Bitcoin has recovered back above the $29,000 level, rising above its 21 and 50-Day Moving Averages in doing so, in wake of another rate hike from the US Federal Reserve.

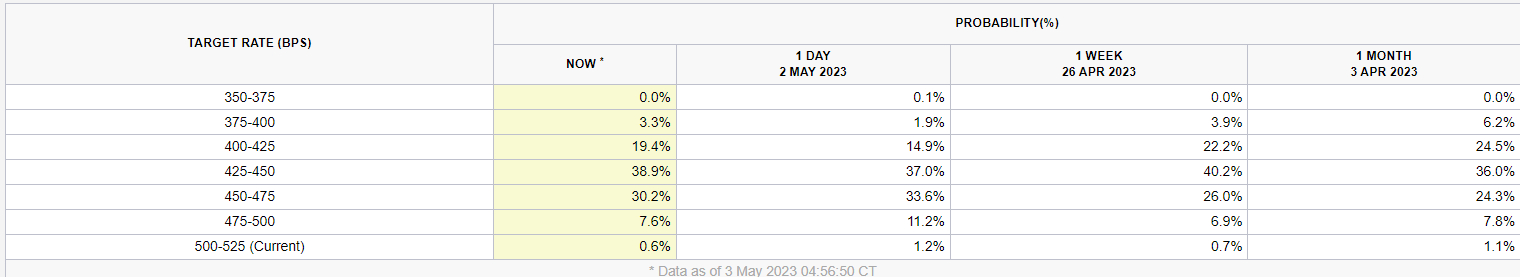

The US central bank lifted the federal funds target range by 25 bps on Wednesday to 5.0-5.25%, marking 500 bps worth of rate hikes in its last ten meetings.

Prior to the rate announcement, many market participants had been betting that this would likely be the last hike from the Fed this tightening cycle, given 1) recent progress on bringing inflation back under control and 2) recent troubles amongst regional US banks, partially caused by tighter financial conditions.

And the Fed did nothing to push back against this narrative, with a reference to the appropriateness of further tightening dropped from the central bank’s policy statement.

As a result, markets are now extending bets that the Fed will begin an interest rate cutting cycle in the second half of 2023 and this could be boosting Bitcoin, which was last up around 1.5% on the day, and more than 3.0% up versus earlier session lows in the low-$28,000s.

According to the CME’s Fed Watch Tool, the probability that the Fed will have cut rates to 4.25-4.5% or below (i.e. at least 75 bps worth of cuts) by December increased ever so slightly on Wednesday to a little over 60%.

