The sudden collapse of Silicon Valley Bank and the subsequent failures of Signature and First Republic have focused attention on the US regional banking sector, as investors and policymakers looked for other lenders that might share the same vulnerabilities. The KBW regional banks index has dropped nearly 30 per cent since early March.

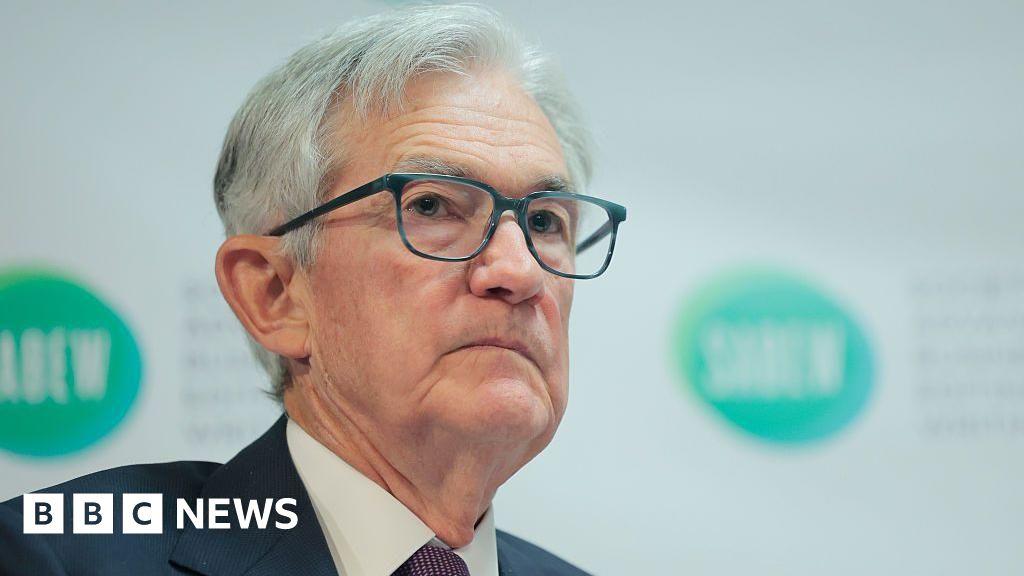

US Federal Reserve Chairman Jay Powell said this week that he believed that Monday’s sale of First Republic’s loans and assets to JPMorgan Chase was “an important step toward drawing a line under that period of severe stress”, adding that the deposit outflows that followed SVB’s demise “have really stabilised now”. But the share prices of some institutions remain profoundly depressed.

The term regional bank covers a diffuse and diverse group of institutions. They sit in the middle to upper tier of a US banking sector that includes 5,000 lenders and ranges from JPMorgan, with $3.7tn in assets, to tiny one-branch community banks.

A Financial Times analysis considered publicly traded banks with $40bn to $400bn in assets and highlighted those that have seen the largest fall in total shareholder return since March 8, the day SVB really began to wobble. We then gathered data that illuminates each institution’s perceived strength, size and business model.

Although some banks have issued updated figures, the chart used numbers from March 31, the last reporting date, in order to provide consistency on specific issues that have been cited as potential causes of financial stress.

Rapid deposit outflows, particularly from accounts too large to be covered by the government insurance scheme, were the main reason the Federal Deposit Insurance Corporation shut down SVB, Signature and First Republic.

SVB’s problems were exacerbated by large unrealised losses on securities holdings that suddenly crystallised when it needed cash to meet deposit outflows. Commercial real estate and lending to that sector is highly vulnerable to rapidly rising interest rates.

Price change — The percentage drop of the bank’s share price since March 8th, two days before SVB failed, until May 5th. (Factset)

Price-to-Book — The ratio compares a bank’s total market value to the value it says all of its loans, investments and other assets, minus its debt, are worth. (Factset)

Uninsured deposits — The percentage of deposits at each bank above the insured level of $250,000 as of March 31. (FDIC and company reports)

Commercial real estate as a percentage of total loans — The percentage of loans to owners of commercial properties, like office buildings or shopping malls, as of March 31. CRE is defined differently by different banks and we have used for the most part the figures presented by the banks in their most recent earnings reports. FNB, Old National, Pinnacle Financial Partners and SouthState present figures for CRE and for owner occupied CRE, which we have combined in the table. PacWest included CRE and multi-family CRE, most commonly taken to mean apartment buildings, which we again combined. Cullen/Frost Bankers and First Republic did not report a figure so we have presented the most recent figure they filed with the FDIC.

Unrealised losses — The value in billions of the paper losses that banks estimate they have incurred on their bond portfolios as of March 31. (FDIC)

Total Deposits and the Change in Quarterly Deposits are as of March 31. (FDIC)

*First Republic was closed by the FDIC at the start of May, with most of its assets and deposits sold to JPMorgan. Silicon Valley Bank and Signature Bank were excluded as they had both failed before reporting March 31 numbers.

Credit: Source link