The Public Company Accounting Oversight Board found problems in its first audit firm inspections in China, after reviewing the audits last year of KPMG Huazhen LLP in mainland China and PricewaterhouseCoopers in Hong Kong, following longtime efforts to gain access to inspect firms in China.

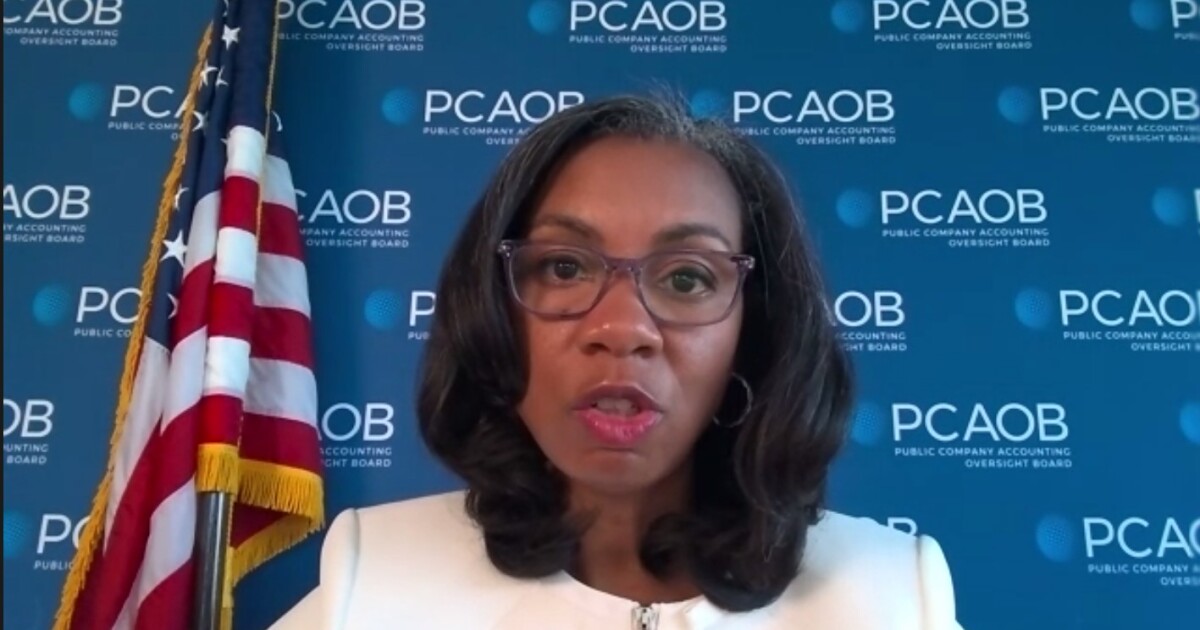

“Both reports show unacceptable rates of Part I.A deficiencies, which are deficiencies of such significance that PCAOB staff believe the audit firm failed to obtain sufficient appropriate audit evidence to support its work on the public company’s financial statements or internal control over financial reporting,” PCAOB chair Erica Williams said during a press conference Wednesday.

She noted that the PCAOB inspected a total of eight engagements in 2022 – four at each firm – including the types of engagements that Chinese authorities had previously denied the PCAOB access, such as large state-owned enterprises and issuers in sensitive industries.

The PCAOB inspectors found Part I.A deficiencies in 100% (four of four) of the audit engagements reviewed at KPMG Huazhen and 75% (three of four) of the audit engagements reviewed for PwC Hong Kong.

“As I have said before, any deficiencies are unacceptable,” said Williams. “At the same time, it is not unexpected to find such high rates of deficiencies in jurisdictions that are being inspected for the first time. And the deficiencies identified by PCAOB staff at the firms in mainland China and Hong Kong are consistent with the types and number of findings the PCAOB has encountered in other first-time inspections around the world.”

She referred to the Holding Foreign Companies Accountable Act, which Congress passed in 2020 in an effort to force countries like China to allow access to PCAOB audit firm inspectors, with the threat of the Securities and Exchange Commission delisting companies whose audit firms hadn’t been inspected for three consecutive years.

“The fact that our inspectors found these deficiencies is a sign that the HFCAA was effective and the inspection process worked as it is supposed to,” said Williams. “We identified problems so now we can begin the work of holding firms accountable to fix them. Today’s reports are a powerful first step toward accountability. By shining a light on deficiencies, our inspection reports provide investors, audit committees, and potential clients with important information so they can make informed decisions and hold firms accountable. And the power of transparency applies public pressure for firms to improve.”

She added that it was only the beginning of the PCAOB’s work to inspect and investigate firms in mainland China and Hong Kong.

“Our enforcement teams continue to pursue investigations, and inspectors have begun fieldwork for 2023’s inspections,” said Williams. “We anticipate fieldwork will continue off and on throughout most of the year, which is common practice for inspections such as these in jurisdictions around the world.”

The two firms inspected by the PCAOB last year audited 40% of the total market share of U.S.-listed companies audited by Hong Kong and mainland China firms, and Williams believes the PCAOB is on track to hit 99% of the total market share by the end of this year.

“So, there is no question that the PCAOB is prioritizing inspections that are the most relevant to investors on U.S. markets — because protecting investors is what this is all about,” she added.

Last year, Congress passed legislation shortening the timeline from three years to two years for PCAOB access to foreign audit firms, and she noted that provided important leverage as the PCAOB continues to demand complete access to inspect and investigate firms headquartered in mainland China and Hong Kong without loopholes and no exceptions.

“As I have said before, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access — in any way and at any time — the board will act immediately to consider the need to issue a new determination,” said Williams.

Credit: Source link