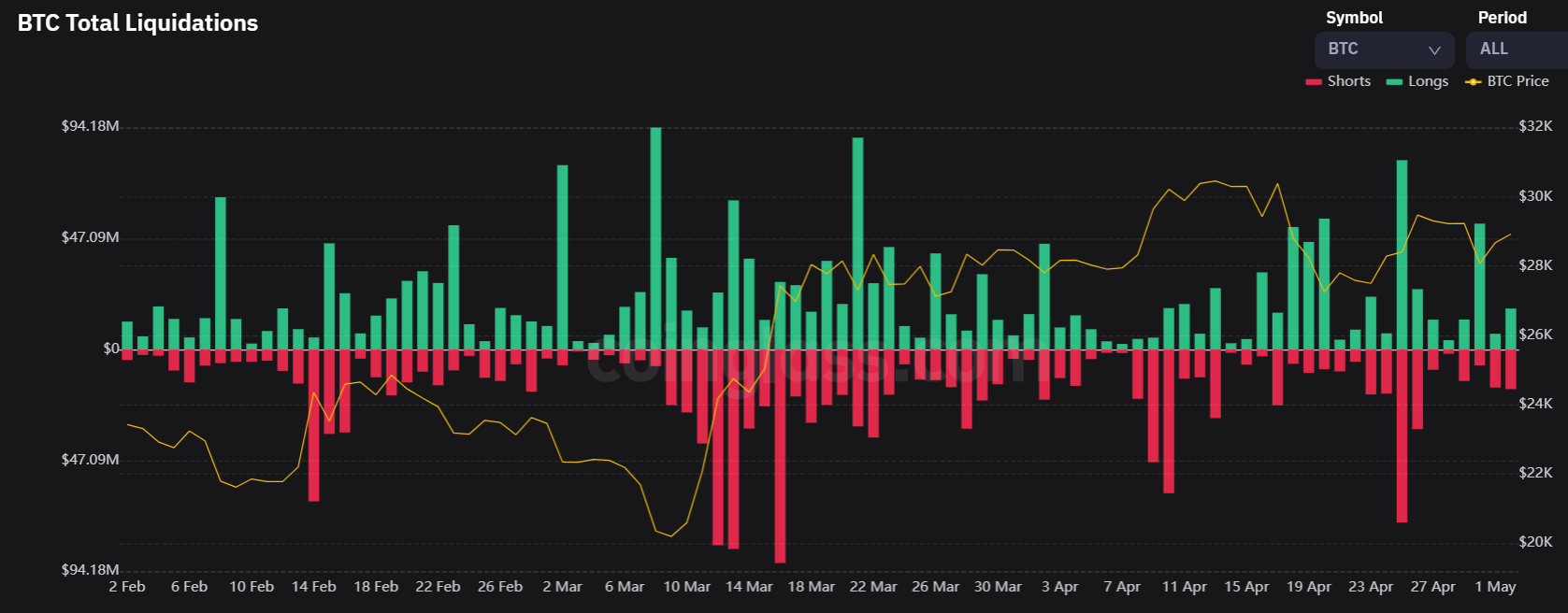

Despite the 3.0% intra-day swing, liquidations of leveraged Bitcoin futures positions remained fairly subdued at only around $34 million, according to data presented by crypto derivatives analytics website coinglass.

Bitcoin Still in Consolidation Mode

Low liquidations suggest that the Fed meeting hasn’t caused too much of a stir in the Bitcoin market, as indicated by the fact that prices still remain well within the recent multi-week $27,000-$31,000ish range and a host of other indicators.

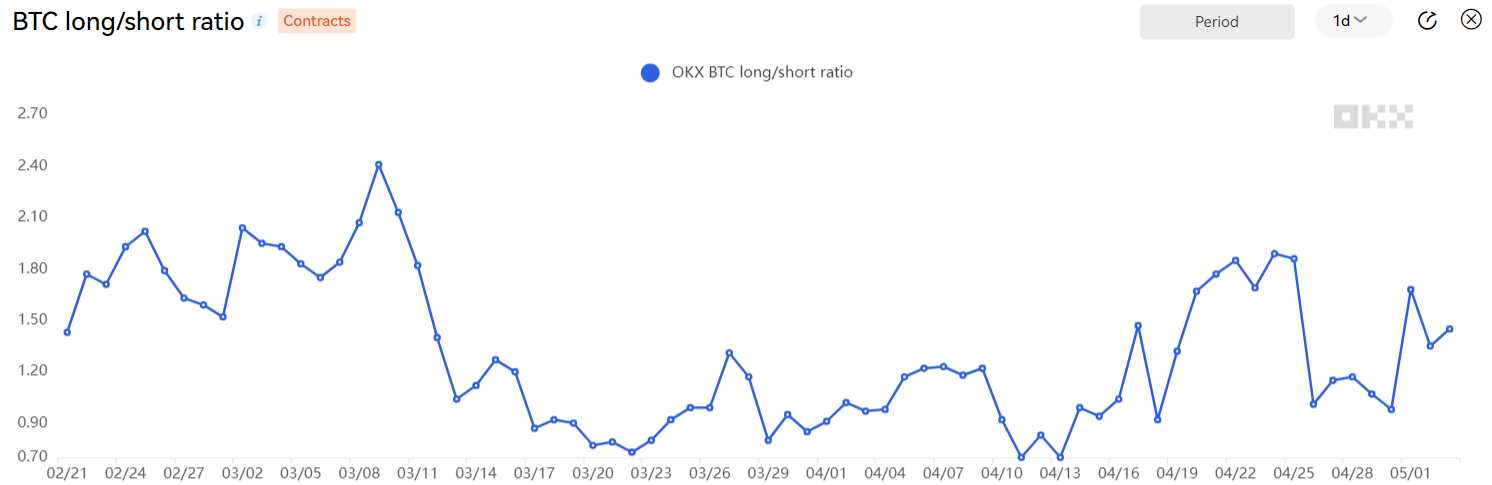

These alternative indicators include OKX’s BTC long/short ratio, which was last at 1.45, broadly unchanged versus its level Tuesday and within recent ranges.

A ratio score of above 1 means traders on the platform still favor Bitcoin upside, but not by as much as was the case last month, when the ratio hit 1.89.

