Bitcoin is trading close to $83,000 after a sharp drop earlier this week that briefly pushed prices down to $81,000. The latest session brought a small gain of about 0.3%, but the overall trend is still weak. Price action remains stuck in a downward channel that has been in place since November, so the short-term outlook is still negative.

Right now, Bitcoin’s market cap is about $1.65 trillion, and 24-hour trading volume is around $50 billion, which is much lower than recent peaks, dropping nearly 40%.

This drop in activity shows that traders are being careful instead of rushing to buy the dip, which is important as Bitcoin tests key technical levels.

Sellers Control Rallies Below Key Moving Averages

Looking at the charts, sellers still have the upper hand. Every recent bounce has stopped below the 50-day and 100-day EMAs, which are both moving lower. These averages now act as resistance and help keep prices inside the downward channel.

Candlestick behavior adds to this picture. The market has printed a series of long red candles, followed by smaller-bodied sessions with lower closes. This pattern points to distribution, not capitulation. Buyers are present, but they are hesitant, stepping in only after declines rather than driving impulsive rebounds.

Momentum indicators also show weak confidence. The RSI is in the low 40s, near oversold levels but without signs of a bullish reversal. This usually means demand is weak, not that sellers are finished, so prices could still move lower.

Bitcoin (BTC/USD) Technical Analysis: $80.5K or $76.4K Next?

Bitcoin price prediction seems bearish as BTC has already dropped below the $86,400 support area, which was important during December’s consolidation. Now, the focus is on $80,500, which lines up with earlier lows and the lower part of the downward channel.

If $80,500 does not hold by the end of the day, the channel suggests prices could fall further to $76,400. Based on typical price projections, Bitcoin could slowly move down to this area as leverage drops and volatility stays low.

Still, this area also represents a potential base-building zone. As long as BTC stabilizes within the $80,000–$76,000 range, the risk of forced liquidations diminishes, setting the stage for a more constructive reset later in the cycle.

Levels traders are watching closely:

- Resistance: $86,400 → $90,400 (trend shift trigger)

- Support: $80,500 → $76,400 (channel target)

What Would Signal a Trend Shift?

For now, patience remains the dominant strategy. A sustained recovery would require more than a short squeeze. The first meaningful signal would be a daily close above $90,400, reclaiming broken structure and flipping short-term momentum. That could open a recovery path toward $98,000, followed by $102,000 if volume expands.

Until then, Bitcoin is still in a correction. The main fundamentals like scarcity, network security, and long-term institutional interest are still strong, but recent price moves show the market is dealing with bigger economic pressures and reducing excess leverage.

In summary, Bitcoin’s drop to $83,000K has not changed the long-term outlook, but the upward channel suggests the correction could continue. What happens around $80,500wills likelydecidne the nextbig move.

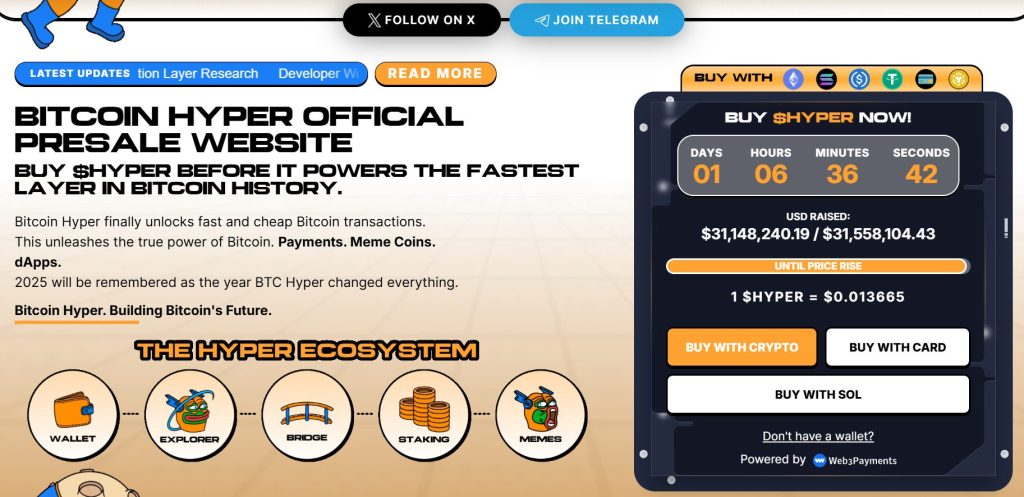

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31.4 million, with tokens priced at just $0.013665 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

Credit: Source link