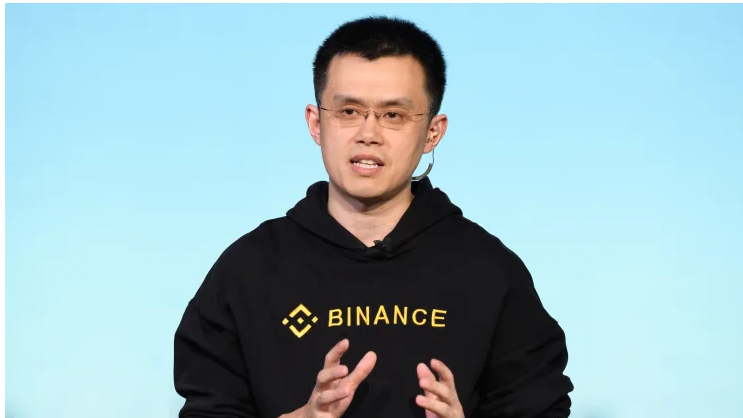

The European Union Parliament has passed into law its MiCA act, and big-time industry player and CEO of Binance Changpeng Zhao is raising support following the new crypto regulations.

EU introduces Markets in Crypto-assets Law, MiCA

The European Union Parliament has passed a bill into law to combat its long-standing battle against the crypto market.

For a long time, the crypto industry has gone without regulations and has been a concern for several regulatory bodies.

In a bid to curb this menace, several regulatory bodies across the EU, the UK, and the US have since continued to clamp down on crypto exchanges and services.

The MiCA regulations should come as a welcome development to many, especially investors, as the law would ensure crypto exchanges are made liable for losses accrued on their platforms.

Crypto industry Bigwig Changpeng Zhao of Binance exchange fame took to Twitter to acknowledge the new crypto regulation.

According to CZ, as he is fondly called, this new bill from the European bloc creates tailored regulations that would better protect investors instead of outrightly witch-hunting facilitators in the burgeoning industry.

“The fine details will matter, but overall, we think this is a pragmatic solution to the challenges we collectively face. There are now clear rules of the game for crypto exchanges to operate in the EU,” he added.

The industry leader expressed willingness to make several changes to the Binance exchange’s operational framework over the next 12-18 months to comply with these newly released laws fully.

The EU lawmakers voted on Thursday to pass a new law for Transfer of Funds regulations, with 529 in favor, 29 opposed, and 14 abstentions.

There was also a vote to pass the Markets in Crypto Assets (MiCA) law, which received 517 votes in favor, 38 votes against, and 18 abstentions.

In a tweet, the European Commission’s Mairead McGuinness applauded the initiative by the European lawmakers, describing the move as a world first for the crypto space.

It should be noted that these last two categories do not include decentralized finance (DeFi) or non-fungible tokens (NFTs).

MiCA and Its Implications for Crypto

The MiCA aims to protect cryptocurrency transactions, and transfers above €1000 from self-hosted wallets can be traced and even blocked on suspicion.

This rule does not apply to person-to-person transfers that do not involve a provider or transfers between providers acting on their behalf.

The crypto asset regulation market is regarded as a significant milestone in cryptocurrency, as it establishes a consistent set of rules and regulations for crypto-related activities across the European Union.

This move is expected to bring clarity, stability, and security to the industry and pave the way for wider adoption and integration into the mainstream financial system.

The MiCA regulations addressed several concerns, including using cryptocurrency for money laundering and financing terrorism and other crimes.

Another concern raised in the MiCA is the previously mentioned issues of transparency, disclosure, authorization, and supervision of transactions.

The provision also ensures that consumers and investors are informed about their operations’ risks, costs, charges, and implications.

The MiCA also agrees to stringent measures against manipulating the markets.

The Act also addresses the environmental implications of cryptocurrencies, imploring service providers to disclose their energy consumption and explore alternative energy sources to reduce their carbon footprint.

Big Win as EU Races Ahead of the US in Providing Clarity

Given that the discourse around crypto regulation has been ongoing for years, the European Union’s (EU) recent decision to provide clarity demonstrates the region’s open-handed approach to the digital asset economy.

So far, several world governments have outrightly banned anything related to cryptocurrencies while embracing the technology it runs on or provided little clarity, making it impossible to attract mainstream investors into the space.

One such country with a reactive approach to crypto regulation is the United States which has gone on a clampdown spree since the year began.

After its successful subpoena of the Ripple blockchain, several centralized entities like Gemini, Binance, and Coinbase, amongst others, have come into the crosshairs of federal authorities in the world’s largest economy.

The continued lack of clarity is currently driving more businesses abroad, with Gemini opening an engineering hub in India.

Coinbase has followed suit and is currently lending a hand to the UK’s blockchain division after securing an operating license from the Bermuda government.

Credit: Source link