The BTC/USD has lost nearly 4.50% of its value in 24 hours, trading at $28,200. The leading cryptocurrency experienced a significant drop following a massive sell order on Binance.

Additionally, the BTC/USD decline is attributed to investors’ concerns about ongoing inflation and rising interest rates.

UK and Euro Area Inflation

On Wednesday, economic data from the United Kingdom and the European Union alarmed traders. Persistent inflation suggests potential rate hikes and the possibility of a global economic downturn. Furthermore, this week’s comments from FOMC members fueled Fed anxiety.

Raphael Bostic of the Atlanta Federal Reserve and James Bullard of the St. Louis Fed agreed that it is too early to discuss a reduction in interest rates given the US inflation rate, which remained stubbornly high in March at 5%, in contrast to the Fed’s target of 2%.

The BTC/USD declined in response to UK inflation data and worries about higher interest rates from central banks.

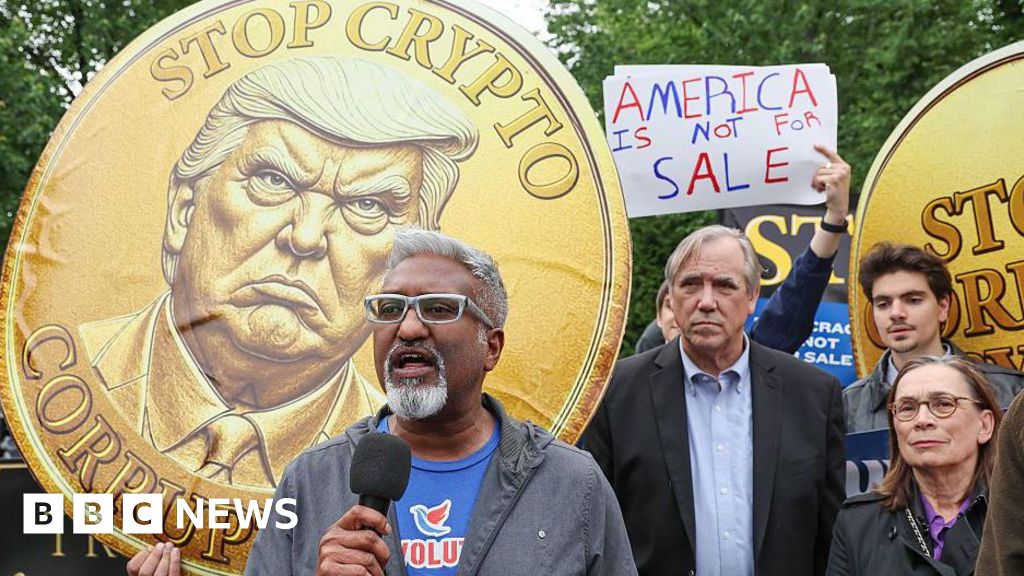

SEC Chair Gary Gensler in Trouble

On Tuesday, investor sentiment towards the cryptocurrency industry improved as more people tuned in to watch the Securities and Exchange Commission (SEC) Oversight hearing. Gary Gensler, the chairman of the SEC, endured a challenging four hours or more due to Patrick McHenry’s intensified questioning about Gensler’s stance on cryptocurrency regulation.

Republican Warren Davidson called for Gary Gensler’s resignation as SEC chairman. Davidson questioned Gensler on his lack of transparency and comments during the SEC Oversight hearing.

However, the crypto sell-off occurred despite Republican Warren Davidson’s request for Gary Gensler’s removal as SEC Chair, causing BTC/USD to decline.

Sell-off hits bitcoin

Recently, the sell-off in the broader digital currency market has intensified. According to data from Coinglass, the sudden sell-off resulted in the liquidation of long bets across all cryptocurrency markets valued at over $300 million. Among all the tracked cryptocurrency exchanges involved in the liquidations, Binance reported the highest amount of liquidations ($49.9 million).

Although there was no clear reason for the sell-off, a notably large sell order on the crypto platform Binance and an unexpectedly high UK March inflation rate of over 10% may have impacted market sentiment.

According to a CNBC report on Wednesday, the latest cryptocurrency sell-off is a long-overdue correction following this year’s surge, as investors adopt a risk-off approach in global markets. A series of long liquidations led to a sharp decline in BTC/USD.

Bitcoin Price

The present Bitcoin price stands at $28,300, with a 24-hour trading volume of $19 billion. The BTC/USD pair exhibits a bearish inclination and may encounter immediate support close to the $28,000 level.

A bearish breach below this $28,000 level could potentially drive the BTC/USD price toward $27,800, while a further decline might push BTC down to the $27,300 level.

On the upside, the BTC/USD pair is expected to encounter immediate resistance around $28,700, with further buying potentially driving BTC toward the $29,730 level.

Buy BTC Now

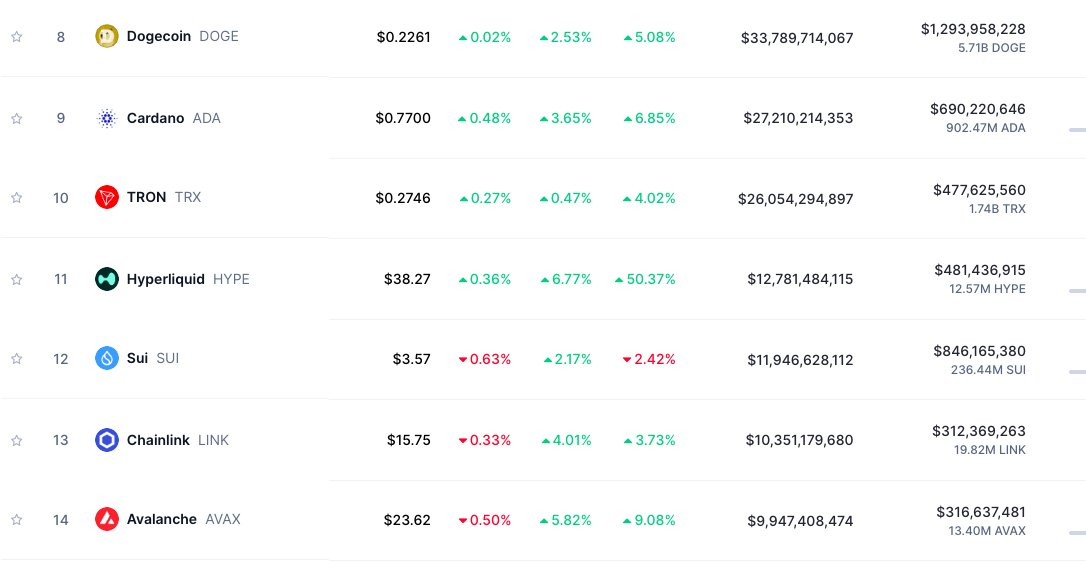

Top 15 Cryptocurrencies to Watch in 2023

To stay up-to-date with the latest ICO projects and altcoins, it is recommended to frequently consult the expert-curated list of the top 15 cryptocurrencies to watch in 2023.

By doing so, you will be better informed about emerging trends and opportunities within the crypto market.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link