Receive free Eurozone economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Eurozone economy news every morning.

Eurozone money supply has shrunk for the first time since 2010 as private sector lending stalls and deposits decline, in a financial squeeze that economists warn points to a further downturn ahead.

The money supply is one of the main metrics monitored by the European Central Bank to check the impact of recent monetary policy tightening. As lending dries up and short-term deposits shrink, economic activity is expected to slow and inflationary pressures to cool.

The latest data will feed into the debate at the ECB’s governing council over whether it should pause interest rate rises for the first time since July 2022 at its next meeting on September 14.

The more dovish members of the council say inflation is already falling and more rate rises risk causing an unnecessarily painful recession. But the hawks argue that inflation of 5.3 per cent in July is still too far above the ECB’s 2 per cent target. Economists say the decision is a “coin toss” that could depend on how much inflation falls in August when that data is released on Thursday.

The ECB’s measure of overall money in the eurozone system — the M3 figure that includes deposits, loans, cash in circulation and various financial instruments — decreased 0.4 per cent in the year to July, down from growth of 0.6 per cent in June, the bank said on Monday.

Economists said the data showed the unprecedented increase in the ECB’s benchmark deposit rate from minus 0.5 per cent to 3.75 per cent in the past year, as well as the shrinking of its balance sheet, was working as intended, supporting the case for a pause.

“On the asset side of banks’ balance sheets . . . things look bad as credit growth collapsed for corporates and especially for households,” Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management, wrote on social media platform X. He said this was “a feature, not a bug, of monetary policy” and it meant “the ECB can [should] stop hiking soon”.

The main cause of the first decline in the bloc’s money supply in 13 years was a drop in the annual growth of lending to the private sector to 1.6 per cent in July, the slowest rate since 2016. Lending to governments also declined 2.7 per cent — the biggest fall since 2007.

“Annual growth in bank lending continues to trend down rapidly,” said Bert Colijn, an economist at Dutch bank ING. “This has been driven by strong declines in business sector borrowing and a steady downward trend in household borrowing — which is mainly for mortgages.”

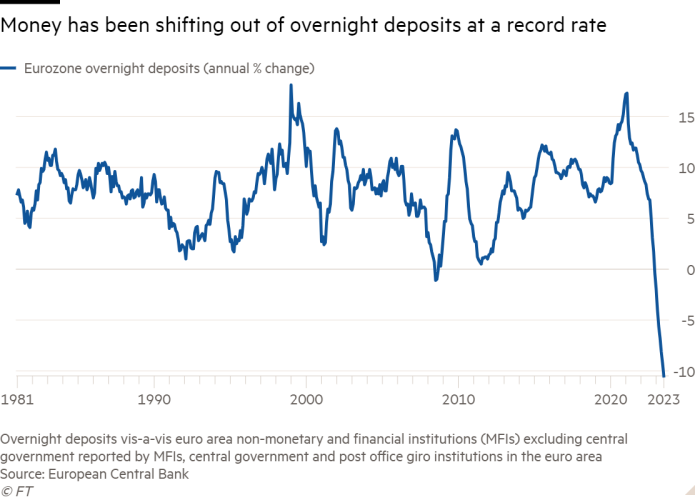

Businesses and households moved money out of overnight deposits at a record rate, with these falling 10.5 per cent in the year to July. This largely reflected a shift into higher yielding fixed-term deposit accounts, which rose 85 per cent in the same period.

Overall deposits, including those held by government bodies and financial institutions as well as households and companies, fell at a record rate of 1.6 per cent in the year to July.

“With economic activity already in stagnation mode at the moment, monetary policy is set to contribute to a weak economic environment for the quarters ahead,” said Colijn.

The eurozone economy grew 0.3 per cent in the three months to June from the previous quarter, having contracted or stagnated in the previous two quarters. But gloomy business surveys point to a likely downturn in the three months to September.

Credit: Source link