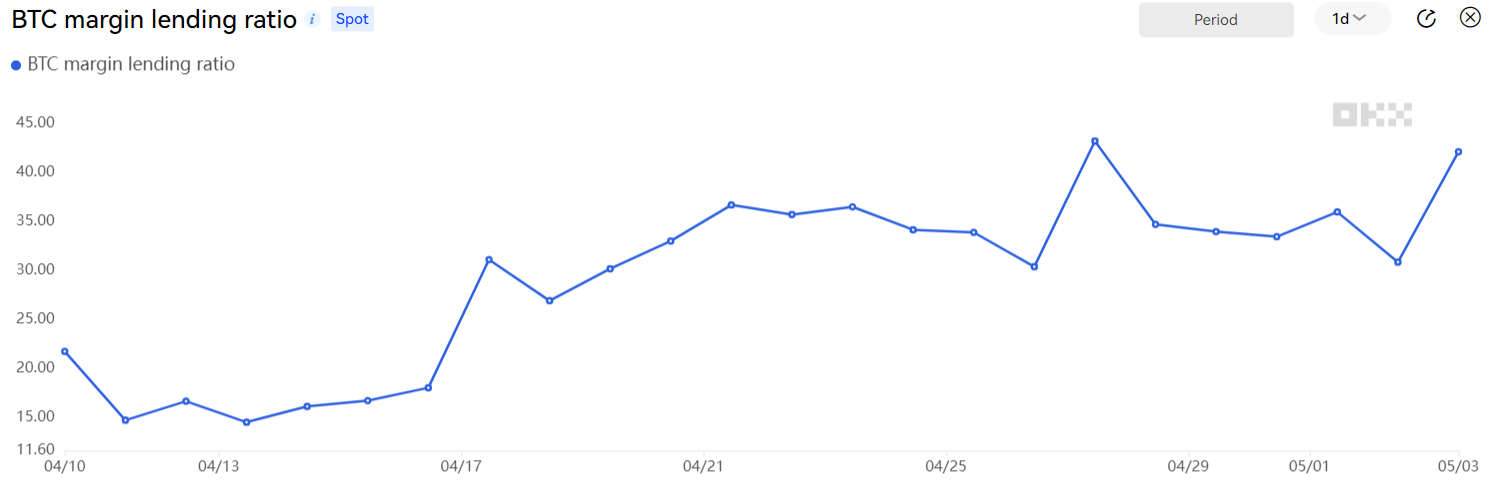

Meanwhile, cryptocurrency exchange OKX’s BTC margin lending ratio jumped from around 30 to around 42 on Wednesday, near its highest level in the last month.

Overall, OKX’s long/short ratio suggests that the Fed meeting hasn’t led to a meaningful shift in market sentiment towards Bitcoin – which is in fitting with Bitcoin’s fairly flat Wednesday price action – but with the meeting now out of the way, it does seem as though traders are keen to lever up once again.

This increases the risk of liquidation-induced volatility going forward.

Elsewhere, funding rates to take out a leveraged Bitcoin futures position remain broadly neutral, as per data presented by coinglass citing OKX and decentralized crypto exchange dYdK, suggesting neither bulls nor bears have gained outsized control of the futures market.

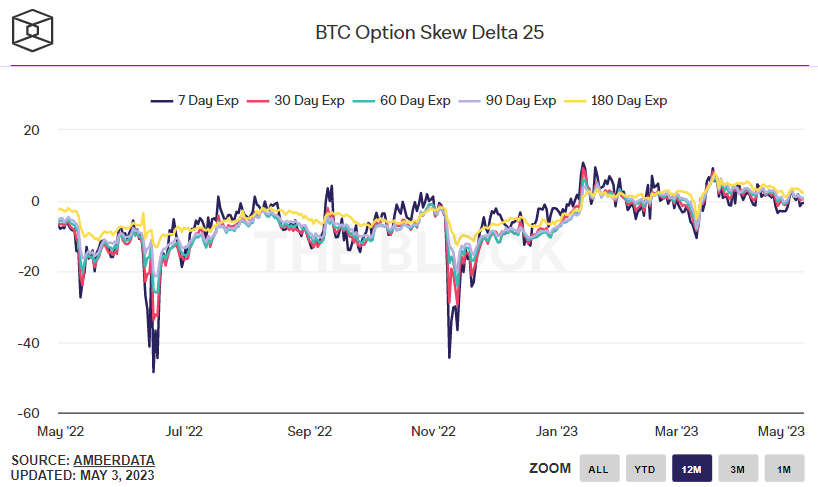

Additionally, the 25% delta skew of Bitcoin options expiring in 7, 30, 60, 90 and 180 days were all largely unchanged on Wednesday at close to zero, above 2022’s bear market levels and still at levels consistent with the ongoing 2023 bull market.

That’s according to data presented by The Block.

A 25% delta skew of above zero means investors are paying a premium for bullish call options versus their equivalent bearish call options, and vice versa.

Bitcoin About to Pop – Where Next for the Bitcoin Price?

While Bitcoin remains well within recent ranges, the cryptocurrency could be about to pop higher again towards $31,000.

That because, if the cryptocurrency maintains its current short-term momentum, it could be about to break to the north of a pennant pattern it has formed over the last few weeks.

Of course, upcoming macro risks, like Friday’s official US jobs report, could up-end bullish sentiment.

That’s because if the data is sufficiently strong, it could boost the argument for the Fed to implement further rate hikes, given the current strong labor market is complicating the Fed’s battle to get inflation under wraps.

Credit: Source link