. The dealmaking stands out for its corporate intrigue, however, with litigation involving companies and their shareholders now playing out in the courts.

“The 3D printing industry, currently stagnating from talent churn and governance issues, needs the shock that only M&A can provide,” said Chris Prucha, a tech entrepreneur who had sold his company to Stratasys.

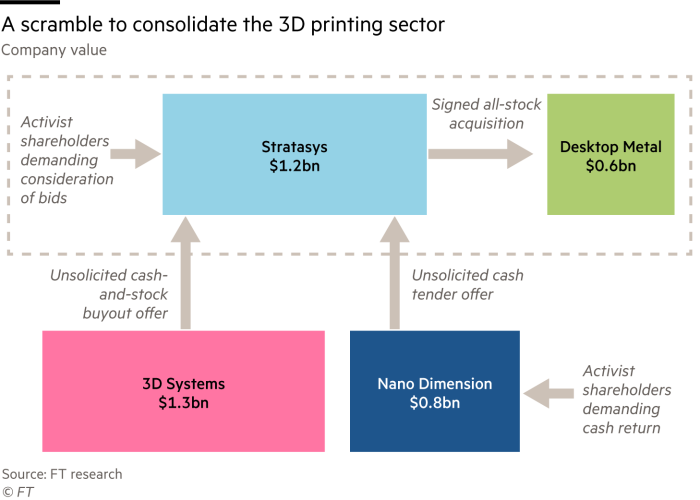

Stratasys agreed in May to pay $700mn in its stock to purchase Desktop Metal, a company in which it had invested venture capital a decade ago. Desktop Metal’s stock has collapsed to below $2 from a high of $31, reached after it went public through a deal with a blank-cheque company backed by investors. They included HPS Investment Partners and Chamath Palihapitiya, a serial promoter of special purpose acquisition companies.

However, Stratasys is a takeover target itself. 3D Systems has been seeking to acquire the Minnesota- and Israel-based company since 2021. Last week 3D criticised Stratasys’s view of Desktop Metal as “unfounded and unreasonable” while making its sixth distinct cash-and-stock offer for Stratasys.

Stratasys has not yet engaged with 3D on its latest bids, calling them “opportunistic”.

Nano Dimension also wants control of Stratasys: after announcing it had taken a 12 per cent stake in the group a year ago, it went on to launch an unsolicited tender offer to buy all of Stratasys for cash in March, later amended to say it wants to reach just a majority stake.

Nano recorded less than $50mn in revenue last year but boasts a cash balance of nearly $1bn — a sum exceeding its market capitalisation — with which to bolster its offer for Stratasys. The company raised around $1.5bn in 2020 and 2021 equity offerings with help from famous tech investors such as Wood. Her PRNT ETF swelled from less than $40mn in assets under management in June 2020 to more than $725mn by February 2021, making it a big buyer of most 3D printing stocks before eventually losing half of its value.

The activist investor Donerail Group, which has taken a 2 per cent stake in Stratasys, has described the company’s resistance to the 3D Systems and Nano bids as “fiduciary negligence” and “unconscionable”.

Stratasys has undertaken a poison pill defence to thwart Nano’s tender offer campaign, prompting Nano to file a lawsuit in the Israeli court system, which has jurisdiction over Stratasys’ corporate affairs.

Yoav Stern, Nano’s Israel-based chief executive, has made a habit of taking aim at both friends and adversaries in blunt, weekly YouTube videos.

However, Stern has also been forced to play defence. A group of activist investors, Murchinson Ltd, Anson Advisors and Boothbay Fund Management, has sought to replace his board and demanded that Nano return its $1bn cash hoard to shareholders rather than pursue Stratasys.

At a March special shareholder meeting called by Murchinson, the fund said fellow shareholders had overwhelmingly voted to remove Stern and three other directors from the Nano board. The outcome of the vote is also being litigated in an Israeli court, giving Stratasys ammunition to push back against Nano’s tender offer.

Nano has also sued its activist nemesis in a New York federal court, alleging that they had filed false and misleading regulatory disclosures and had sought to manipulate Nano’s stock price.

3D, Nano, Murchinson, Anson and Boothbay declined to comment for this article, while Stratasys and Desktop did not respond to requests for comment.

Murchinson, in a public letter this year, accused Nano of “spending its time and money acting like an activist hedge fund and not focusing on 3D printing”.

Days later, Stern responded to Murchinson on YouTube, saying that Murchinson was not a long-term shareholder. “I spend time running the company and doing these videos which is three hours a week, so no, this company is not distracted,” he said.

He said he would leave immediately if shareholders sacked him. “But until then, you are not getting the money”, he added, indicating Nano would continue to pursue Stratasys and not return cash.

He went on to warn critics: “You didn’t get me to the point where I’m angry . . . you got me to a point where I’ve got nothing to lose. And that’s a dangerous place to put a person.”

In their recent deal announcement, Stratasys and Desktop Metal projected the 3D printing market would amount to $100bn a decade from now. However, the four listed companies generate less than $2bn in revenue annually.

“Everyone is aligned on one thing: that consolidation should happen,” said one investment banker involved in the dealmaking drama. “Three of the pieces [Stratasys, 3D Systems, Nano] should be together, and the question now is, ‘What is the order of operations?’”

Credit: Source link