Bitcoin (BTC) has made a significant move in the market as it shattered the crucial $27,200 level.

This breakout has sparked speculation among traders and investors about the future direction of Bitcoin’s price.

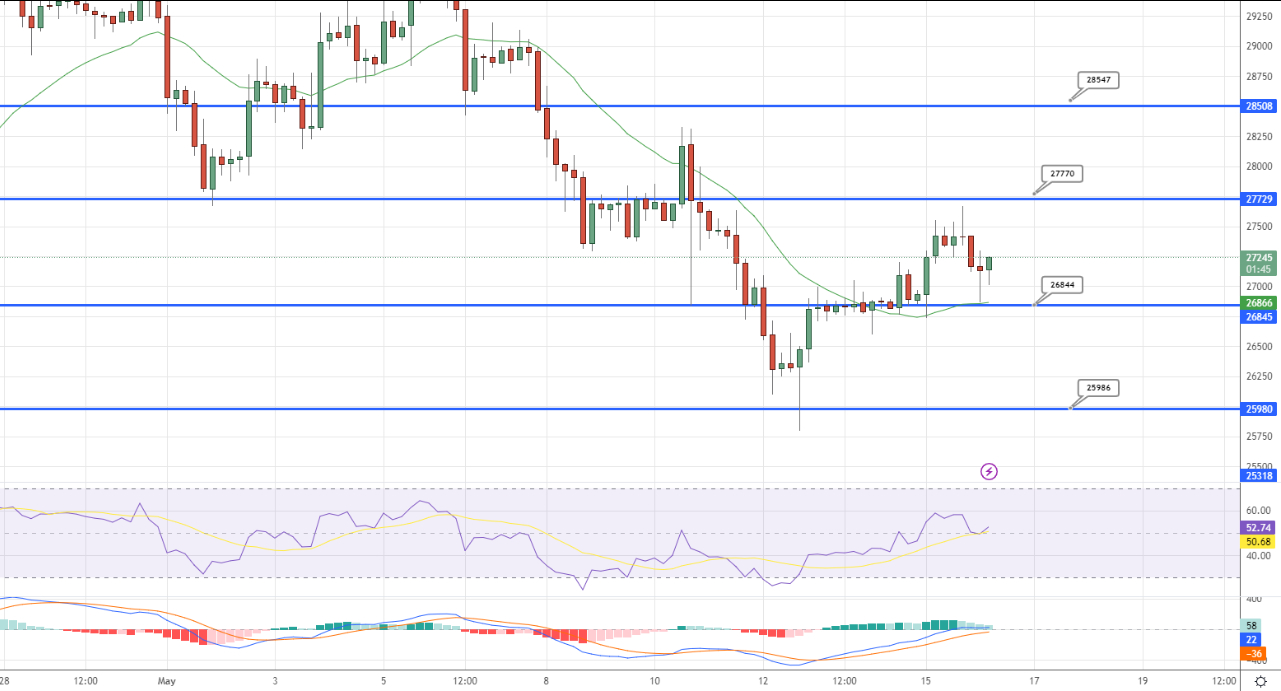

One key indicator to watch in the coming days is the 50-day Exponential Moving Average (EMA), which has the potential to act as a support level and trigger a potential bounce-off.

As Bitcoin continues its price action, market participants eagerly await further developments to assess the strength of the current bullish momentum.

Paul Tudor Jones: Bitcoin in the US Faces “Real Problem”

Billionaire hedge fund manager Paul Tudor Jones believes that Bitcoin is facing significant challenges in the United States due to the hostile regulatory environment.

Furthermore, his expectation of lower future inflation diminishes the positive outlook for the cryptocurrency.

Taking these factors into account, Jones expressed doubts about Bitcoin’s attractiveness in the coming months.

The regulatory landscape in the United States has undergone changes following the downfall of FTX in November 2022, leading to increased caution surrounding the cryptocurrency market.

Recent statements from hedge fund manager Paul Tudor Jones demonstrate a more cautious stance towards Bitcoin compared to his previous remarks.

He emphasized the importance of holding cash while expressing confidence in the Federal Reserve’s ability to address concerns about inflation.

While Jones acknowledged the impending challenges for Bitcoin, he also expressed belief in its long-term potential.

He noted that its main appeal lies in the fact that humans cannot manipulate its supply, which is why he intends to hold onto his Bitcoin holdings.

Crypto Investment Funds Experience 4 Consecutive Weeks of Outflows

According to a report published by CoinShares on Monday, Digital Asset Investment Funds experienced net outflows of $54 million last week, marking the fourth consecutive week of outflows.

The consistent outflows of such a significant amount indicate that the negative sentiment is not limited to a few investors, but rather more and more individuals are divesting from crypto investment funds.

The report highlights that out of the $54 million exiting the market, $38 million belonged to Bitcoin-related products.

In the past four weeks, the total outflows of Bitcoin have reached $160 million, accounting for approximately 80% of the total outflows across all cryptocurrencies during the same period.

As the net outflows of crypto investment funds continue to increase, cryptocurrency prices have experienced a notable decline, falling from $28,000 to $26,000 within a span of 10 days.

