Bitcoin enthusiasts and investors are buzzing with excitement as the world’s most prominent cryptocurrency surges by 4% within just 24 hours. The sudden increase in Bitcoin’s price has left many speculating about the factors driving this upswing, while others scramble to make sense of the market dynamics.

As we explore the possible reasons behind this unexpected surge, we’ll consider several key factors that could be influencing the market and attempt to predict where Bitcoin’s value might be heading in the near future.

Stay with us as we unravel the mystery behind this abrupt pump in Bitcoin’s price and what it could mean for the crypto ecosystem.

First Republic Bank Price Crash and Its Impact on Bitcoin’s Surge

First Republic announced results that exposed the precarious state of the bank since mid-March, attributed to the collapses of Silicon Valley Bank and Signature Bank. The bank reported a staggering $102 billion withdrawal in deposits during the first quarter, significantly higher than the $176 billion it held at the end of last year.

The bank’s shares plummeted by nearly 50% on Tuesday, following the revelation that clients had withdrawn over $100 billion in deposits in the first three months of the year.

Consequently, there are growing concerns that First Republic Bank may soon become the third major bank to collapse this year, as anxiety spreads across the United States and around the world.

The news has elicited a variety of responses in the US stock market. Nonetheless, the BTC/USD experienced a boost as the First Republic Bank deposit debacle intensified fears of a potential financial crisis in the United States.

Standard Chartered Predicts $100K Bitcoin Milestone in 2024

In a research report published on Monday by Standard Chartered Bank, it is suggested that Bitcoin, the world’s leading cryptocurrency, could potentially reach $100,000 by 2024. The bank’s analysis indicates that several factors may contribute to Bitcoin’s ascent above $100,000.

One such factor is the ongoing banking sector crisis, which could help re-establish Bitcoin’s role as a decentralized, scarce digital asset.

Additionally, the research found that the improving macroeconomic backdrop for risky assets, as the Federal Reserve nears the end of its tightening cycle, may also serve as a price driver.

Standard Chartered is not the only institution forecasting a substantial increase in Bitcoin’s price. At a blockchain conference in Paris last month, numerous cryptocurrency industry insiders predicted that Bitcoin would achieve a new all-time high in 2023.

A representative from the US-based cryptocurrency exchange Gemini also suggested that $100,000 is a viable target.

Bitcoin Price

Bitcoin has broken the significant resistance level of $28,790, leading to further gains and a breakout of the $29,350 resistance. Currently heading towards $30,500, BTC may face challenges due to overbought technical indicators such as RSI and MACD.

A close below $30,500 could trigger a downtrend to $29,360, making it crucial for investors to monitor this level for potential sell or buy positions. A bearish correction below $30,500 can be anticipated.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Bitcoin’s rebound could be slow, leading profit-seeking traders to consider alternative options. With a variety of emerging altcoins and presale tokens available, numerous promising cryptocurrencies in the market present the potential for significant returns.

As a result, the Cryptonews Industry Talk team has assembled a list of the top 15 cryptocurrencies for 2023, each boasting solid short-term and long-term potential.

The list is constantly updated to incorporate fresh altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

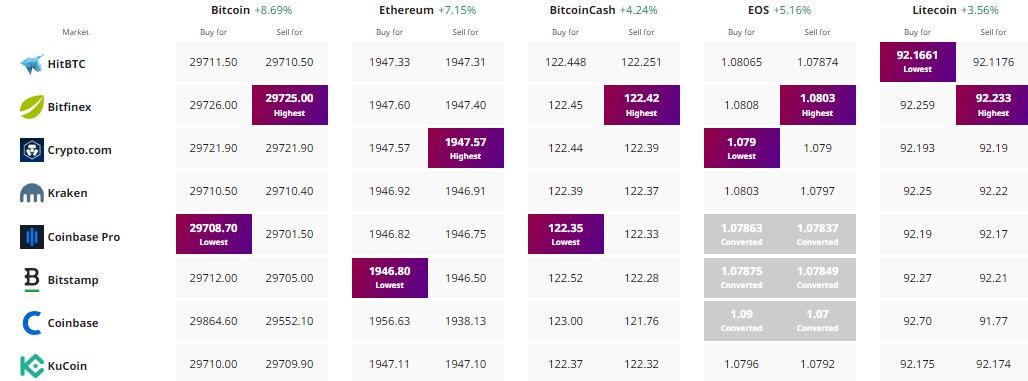

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link

![[LIVE] Crypto News Today: Latest Updates for July 14, 2025 – Bitcoin Hits $123K, XRP Nears $3 as Bullish Momentum Continues [LIVE] Crypto News Today: Latest Updates for July 14, 2025 – Bitcoin Hits $123K, XRP Nears $3 as Bullish Momentum Continues](https://cimg.co/wp-content/uploads/2025/07/14034100/1752464459-daily-news14.jpg)