In a dramatic regulatory reversal, the U.S. Securities and Exchange Commission (SEC) dropped its landmark lawsuit against Binance and founder Changpeng Zhao on May 29, 2025, ending a two-year battle that once threatened the world’s largest crypto exchange. Does this dismissal, signed jointly by both sides, indicate a new era for crypto oversight under the Trump administration?

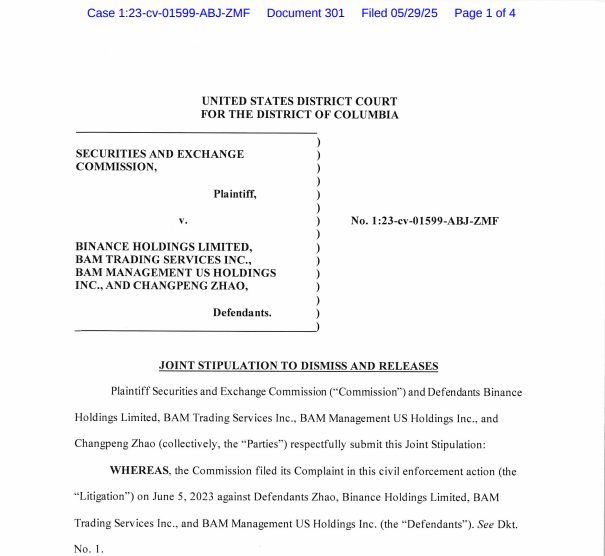

The SEC’s case, filed in June 2023, had accused Binance Holdings, BAM Trading Services, BAM Management U.S. Holdings, and former Binance CEO Changpeng Zhao of inflating trading volumes, diverting customer funds, and enabling trading in unregistered securities.

SEC Dismisses Civil Case Against Binance and Changpeng Zhao

The SEC voluntary dismissal, filed jointly with Binance with prejudice in Washington, D.C., means the regulator cannot revive these charges, marking a major shift in U.S. crypto policy and enforcement.

According to the court document, the SEC stated, “in the exercise of its discretion and as a policy matter, the Commission believes the dismissal of this Litigation is appropriate.”

While the regulator provided no further explanation, it did clarify in its litigation release that the move does not necessarily reflect its stance on other cases.

Over the past several months, the case had remained in limbo. In April 2025, the SEC and Binance requested a stay, followed by extension requests, suggesting shifting priorities and behind-the-scenes negotiations.

The dismissal follows a turbulent 2023 for Binance, which included a $4.3 billion settlement with the U.S. Department of Justice over Bank Secrecy Act violations.

Zhao and Binance admitted to criminal wrongdoing as part of that settlement and agreed to overhaul compliance protocols.

In a tweet celebrating the SEC’s decision, Binance called it “a huge win,” adding, “Thank you to Chairman Atkins and the Trump team for pushing back against regulation by enforcement.”

Thursday’s court filing also referenced the SEC’s newly formed crypto task force, which has recently engaged with industry stakeholders.

The task force indicates a potential shift in the agency’s regulatory strategy under evolving political and administrative leadership, particularly in contrast to the aggressive enforcement style seen during former SEC Chair Gary Gensler’s tenure.

While the SEC may be recalibrating its crypto policy direction, it remains unclear how this dismissal might influence other ongoing or future enforcement actions.

For Binance and Zhao, however, the end of this legal chapter marks a significant win as they explore continued global regulatory challenges.

Policy Reset: SEC Retreats from Enforcement-Led Crypto Regulation

The SEC’s dismissal of its lawsuit against Binance is part of the shift in regulatory posture under the Trump administration, marked by a move away from aggressive enforcement and toward more structured policymaking in the crypto space.

In recent months, the SEC has either settled or dropped multiple high-profile cases involving other major industry players.

Coinbase, ConsenSys, and Kraken all reached settlements earlier this year. Investigations into Circle, Immutable, and others were quietly closed without further action.

Lawsuits against Uniswap and OpenSea have also been withdrawn, significantly softening the agency’s stance.

The post SEC and Binance Seek to Dismiss Legal Clash—Is the Crypto Industry’s Biggest Showdown Over? appeared first on Cryptonews.

Credit: Source link

The SEC officially dropped its cases against Consensys, Kraken, and Cumberland DRW as the agency shifts its regulatory approach.

The SEC officially dropped its cases against Consensys, Kraken, and Cumberland DRW as the agency shifts its regulatory approach.