US Debt Ceiling Negotiations and Retail Sales Data Influence the USD Market

On Tuesday, the US Dollar Index (DXY), which measures the value of the greenback against a basket of six major currencies, rose by 0.04% to reach 102.45.

Today, the US Economic Docket will release a highly influential report on Retail Sales for the month of April. It is expected that Retail Sales in April will show a growth of 0.8%, with Core Retail Sales projected to increase by 0.5%.

In addition, crucial US Debt Ceiling Talks are set to commence between House Republicans and the White House on Tuesday.

President Joe Biden is scheduled to meet with House Speaker Kevin McCarthy and other congressional leaders to discuss the debt ceiling.

On Monday, US Treasury Secretary Janet Yellen reiterated her concerns, stating that the US could potentially default on its obligations in early June if Congress fails to take action.

The US dollar has been gaining some bets ahead of the release of the US debt ceiling talk’s results and the US Retail Sales data on Tuesday.

Bitcoin Price

Bitcoin is currently trading at $27,126, experiencing a 0.48 percent decrease on Tuesday. Following a two-day recovery, the BTC/USD pair faced some pressure on Tuesday, influenced by mixed sentiment prevailing in the market.

The $26,800 resistance level on the four-hour chart, which has now turned into a support level, presents a potential reversal point for Bitcoin.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), two important technical indicators, currently suggest that the market is coming into a buying zone.

This suggests that if Bitcoin manages to hold above the $26,800 level, there is a high probability of a bullish rebound targeting $27,800 or $27,500.

It is worth noting that the 50-day Exponential Moving Average (EMA) acts as a significant resistance point around $27,500, indicating that a bearish sentiment still prevails in the market.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

The Cryptonews Industry Talk team has curated a list of promising cryptocurrencies for 2023 that show strong prospects. These cryptocurrencies exhibit substantial potential for growth in the near and distant future.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

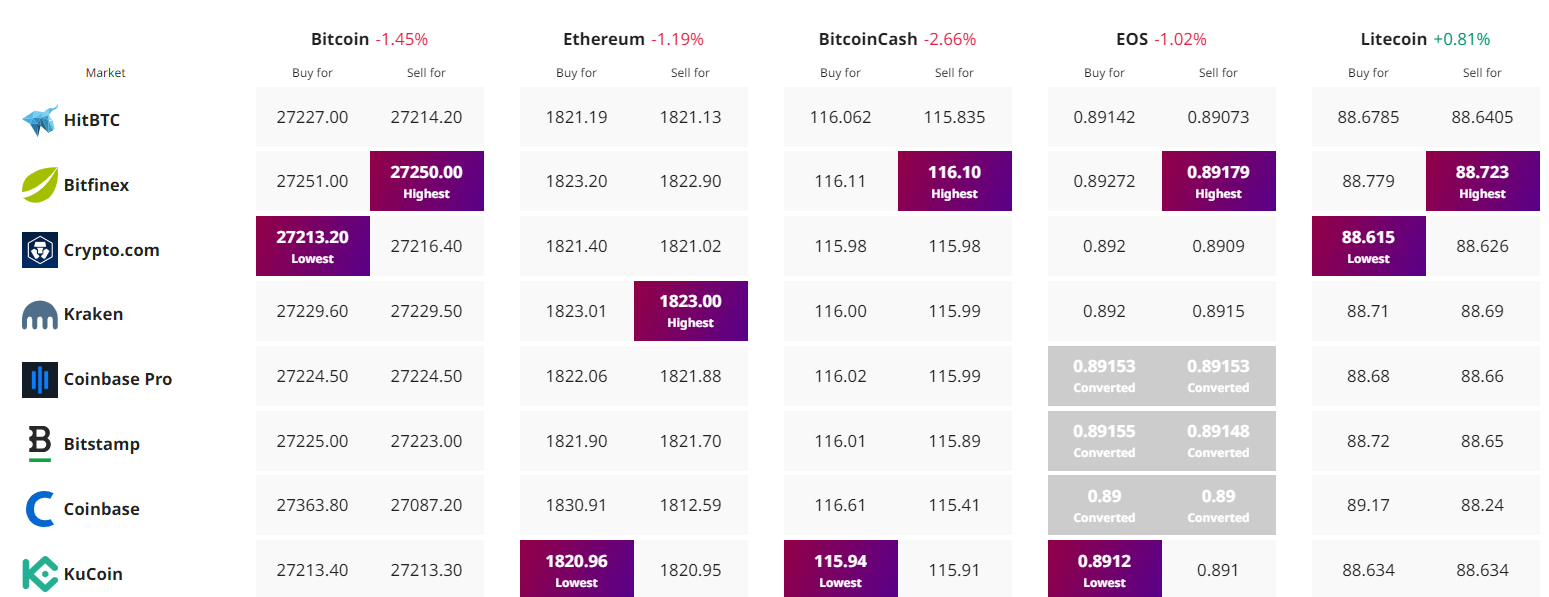

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link

-May-01-2023-08-12-13-4077-PM.png#keepProtocol)