In recent trading sessions, Bitcoin has experienced a 2.5% drop, raising questions about the future trajectory of the leading cryptocurrency. As market participants analyze various technical indicators and market trends, it becomes crucial to understand the factors that may influence Bitcoin’s next move.

In this Bitcoin price analysis, we will discuss the current market conditions, key support and resistance levels, and possible scenarios for the BTC price in the near future.

Fed Rate Hike Expectations

The US Personal Consumption Expenditures (PCE) Index data from last Friday, which was expected to be the week’s big macro event, fell short of expectations. However, the dollar rose as data suggested the Federal Reserve will not defer raising interest rates. The dollar index (DXY) has increased by 0.15% to 101.81.

The interest rate will likely increase by 25 basis points at the Fed’s rate decision on May 3, going from 5% to 5.25%. Furthermore, the probability of a rise in June rose to 27%.

If the Fed deviates from this strategy and suggests an increase of more than 25 basis points, it would be a hawkish hold that indicates a stronger US Dollar, resulting in a decline in the price of BTC/USD. Therefore, investors are exercising caution because this macroeconomic event may cause volatility.

Tesla Maintains Consistent Bitcoin Holdings in Q1 2023

Tesla’s Q1 results show that it maintained a consistent Bitcoin balance during the first three months of 2023. According to the company’s announcement, it held the same amount of digital assets in Q1 2023 as in Q4 2022: $184 million.

The revelation that the corporation neither bought nor sold any Bitcoin throughout the volatile quarter has created a buzz in the Bitcoin sector.

Additionally, this decision could indicate a long-term investment strategy or a display of confidence in the future growth of cryptocurrencies. However, how the market will respond to Tesla’s stance remains uncertain.

Moving forward, many people will closely monitor Tesla’s involvement in the industry, as it can significantly impact the crypto market’s overall direction and the price of BTC/USD.

Bitcoin Price

The BTC/USD pair is trading at $28,591, down by 2.5% in a day. The price of Bitcoin decreased after the US PCE data sparked expectations for another Fed rate hike in June. The Bitcoin prices fell dramatically from the 29,600 level to the 28,640 level. On the four-hour timeframe, Bitcoin has crossed below the 50-day exponential moving average, which was a supporting area of around 29,000.

The formation of candles suggests that the bearish bias is dominating in the market, and at the same time, the RSI & MACD indicators are in the sell zone, supporting the chances of a downtrend in Bitcoin price today.

On the lower side, Bitcoin is likely to find immediate support around the 28,000 level, which is being extended by a trendline that you can see on the 4-hour timeframe. A break below this particular 28,000 level has the potential to lead BTC price to the next support level of 27,195.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Besides Bitcoin, the market presents an array of promising cryptocurrencies, covering up-and-coming altcoins and presale tokens with the potential for significant returns.

As a result, the Cryptonews Industry Talk team has assembled a list of the top 15 cryptocurrencies for 2023, each displaying robust prospects for both short-term and long-term growth.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

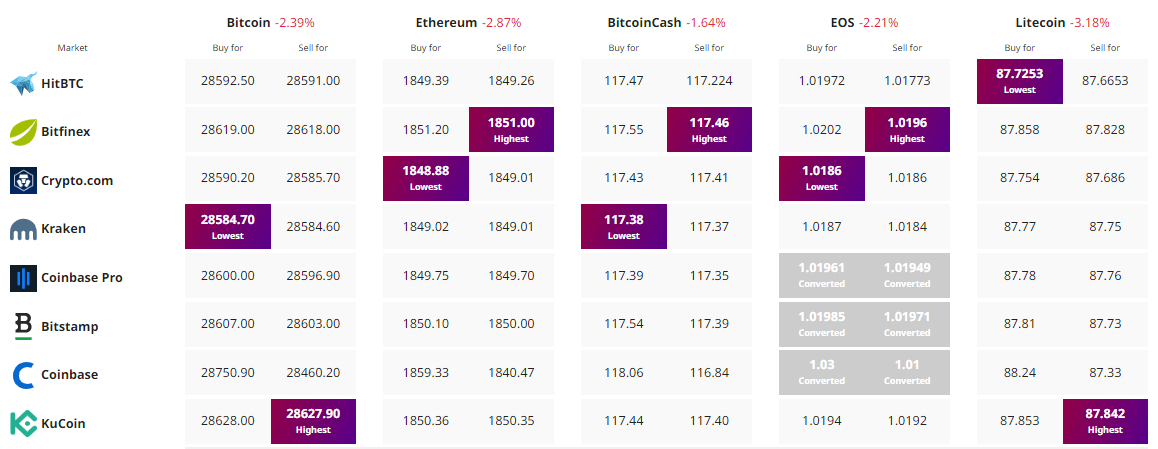

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link