The price of Bitcoin has experienced a notable spike of 2% from its recent bottom, leading to speculation about the optimal time to buy the cryptocurrency.

This upward movement has caught the attention of investors and traders, who are now considering whether it presents a favorable opportunity for investment.

The current price surge raises questions about the potential for further gains and the overall market sentiment surrounding Bitcoin.

In this update, we will delve into the factors contributing to this price increase and analyze whether it is indeed a good time to buy Bitcoin.

BTC Declines Amid BlockFi’s Liquidation and Platform Challenges

Bitcoin faced a significant decline of over 1.5% following BlockFi’s announcement of its closure.

The prominent crypto lending platform has been attempting to sell its crypto platform and around 700,000 customer accounts since January due to regulatory challenges.

Unfortunately, their efforts were unsuccessful, leading to their filing for bankruptcy in November of the previous year.

This is part of a trend where various crypto platforms, including Terraform Labs, Three Arrows Capital, Alameda Research, and FTX exchange, have also faced difficulties in recent times.

Market Speculation Arises as Coinbase Transfers Considerable Amounts of Bitcoin to Anonymous Wallets

As per Whale Alert, a renowned cryptocurrency tracking service, noteworthy quantities of Bitcoin were recently transferred from Coinbase, a leading crypto exchange in the US, to wallets of unknown ownership. These transfers occurred approximately 15 hours ago.

Whale Alert observed incoming Bitcoin transactions to Coinbase from two anonymous wallets, preceding the price drop. Furthermore, two anonymous wallets transferred a substantial amount of Ethereum (19,635 ETH each) to Coinbase.

The precise impact of these transfers on Bitcoin’s price remains uncertain. However, it is important to acknowledge that large-scale movements of cryptocurrencies have the potential to introduce market volatility. Traders and investors closely monitor such transactions as they can indicate significant market shifts.

Coinbase’s transfers also encompassed Ethereum, as two anonymous wallets sent 19,635 ETH each to the platform. This emphasizes the active trading activity on Coinbase and the participation of various cryptocurrencies in the market.

Bitcoin Price

Bitcoin is currently being traded at a price of $26,950 and after a two-day recovery, the BTC/USD pair encountered some pressure on Tuesday, influenced by mixed sentiment prevailing in the market.

The support level of $26,800 on the four-hour chart, previously acting as resistance, now serves as a potential turning point for Bitcoin.

Key technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicate that the market is entering a zone favorable for buying.

Therefore, if Bitcoin manages to maintain its position above the $26,800 level, there is a significant likelihood of a bullish rebound, targeting $27,800 or $27,500.

It is important to highlight that the 50-day Exponential Moving Average (EMA) serves as a notable barrier at approximately $27,500, signaling the dominance of a bearish sentiment in the market.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

The team at Cryptonews Industry Talk has compiled a selection of cryptocurrencies with promising outlooks for 2023. These digital currencies demonstrate significant potential for growth both in the short term and the long term.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

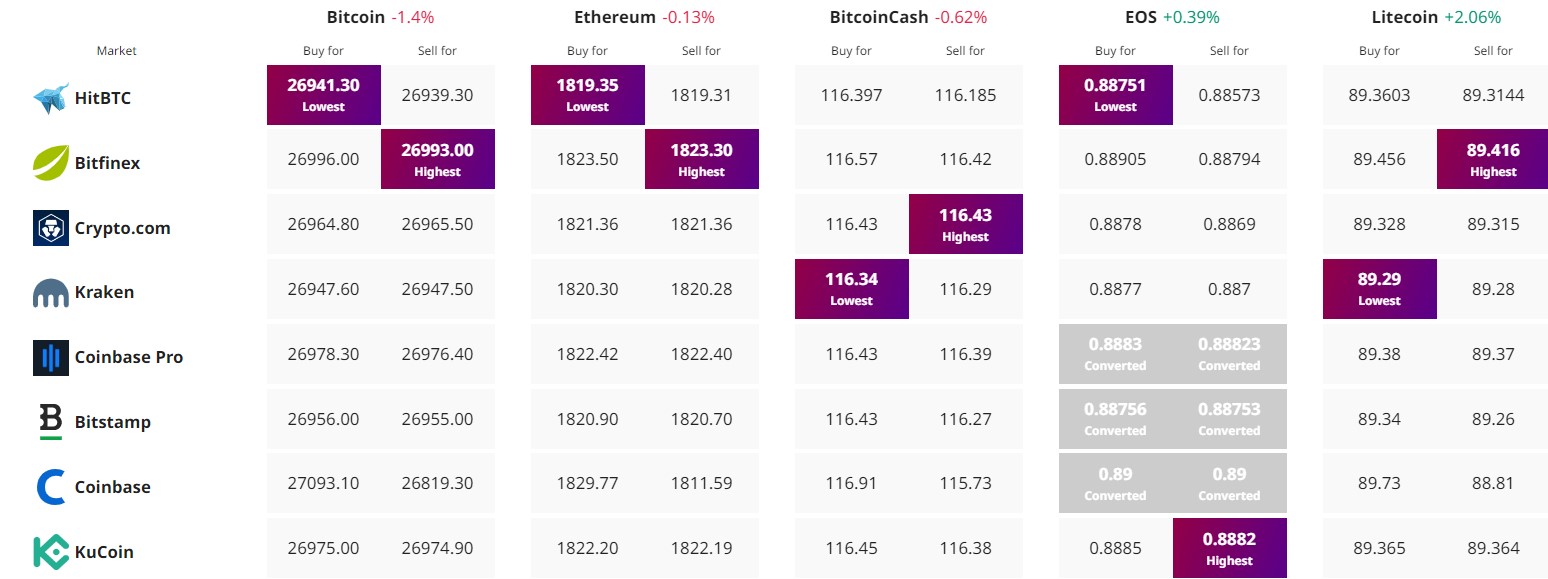

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link