The return of risk-on sentiment has sparked a recovery, but many still question Ethereum as a “best crypto to buy” contender, with long-term holders offloading at a loss.

As global investment markets rallied on Trump’s 90-day “tariff war” pause, the front-running altcoin saw a 24% surge during Wednesday trading to a $1695 peak.

While this policy shift opened the door to fresh liquidity, sentiment quickly cooled. A likely “sell-the-news” event has since dragged Ethereum back to $1550.

Now down over 60% from its post-election rally highs, ETH is seeing capitulation trades from holders looking to limit further downside.

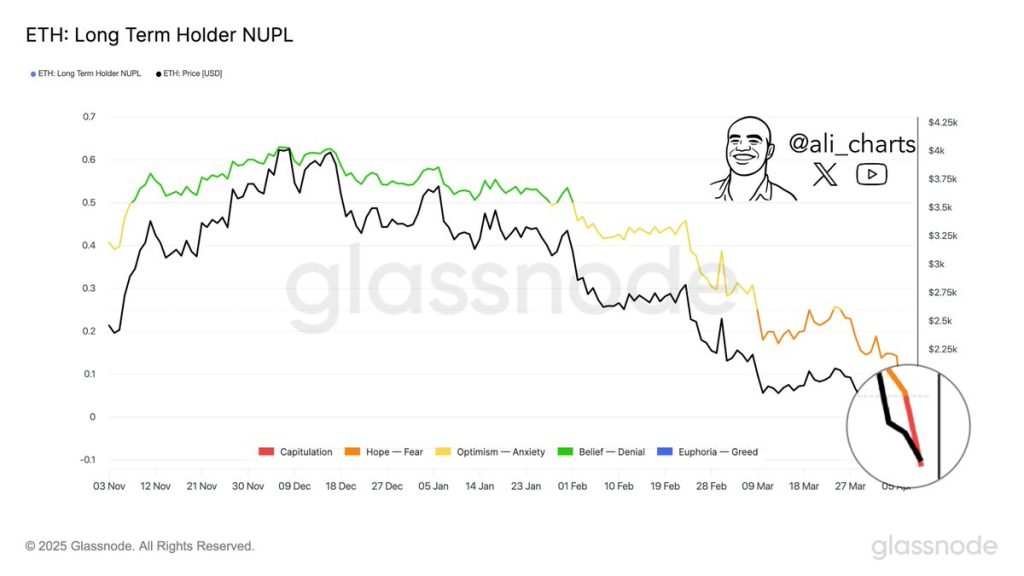

Long-Term Holders Enter Capitulation Mode

Long-term Ethereum holders have now entered what’s commonly referred to as “capitulation” mode—a stage when even the most patient investors begin to fold under pressure.

With the multi-month free fall, many investors have already exited positions, while others remain sidelined waiting for clarity. Still, some see opportunity.

According to popular analyst Ali Martinez, this could present a rare window for contrarian buyers.

“For those watching risk-reward dynamics, this phase has historically marked prime accumulation zones,” he shared on X.

ETH Price Analysis: Time to Accumulate Ethereum?

The buy-the-dip opportunity may not be over for Ethereum with the loss of a critical historical support that marked every major bottom since mid-2020.

This breakdown breaches the lower boundary of a massive symmetrical triangle pattern—a final line of defense before deeper losses set in.

While much of these losses have already materialized, the next key support sits at $1,050. That marks a potential 30% slide before substantial buying pressure is likely to return.

While much of the downside has already played out, the next key support lies at $1,050, leaving room for a potential 30% slide before meaningful demand returns.

This scenario holds weight, with the MACD line accelerating its move away from the signal line, underscoring dominant selling pressure.

While the Relative Strength Index (RSI) has hit the oversold threshold at 30—a sign of seller exhaustion—a pronounced reversal seems slim without conviction from buyers.

Instead, a short-term consolidation around the immediate $1,525 support level—seems the most probable outcome without any fresh market catalysts.

Keep Your Eyes on This New ICO Before the Bull Market Returns

Any trader hedging their risk likely features Bitcoin (BTC) as a major part of their portfolio, especially as the altcoin market continues to fall.

While Bitcoin provides stable gains, it often sacrifices upside potential—that’s where Bitcoin Bull (BTCBULL) comes in, offering a fresh way to capitalize on BTC tailwinds.

True to its name, Bitcoin Bull ties its tokenomics to Bitcoin’s price growth in a deflationary model.

The project burns tokens and distributes BTC airdrops whenever Bitcoin reaches key milestones—starting at $125,000 and triggering new rewards for every $25,000 climb thereafter.

With some analysts forecasting BTC highs of $1 million by 2030, BTCBULL could become a Bitcoin Maxi’s best friend.

With over $4.5 million raised in its initial few months, the project is already gaining strong momentum—potentially credited to its 91% APY on staking that rewards early investors.

You can keep up with Bitcoin Bull on X and Telegram, or join the presale on the Bitcoin Bull website.

The post Are Ethereum Whales Giving Up? Long-Term Holders Start Selling as Price Recovers appeared first on Cryptonews.

Credit: Source link