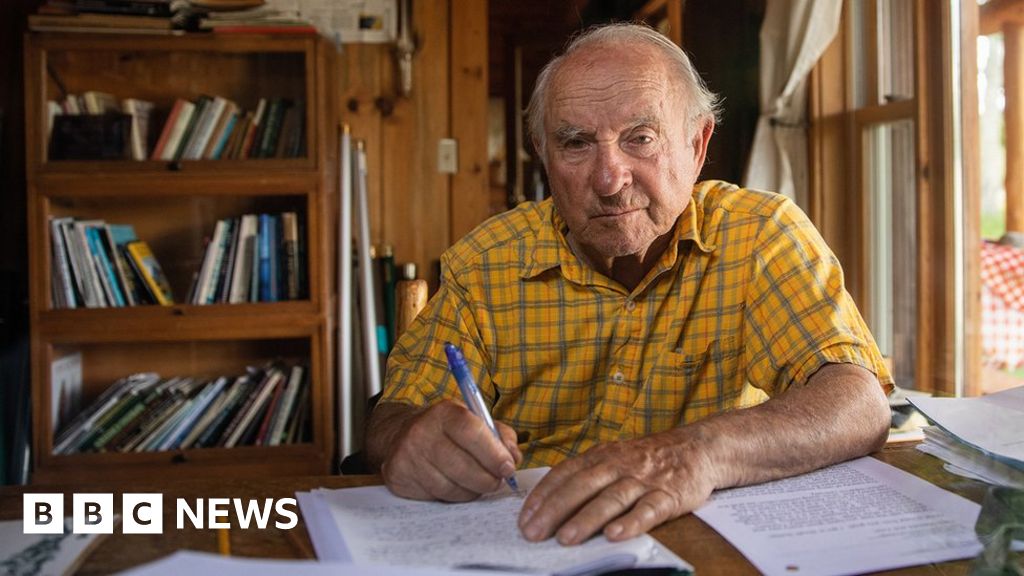

An “Office Space Available” sign in the Loop neighborhood of Chicago, Illinois, US, on Friday, May 12, 2023. Hollowed-out downtowns are a depressing characteristic of American cities right now. Photographer: Christopher Dilts/Bloomberg

© 2023 Bloomberg Finance LP

The office real estate market is already grim. And despite bosses’ efforts to draw people back to the office, it’s going to remain gloomy, even in projections that are more moderate, warns a new report from McKinsey Global Institute.

The new report finds that office attendance has held steady at 30 percent below pre-pandemic norms, and that even by 2030, demand for office space will be lower than it was in 2019. In moderate scenarios, McKinsey’s models suggest there will be 13 percent less demand for office space in 2030 (noting its moderate projection isn’t quite as dismal as other researchers’). In more severe projections, demand could fall by 38 percent in cities that are more heavily impacted.

But it’s not all bad news: Residential supply remains short, urban areas with more mixed use development won’t be hit as hard as office-driven urban cores and some cities without as many knowledge workers in industries like tech or professional services, such as Houston, could actually see some growth.

“The scariest stories you hear on this front are going to be specific with respect to geography and with respect to asset class,” says Ryan Luby, a McKinsey senior expert and associate partner who worked on the report. “The hardest hit areas are going to be … undiversified central business districts that relied really heavily on folks commuting in long hours,” he says, pointing to urban cores without much residential real estate, less green space or other mixed use development.

The report looked at office real estate, as well as retail and residential space, in nine “superstar” cities that have outsized shares of GDP growth. U.S. urban cores—in cities like New York, San Francisco and Boston—have been more affected than cities in Japan or Europe, thanks to less mixed-use development.

The staying power of hybrid work—as well as a worsening economy—is clearly having an impact, and McKinsey’s report suggests it could be decades before office space demand returns to pre-pandemic levels. It finds that in real terms, a total of $800 billion in value is at stake by 2030, even in its moderate scenario, and that the total value of office space could decline by 26%. While top quality “class A” office space price per square foot actually rose slightly between 2020 and 2022 as employers tried to “earn the commute” with flashy office spaces built for hybrid work, less sophisticated buildings have seen demand fall.

“There is a lot of capital at stake,” Luby says. “Trillions of dollars of valuation. … That is a recipe for high conflict, slow change.”

Fixing the problem won’t be easy. For one, workers don’t seem drawn by perks such as free meals or onsite perks like concerts on office campuses—just 3% of respondents in McKinsey’s survey said such perks were their top reasons for returning. And while the report suggests building more mixed-use development, constructing more flexible buildings and designing more modular spaces, conversions of existing real estate aren’t easy, Ruby warns.

“This is a structural break in economic and behavioral patterns,” Luby says. “Had the pandemic only lasted three or six months, I think it would have been possible to stop [those patterns]. … I don’t think it’s possible any longer, given that this has now lasted in excess of two years.”

The report also included surveys of nearly 13,000 full-time office workers across six countries about their hybrid work practices. Among respondents, 56% had a hybrid work arrangement, just 7% worked fully remote and the remainder were on-site each day.

Interestingly, the average number of days respondents spent in office did not vary much by age, income or seniority, though there were some notable differences. Unsurprisingly, baby boomers are more likely to go to the office five days a week than younger workers, and employees are less likely to go to the office if they work for smaller companies. But it also found that junior-level workers are both much more likely than their mid- and senior-level peers to both work in the office five days a week and work entirely remote.

The report suggests three reasons office attendance appears to have stabilized. For one, it has been steady since mid-2022. Moreover, surveys of office workers suggest the number of days they prefer to go to the office and how much they go or expect to have to go are showing narrower gaps.

Finally, survey data suggests even highly paid, senior-level workers say they would quit their job if they had to go to work onsite every day, even being willing to trade pay for the privilege, suggesting even decision makers want hybrid work. When the boss wants to keep some of that flexibility, others will likely keep it too.

Credit: Source link