As open enrollment season approaches for many employers, new data shows that an increasing number of HR and benefits leaders are going retro with their healthcare plans—by expanding their limited health plan offerings.

Specifically, some organizations have been adding PPOs and HMOs back into benefits packages that previously offered only high-deductible healthcare plans with health savings accounts. In fact, the number of employers offering only these account-based health plans, which tie in a health savings account with a high-deductible health plan, has decreased by 33% since peaking in 2020, according to Willis Towers Watson data. And that erosion is likely to continue into this year’s open enrollment, healthcare experts say.

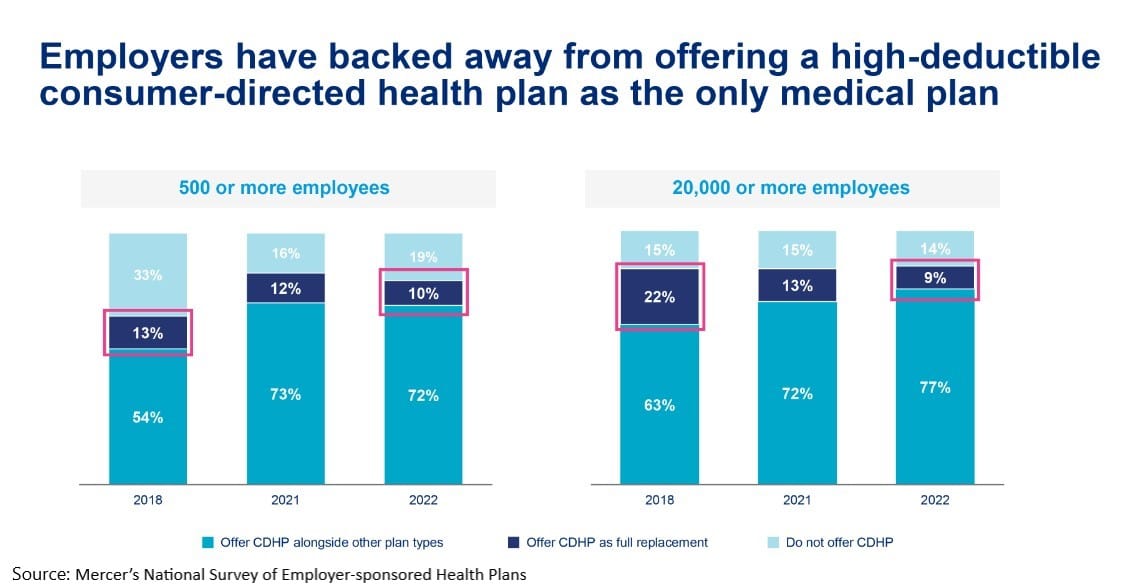

Employers increasingly are offering employees a combination of PPOs, HMOs and high-deductible health plans linked to health savings accounts as part of their healthcare packages, says Jeff Levin-Scherz, population health leader with Willis Towers Watson’s health management practice. As a result, the percentage of full-replacement high-deductible health plans is declining, while the percentage of health plans that include all three is rising.

For example, 22% of employers with 20,000 employees or more offered only high-deductible healthcare plans in 2018, a number that plummeted to 9% in 2022, according to Mercer’s National Survey of Employer-sponsored Health Plans report. That number also has dropped among smaller organizations, the report shows. These drops come after 15 years of steady increases.

A number of catalysts are driving the change, experts say, including the pandemic, concerns over low-wage workers’ ability to pay for care, and organizations offering more health plan choices as a retention strategy, particularly after the Great Resignation in 2021, when nearly 48 million people voluntarily quit their jobs.

Employers also began moving away from their full replacement high-deductible plans after Congress in December 2019 nixed plans to implement the high “Cadillac tax” within the Affordable Care Act. Although that decision came too late in the year for employers to change their 2020 offerings, they began making those changes in their 2021 offerings, says Paul Fronstin, director of health benefits research at the Employee Benefit Research Institute.

See also: High-Deductible HPs Keeping Lower-Income Workers from Care

Under the proposed “Cadillac tax,” employers would have been hit with a 40% tax on self-funded healthcare plans that surpassed a certain value. Because of this threat and the lower cost, a number of employers had dumped their PPOs and solely offered high-deductible plans with health savings accounts, Fronstin says.

High-deductible plans here to stay

Despite the shift away from only offering high-deductible healthcare plans, the offering will remain an appealing option for some organizations, experts say.

That’s because high-deductible plans with HSAs—particularly for high-wage earners in good health—make sense for the tax benefits they offer employees and the low costs they provide employers.

“I’m not sure employers are going back to offering only HDHPs,” Fronstin says. “But I could certainly see a situation where employers that haven’t been offering one will begin to do so as an added choice.”

Credit: Source link