Key Takeaways:

- Binance’s leverage adjustments triggered cascading liquidations, leading to ACT’s sharp price drop.

- The ACT team emphasized the crash was market-driven, not due to project flaws.

- This incident has raised concerns about the risks of sudden exchange policy changes on token stability.

Act I The AI Prophecy (ACT), a token associated with the eponymous project focused on artificial intelligence, released a post-mortem about the fall of their token on Wednesday..

On Tuesday, the token experienced a sudden and severe price drop, plunging 58% from $0.19 to $0.08 in less than an hour. According to CoinGecko data, the token’s market capitalization shed $96 million.

ACT Team Addresses Crash, Says Liquidations Triggered Sell-Off

The sharp decline coincided with Binance’s update to leverage and margin tiers for multiple tokens, including ACT.

The adjustment triggered a wave of liquidations, with blockchain analytics platform Lookonchain reporting that a whale was liquidated for $3.79 million at $0.1877.

The impact of these liquidations intensified selling pressure across the market.

In response, Act I addressed the community, assuring that the project was investigating the situation and working with the relevant parties, before then releasing this latest report.

According to the team, Binance’s leverage adjustments were announced with short notice, forcing traders and market makers with large positions to close or downsize, leading to cascading sell-offs.

Binance’s preliminary findings indicated that four users, including three VIP traders and one non-VIP, collectively sold over $1 million worth of ACT on the Binance spot market, accelerating the price decline.

Act I emphasized that the crash was not due to any internal failure or fundamental flaw in the project.

“No single party appears to have profited disproportionately from this sequence of trades,” the team stated.

It also clarified that the full circulating supply of ACT is live on the open market, meaning centralized exchanges like Binance cannot restrict user behavior once tokens are held in personal accounts.

Despite the turbulence, Act I reaffirmed its commitment to its long-term mission of integrating artificial intelligence into decentralized ecosystems.

“Although we are unable to directly impact the price of the token, we remain focused on our core mission: to build real AI infrastructure for Web3,” the team stated.

The project plans to present its developments at Token2049 later this month.

Act I acknowledged the frustration among its holders but remained steadfast in its goals.

“This incident, while difficult, does not change our fundamentals, our partnerships, or our long-term vision,” the statement read.

“If anything, it has made us double down on decentralization, transparency, and resilience.”

As the project works to regroup after this market event, the token’s price continues to face pressure in the broader market.

ACT Token Bleeds 70% in a Week, CZ Urges AI Projects to Build First

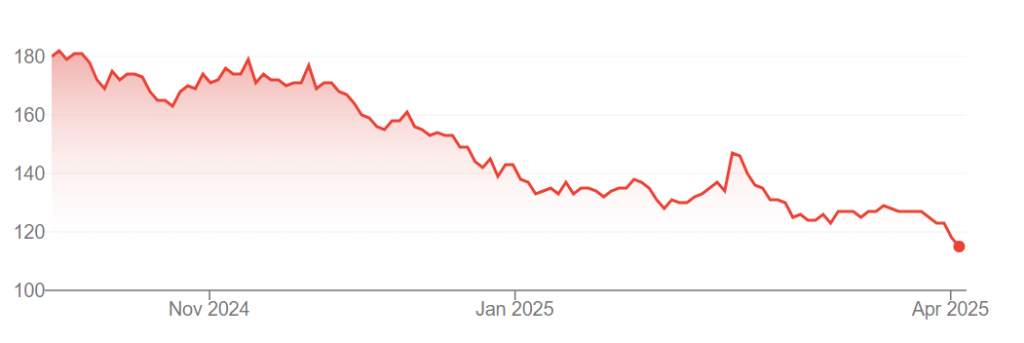

The sell-off in Act I The AI Prophecy (ACT) has intensified, with the token plunging 37.4% in the past hour and down 70.8% over the last week, according to CoinGecko.

Source: CoinGecko

Currently trading at $0.05643, ACT has lost nearly 94% from its all-time high of $0.9198, though it remains 340% above its lowest price.

Market activity has also declined, with 24-hour trading volume dropping 21.6% to $477.7 million.

Amid the turmoil, Binance co-founder Changpeng “CZ” Zhao has weighed in on the broader AI and crypto intersection, criticizing AI projects that prioritize token launches over real utility.

In a post on X, CZ stated that “many AI agent developers focus too much on their token rather than the agent’s actual usefulness.”

He urged teams to build a strong product first and only introduce a token after achieving product-market fit.

His remarks echo previous criticisms of AI-focused crypto projects.

On March 17, he argued that while crypto can serve as the currency for AI, most AI agents don’t need their own tokens.

Looking forward, he suggested charging fees in existing cryptocurrencies so AI project teams could focus on real-world adoption instead of token performance.

The ACT token crash shows the delicate interplay between exchange policies, market dynamics, and project fundamentals in the cryptocurrency ecosystem.

While factors like leverage adjustments can trigger immediate price movements, long-term project viability ultimately depends on delivering real utility.

As the dust settles on this particular event, the broader conversation about responsible tokenomics and the relationship between centralized exchanges and token projects is likely to intensify across the industry.

The post Binance Leverage Adjustment Triggers ACT Sell-Off; Project Dismisses Issues appeared first on Cryptonews.

Credit: Source link

BNB (@cz_binance)

BNB (@cz_binance)