BitMEX co-founder, Arthur Hayes, projects an optimistic outlook for Bitcoin, especially in light of the Federal Reserve’s current monetary policies.

He critiques the Fed’s efforts to control inflation, emphasizing that assets like Bitcoin, which possess a finite supply, are set to prosper.

Hayes’s recent blog post delves into the Federal Reserve’s strategies, pinpointing the contradiction in expanding the Reverse Repo Program (RRP) and Interest on Reserve Balances (IORB) payments.

These measures, he argues, effectively counteract the intended effects of quantitative tightening.

Despite the Federal Reserve’s persistence with its strategies, Hayes predicts a shift away from such tightening, especially as alternate buyers for US Treasury debt come to the fore.

This perspective offers hope for Bitcoin’s future trajectory, suggesting a potential positive trend or a cushioning against further decline.

Hayes champions Bitcoin’s unique position in the market, emphasizing its benefits as a counter to the flaws of the fiat banking system and its appeal in the context of increasing fiat liquidity.

US Dollar Holds Steady, Fed Chair Cautious About Interest Rate Increases

On Friday, the value of the U.S. dollar remained stable and is expected to end the week with strength.

Federal Reserve Chair Jerome Powell expressed that the central bank may need to increase interest rates to ensure inflation is managed, but emphasized the importance of proceeding with caution during upcoming meetings.

During a speech at an economic summit in Jackson Hole, Wyoming, Powell stated that policymakers will be careful when deciding whether to tighten further.

However, he also made it clear that the central bank has not yet determined whether its benchmark interest rate is high enough to guarantee a return to the 2% inflation target.

Bitcoin Price Prediction

Bitcoin , a widely recognized digital asset, has recently rebounded from its foundational price of $25,500.

Currently, BTC/USD exhibits tendencies of an upward correction, potentially pushing its value towards $27,400.

Data from Tradingview’s Bitcoin price chart suggests a promising scenario in which a surge beyond $27,400 might drive BTC to the vicinity of $28,650.

Furthermore, a climb reaching as high as $30,300 isn’t off the table for BTC.

Conversely, a downside breakout beneath $25,450 could see Bitcoin’s price descending to around $24,100.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

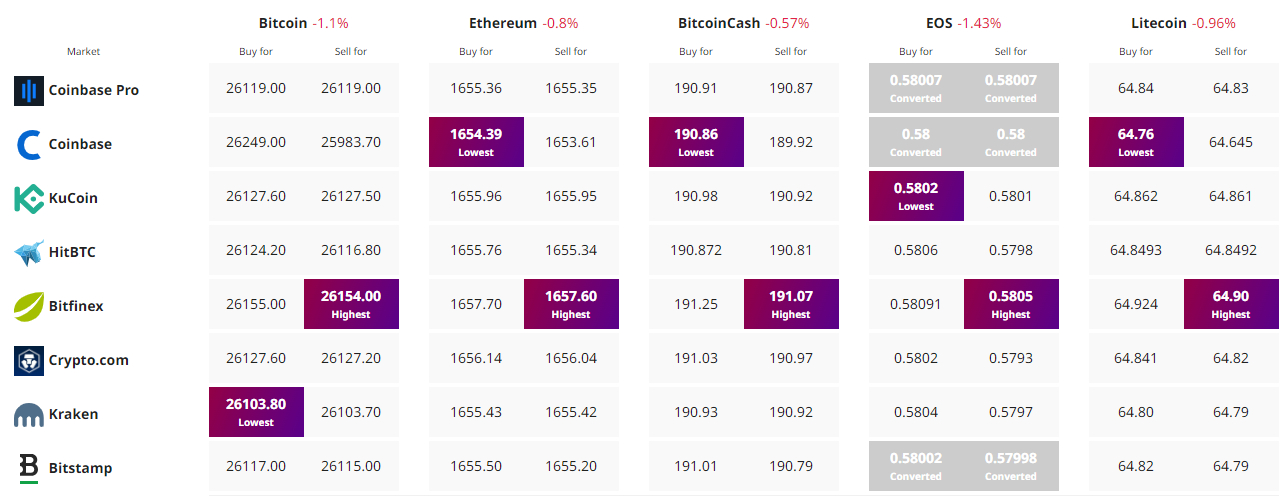

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link