Capital requirements for banks are yielding tax-advantaged gains for financial advisors and their clients in the form of preferred securities — a bond that shares some characteristics with stocks.

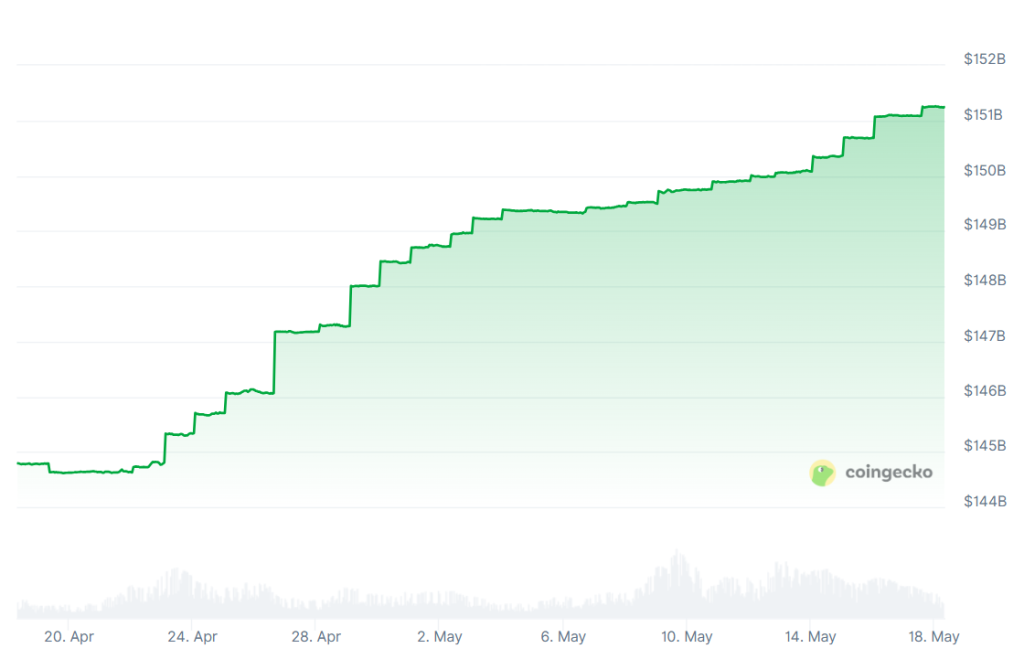

Investments in the fixed-income products are growing by billions of dollars due to the appeal of after-tax returns that are favorable to municipal, investment-grade corporate and high-yield bonds, according to

READ MORE:

Risks in the asset class include their subordination in the default scenario to senior tranches of debt, crises like the

“It’s popular with financial advisors and retail investors,” he said, noting how individual clients and wealth management professionals have become “very focused on

Other large asset and wealth management firms are taking notice of the possible opportunities.

“Investors that are looking for income and are willing to take some risk for higher yields could consider preferreds, but investors with more conservative-to-moderate risk tolerances might want to consider investment-grade corporate bonds instead,” Schwab Director Collin Martin wrote in a March report on the asset class. “Investment-grade corporate bonds offer average yields of 5% or more with less credit risk than preferreds. For those considering preferreds, we always suggest that they be considered long-term holdings given their long maturities.”

At that time, Schwab’s outlook for them remained “positive,” but Martin’s note pointed out that “it may be difficult to replicate the strong returns of the past few quarters.”

READ MORE:

In

“These financial institutions can likely weather any potential recessionary storm while continuing to pay dividends on their preferred securities,” he wrote. “While we still recommend the majority of fixed income exposure to be allocated to core bonds, for those income-oriented investors willing to take on some additional credit risk, preferred securities may be an attractive investment to consider.”

Alongside the after-tax income, the preferred securities carry a “low correlation to traditional fixed income” and comparable pretax returns to U.S. junk bonds, according to

“In the [investment-grade] fixed income universe, few alternatives can match the high potential after-tax yields of preferreds,” the report by Lynyak and Parametric Director James Benadum said. “With their unique structure and lower correlation, preferreds are an attractive complement to traditional fixed income, and

READ MORE:

The active management can also help keep investors away from riskier holdings in small banks, Lynyak noted. Most preferred securities receive investment-grade ratings that are just below the senior debt, and default rates on the products have averaged less than 1% per year — which is about the same as comparably rated corporate bonds.

“You’re getting a coupon at 20% instead of 37% and a lot of it in very solid names,” Lynyak said. “For taking some of the subordination risk, some of the financial exposures, I think you’ve got potential for some outsize returns.”

Credit: Source link