Key Takeaways:

- Gemini’s MiFID II license from the Malta Financial Services Authority allows the exchange to offer crypto derivatives across all EU and EEA countries./span>

- Malta’s crypto-friendly stance was key to Gemini’s choice of base, and the license shows months of engagement with local regulators to meet compliance standards.

- The exchange is actively pursuing a MiCA license to expand its offerings and cement its role in the evolving European crypto regulatory environment.

Cryptocurrency exchange Gemini has received regulatory approval to expand its crypto derivatives trading business across the European Union.

The exchange, founded by Cameron and Tyler Winklevoss, announced on May 9 that it had secured a Markets in Financial Instruments Directive II (MiFID II) license from the Malta Financial Services Authority (MFSA).

Gemini Expands European Footprint With Malta-Backed MiFID II Approval

According to the announcement, the new license from Malta allows Gemini to offer crypto derivatives, including perpetual futures, to advanced users throughout the EU and the European Economic Area.

The exchange said it is now working with regulators to meet the conditions for a full-scale launch of its derivatives platform.

“Once we commence business activities, we will be able to offer regulated derivatives throughout the EU and EEA under MiFID II,” said Mark Jennings, Gemini’s head of Europe.

The approval follows months of regulatory engagement in Malta, where Gemini chose to base its European licensing efforts. Malta is known for its crypto-friendly regulatory environment, making it a common hub for digital asset firms seeking access to EU markets.

MiFID II, which was launched in January 2018, is not a single license but a framework that allows companies to operate across EU member states through a system known as “passporting.”

Once licensed in one EU country, a firm can offer services across the region without requiring separate local approvals.

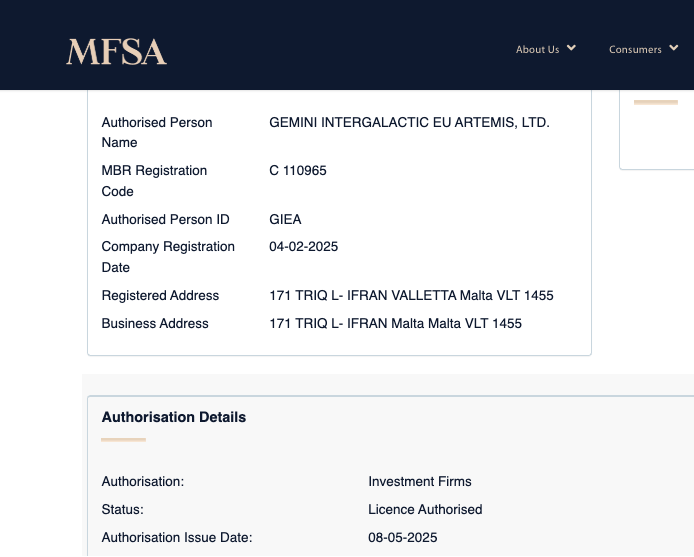

According to MFSA records, Gemini’s Maltese entity, Gemini Intergalactic EU Artemis, was issued the MiFID II license on May 8. The license is a major step in the company’s broader European expansion strategy.

“This is a significant milestone,” said Jennings. “It puts us one step closer to delivering a secure and regulated derivatives offering to both retail and institutional users in Europe.”

The announcement further noted that Gemini plans to introduce a range of crypto derivatives in the coming months, beginning with perpetual futures for advanced users. The exchange said it will continue to work with regulators to fulfill all launch requirements.

The firm also stated that it is actively pursuing a Markets in Crypto-Assets (MiCA) license, allowing it to provide a wider suite of regulated crypto services across the EU.

Gemini Advances Global Ambitions With New EU License, U.S. Office, and IPO Plans

Gemini’s latest EU license marks another step as the crypto exchange accelerates its global derivatives push.

In January, the firm named Malta its European hub for compliance under the Markets in Crypto-Assets (MiCA) framework, indicating its intent to anchor deeper within the EU regulatory fold.

This followed Gemini’s sixth virtual asset service provider (VASP) registration in Europe, secured from Malta’s Financial Services Authority in December 2024. However, the exchange is still awaiting full MiCA authorization.

The expansion of derivatives comes as competition in the space intensifies. On May 8, Coinbase revealed a $2.9 billion deal to acquire Deribit, one of the world’s top derivatives platforms. A week earlier, Kraken confirmed its $1.5 billion acquisition of NinjaTrader, targeting futures trading.

Meanwhile, Gemini is also growing stateside. The firm signed a lease for a new office in Miami’s Wynwood Art District, as its long-standing battle with the U.S. Securities and Exchange Commission (SEC) shows signs of winding down.

In March, a federal judge ordered a 60-day pause in the SEC case over Gemini Earn, giving both parties time to negotiate. The company filed confidentially earlier this year, paid a $5 million CFTC fine, and is reportedly preparing for an IPO.

The post Gemini Bags Malta MiFID License, Eyes EU-Wide Crypto Perps Rollout appeared first on Cryptonews.

Credit: Source link