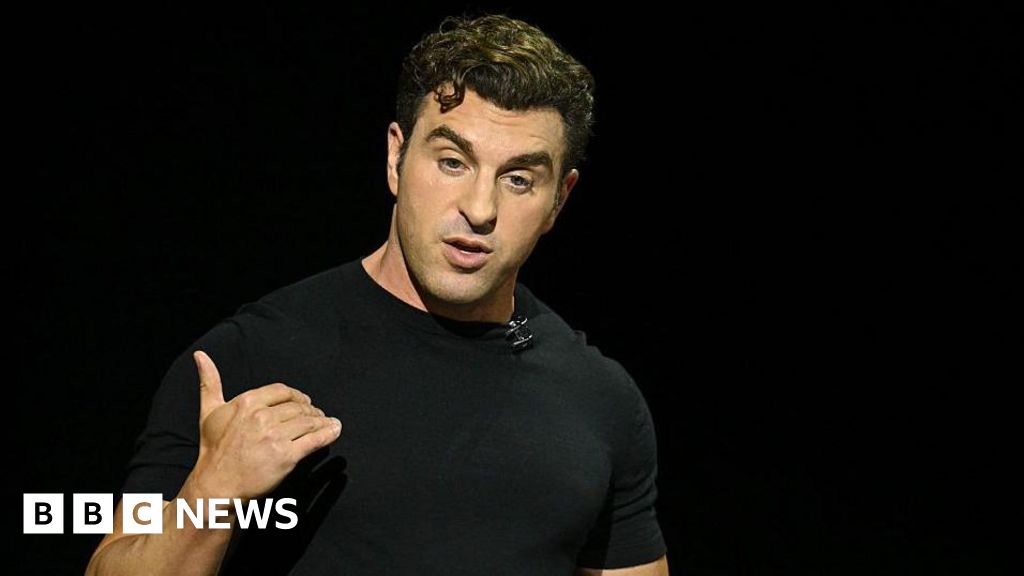

Fundstrat Global Advisors cofounder Tom Lee was among the few voices on Wall Street last year who predicted a stock market surge while most of his peers saw a slump amid widespread expectations for a recession.

But he—and the U.S. economy—proved the doomsayers wrong. In fact, among the forecasters surveyed by Bloomberg, Lee’s call in 2023 turned out to be the most accurate.

And this year, he’s still calling his shots and nailing them. In early June, he said the S&P 500 would hit 5,500 by the end of the month. As of Friday’s close, it was at 5,464.62.

Now, he’s got a longer-term forecast, and it’s a whopper: by the end of this decade, Lee said the S&P 500 could hit 15,000, representing upside of more than 170%.

On a recent episode of Bloomberg’s Odd Lots podcast, which was recorded on Tuesday, he began by explaining his evidence-based approach to forecasting, which looks across history and across assets. He said the bond market is smarter than the stock market: “That’s why they say equities are the land of C students.”

He also believes investors can’t fight the Federal Reserve and focuses more on themes that will drive growth, such as how millennials are reshaping the economy, the global labor shortage that will boost AI and tech stocks, as well as energy security and cybersecurity. By picking the strongest stocks within each theme, he has outperformed the market every year since 2019, Lee said.

Wall Street typically underestimates the impact of new technologies, which are usually adopted first by younger people in their teens and 20s while most top investment professionals are in their 40s and 50s, he added, noting that cell phones were initially dismissed as toys for the rich. Something similar is happening with AI.

“The adoption rate of AI is staggering, but the use case is important because there’s a labor shortage,” Lee said. “So to me, I think it’s very likely we’re underestimating how much revenue all these companies will make.”

And as the demand for workers continues to outstrip supply, AI will become more critical. By end of decade, he estimated the global labor shortage will be equivalent to 40 million workers, or about $3 trillion worth of wages. Considering that most of automation is from hardware like semiconductors, that means whoever is supplying the chips might have $2 trillion in revenue, he explained.

Eventually, technology will represent 40%-50% of global stock market weighting, up from about 20% today, Lee said.

“In a normalized world, if this is a normal S&P cycle following demographics, I could provide a chart later, S&P should be potentially 15,000 by the end of the decade,” he said. “As you move into longer timeframes, that’s probably where I think we’re moving towards.”

The stock market is already heavily concentrated on tech and AI stocks, with Nvidia alone accounting for more than a third of the S&P 500’s gains this year. Meanwhile, Wall Street is scrambling to keep up with the market’s relentless rally, with more analysts raising their year-end targets.

Such bullishness and market concentration have raised concerns that the AI hype is a sign of a bubble about to pop. But Lee downplayed those worries, pointing to key differences between earlier bubbles like the dot-com boom and bust.

He noted that Nvidia has a much steeper competitive advantage than Cisco did during the early stages of the internet boom. And unlike the dot-com bubble, there is a lack of overly hyped IPOs today, he added.

Lee isn’t the only Wall Street bull making bold predictions. Ed Yardeni has been pounding the table about another “Roaring 20s” super-cycle and has said the S&P 500 would jump to 6,000 by next year.

And by the end of the decade, he said the stock index could reach 8,000—not as high as Lee’s estimate but still good enough for a 46% jump.

Credit: Source link