A growing number of Millennials and Gen Z investors are allocating over half of their investment portfolios to cryptocurrency, according to the World Economic Forum’s 2024 Global Retail Investor Outlook published Wednesday.

Rather than a passing trend, this reflects a clear shift in how younger investors are approaching risk, trust and financial planning.

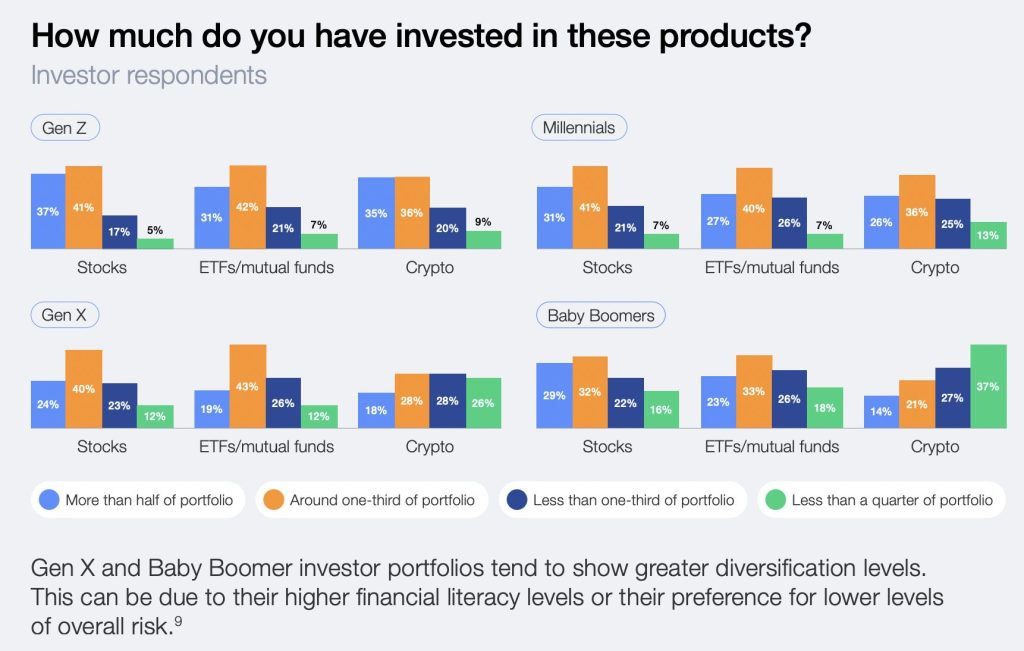

The report, which surveyed over 13,000 individuals across 13 countries, reveals that 62% of Millennial investors have crypto holdings making up at least a third of their portfolios. Among Gen Z investors, 35% allocate more than half of their portfolio to crypto, while 20% invest around one-third of their portfolio in digital assets.

These allocations often exceed their investments in stocks, mutual funds, or bonds—asset classes long considered cornerstones of a balanced portfolio.

How Gen Z and Millennials Are Rewriting Investment Rules

Young investors’ confidence in crypto appears to stem from a broader trend: many perceive it as easier to understand than traditional investments such as ETFs or bonds. This perception contrasts with the conventional view of crypto as a complex and high-risk asset. For digital-native generations, guidance now comes from crypto platforms, influencer content, and peer networks rather than traditional sources like licensed advisers or institutional analysts.

This generational shift is also about values. The report notes that 70% of Millennials and 66% of Gen Z choose financial institutions based on personal values alignment. Crypto, often associated with decentralization and transparency, appears to resonate with those priorities.

Image Source: WEF / Global Retail Investor Outlook 2024

At the same time, these younger investors are more likely to explore alternative assets and engage in shareholder activism, suggesting a broader appetite for influence and innovation.

Crypto’s Rise in Emerging Markets Highlights Shifting Financial Access

Emerging markets echo this enthusiasm. Investors from countries like India, Brazil, and South Africa show higher crypto adoption rates than their developed-market counterparts. In fact, 36% of emerging market investors hold crypto, compared to 27% globally. For some, crypto offers an accessible gateway to capital markets in environments where banking infrastructure remains underdeveloped.

Technology plays a powerful role in shaping this trend. The report finds that 41% of investors globally—and nearly half of Gen Z and Millennial respondents—are willing to delegate financial decisions to AI-based advisers. These same cohorts are also the most active users of budgeting apps, robo-advisers, and fintech platforms, further embedding crypto into their daily financial lives.

Still, the risks are real. The high concentration of portfolios in volatile assets raises concerns about long-term financial stability. Financial educators and regulators face a new challenge: how to guide a generation that prefers learning-by-doing and places more trust in YouTube than in brokerage whitepapers.

The post Crypto Becomes a Staple for Millennial and Gen Z Investors: WEF Report appeared first on Cryptonews.

Credit: Source link