Receive free Global Economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Global Economy news every morning.

As evidence mounts that global economic activity is slowing, economists, financial markets and most central banks have become convinced that no further interest rate rises will be needed.

This week policymakers in the US, UK, Japan, and Switzerland all decided to keep rates on hold. Central bankers stressed the need to hold their nerve rather than tighten policy further as inflation continues to fall in most western nations.

“We have reached a milestone in the global monetary policy cycle,” said Jennifer McKeown, chief global economist at Capital Economics. “The global monetary tightening cycle has ended.”

For the first time since the end of 2020, more of the world’s 30 largest central banks are expected to cut rates in the next quarter than raise them, the consultancy said.

Financial markets have got the message: traders now price in no further rate rises from most major central banks and cuts by those in many emerging economies.

Nathan Sheets, chief economist at US bank Citi, said the global economy was approaching a “transition point” of lower growth and inflation.

“We’re seeing evidence of a new regime characterised by gradual disinflation and decelerating growth,” Sheets said.

The change in attitude follows reports of a slowdown in inflation in many countries and OECD forecasts showing the steep increase in interest rates over the past two years and a recent rise in oil prices to around $95 a barrel were generating “increasingly visible” signs of slowing growth.

Central banks are beginning to respond to this data. Many emerging economies have started cutting rates while decisions to hold rather than raise borrowing costs at the Bank of England and Swiss National Bank surprised economists.

Monetary policymakers in leading economies are not yet willing to talk about the possibility of rate cuts and are seeking to hold firm until there is more certainty that they have restored price stability.

The European Central Bank raised borrowing costs last week, but Philip Lane, its chief economist, said on Thursday that interest rates were on track to defeat inflation providing they were “maintained for a sufficiently long duration” at current levels. It was the bank’s strongest signal so far that eurozone rates are likely to have peaked.

The Bank of England members who voted to hold rates also stressed the need to keep monetary policy “restrictive” until material progress had been made against inflation, rather than pushing for further tightening of policy.

In the US, Fed chair Jay Powell reaffirmed the central bank’s belief that it needs to keep rates higher for longer to account for the fact that growth has held up surprisingly well in the world’s largest economy.

Richard Clarida, who previously served as the Fed’s vice-chair and is now at bond manager Pimco, said this approach reflected the central bank’s “resolve” to insure against inflation proving persistent. He said the next moves by the Fed, ECB and BoE would all be “data-dependent” and they would all be “jealously guarding” their reputations for price stability.

Still, many economists questioned whether the Fed will need to be as aggressive on rates as US prices stabilise, especially given a tightening of financial conditions that many believe could offset the need for a final rise projected by officials in their updated economic forecasts published this week.

Powell made clear that the Fed’s decision to hold rates steady should not be interpreted as a signal the central bank thought it had reached the end point of its tightening campaign.

But the rosier outlook, especially on growth and unemployment, appeared fanciful to some. Monica Defend, head of the Amundi Institute, warned: “The Fed has done too much and this amount of lagged tightening will harm the economy eventually.”

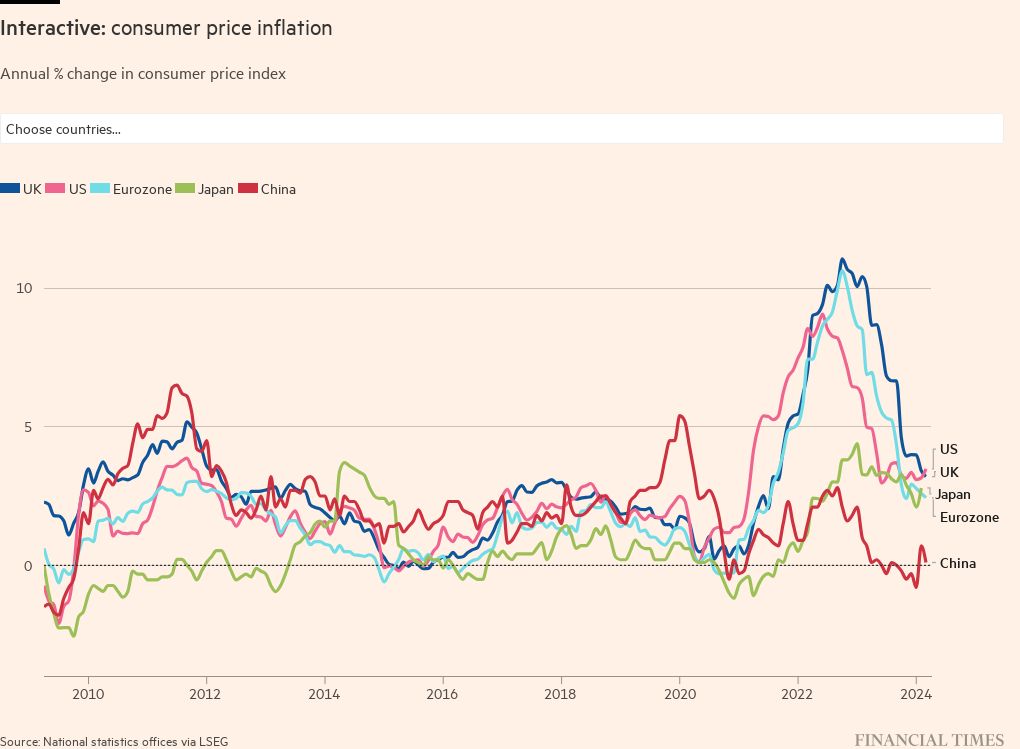

The pause in rate rises comes as inflation has eased sharply in many regions. In the US, the pace of price growth has more than halved from a peak of 9.1 per cent in June 2022 to 3.7 per cent last month.

In some Baltic and eastern European countries, inflation is down by more than 10 percentage points from the peak. In the coming week official data is expected to show that eurozone inflation fell close to a two-year low of 4.6 per cent in September, down from 5.2 per cent in August and a peak of 10.6 per cent last October.

At the same time, economic activity has weakened. September’s purchasing manager indices, a key measure of economic performance, indicated weakness in the UK and the eurozone, while the US registered a further slowdown.

Credit: Source link