The Internal Revenue Service is sending more than 20,000 letters rejecting questionable claims for the Employee Retention Credit as it continues to combat scammers and promoters encouraging businesses to file claims for the pandemic tax credit.

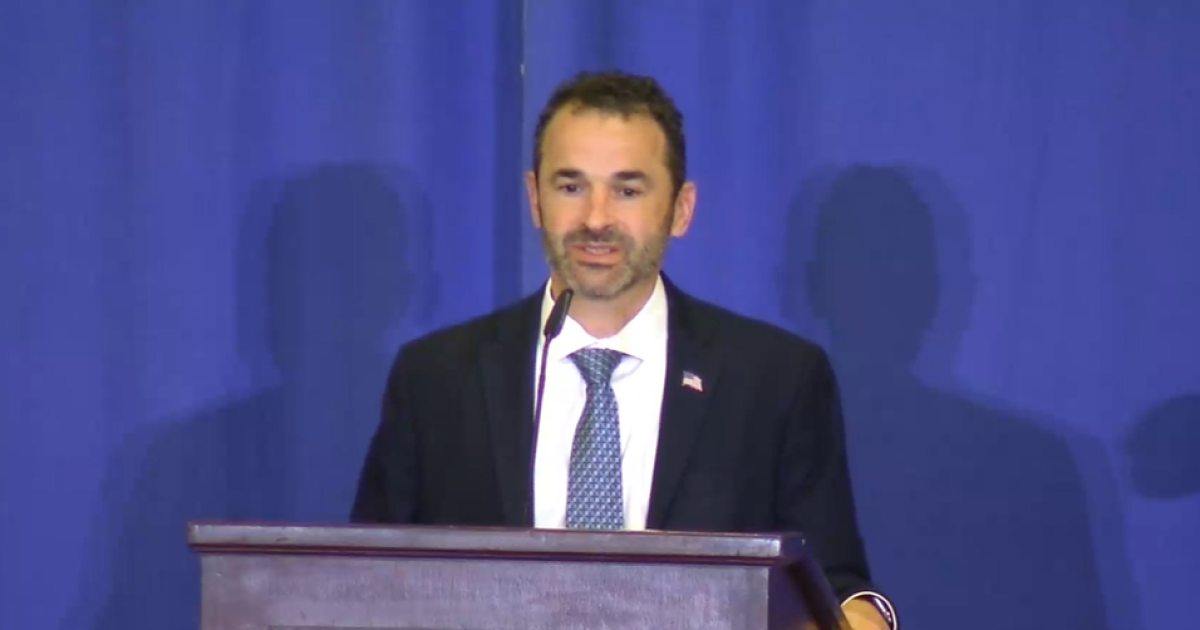

In September, the IRS declared a moratorium on processing new ERC claims through the end of the year after receiving a flood of claims pushed by so-called “ERC mills” advertising the tax credit on TV, radio, billboards and robocalling pitches. At the time, IRS Commissioner Danny Werfel said the IRS has received around 3.6 million ERC claims, and its inventory of open claims was over 600,000, nearly all of which had been received within the past 90 days.

In October, the IRS offered a process for businesses to withdraw any dubious ERC claims before they face penalties and encouraged tax professionals to work with their clients to help them through the process. Later this month, the agency plans to offer a separate voluntary disclosure program allowing those who received questionable payments to come forward and avoid future IRS action. Now the IRS is sending out an initial round of 20,000 disallowance letters, with more on the way.

After an initial review this fall, the IRS found that a large number of taxpayers did not meet basic criteria for the credit. Starting this week, taxpayers who are ineligible for the credit will begin receiving copies of Letter 105 C, Claim Disallowed. The letters will cover those taxpayers who are deemed to be ineligible for the ERC either because their entity didn’t exist or didn’t have employees for the time period when the credit was claimed.

“With the aggressive marketing we saw with this credit, it’s not surprising that we’re seeing claims that clearly fall outside of the legal requirements,” Werfel said in a statement Wednesday. “The action we are taking today is part of an initial set of steps in our compliance work in this area, and more letters will be going out in the near future, including both disallowance letters and letters seeking the return of funds erroneously claimed and received. As we continue our audit and criminal investigation work involving the Employee Retention Credits, we continue to urge people who submitted a claim to review the rules with a trusted tax professional. If they filed an inaccurate claim, we urge them to consider withdrawing their pending claim or use the upcoming disclosure program to repay improper refunds to avoid future action.”

The IRS is working on hundreds of criminal cases, and thousands of ERC claims have been referred for audit.

The mailing reflects only part of the IRS’s ongoing review of ERC claims. Within this group, two categories of claims have been identified and are being disallowed:

- Entity not in existence during period of eligibility: The ERC applies to qualified wages for periods between March 13, 2020, and Dec. 31, 2021. Entities established after Dec. 31, 2021, are not entitled to the ERC under the law passed by Congress.

- There are no paid employees during the period of eligibility: The ERC is intended as a credit against qualified wages paid. Entities that did not pay any wages are not eligible for ERC.

The disallowance letter will explain that a taxpayer who disagrees with the disallowance can respond with documentation supporting their eligibility or claim amount, or they can file an administrative appeal.

The disallowance letters aim to help ineligible taxpayers avoid audits, repayment, penalties and interest, protect taxpayers by preventing an incorrect refund from going to an ERC promoter, and save IRS resources by disallowing incorrect credits before they enter the audit process.

The IRS plans to send additional letters beyond the disallowance letters. It’s also finalizing plans for a special voluntary disclosure program involving ERC claims that will be announced later this month.

For more information on ERC eligibility, see the ERC frequently asked questions and the ERC Eligibility Checklist, which is available as an interactive tool or as a printable guide.

Credit: Source link