Partners at firms that have chosen to remain independent are now asking whether a firm’s internal buyout multiple should be adjusted. Some believe the multiple should be increased to reflect the additional value that could be captured by selling externally to private equity or through a traditional sale to another independent CPA firm.

Processing Content

CPA firm partners have invested heavily in their careers. They’ve typically earned a great living and look forward to a comfortable retirement.

The value they have built in their practice can significantly impact how comfortable that retirement will be.

Current buyout changes: poll results

We polled CPA firms to explore how buyouts are changing in response to PE, and the results were mixed. Some firms have responded by increasing their buyout multiples or adjusting related terms. Others have reduced their buyout multiples or modified their plans, in order to keep retirements affordable for remaining partners and incoming partners.

Firm leader comments related to increased buyouts and related valuation tactics:

- “Increased the multiple of comp from 2x to 2.5x”;

- “Shorter buyout period”;

- “Changed the terms for valuation. In the past, it was based on revenue; current is based more on profitability.”

Firm leader comments related to reduced buyouts and related succession tactics:

- “Reduced buyout percentage to make retirements more affordable to new partners. Added a cap for the total amount we will pay each year to retired partners”;

- “Lowered total payout amounts. Increased vesting”;

- “Reduced the buy-in price to make it more appealing.”

Clawbacks

Several firms indicated a strong interest in adding a clawback. A clawback would allow retirees to share in any increased value if the firm is sold during their buyout period, while still giving remaining partners full flexibility to pursue a sale when it makes the most sense.

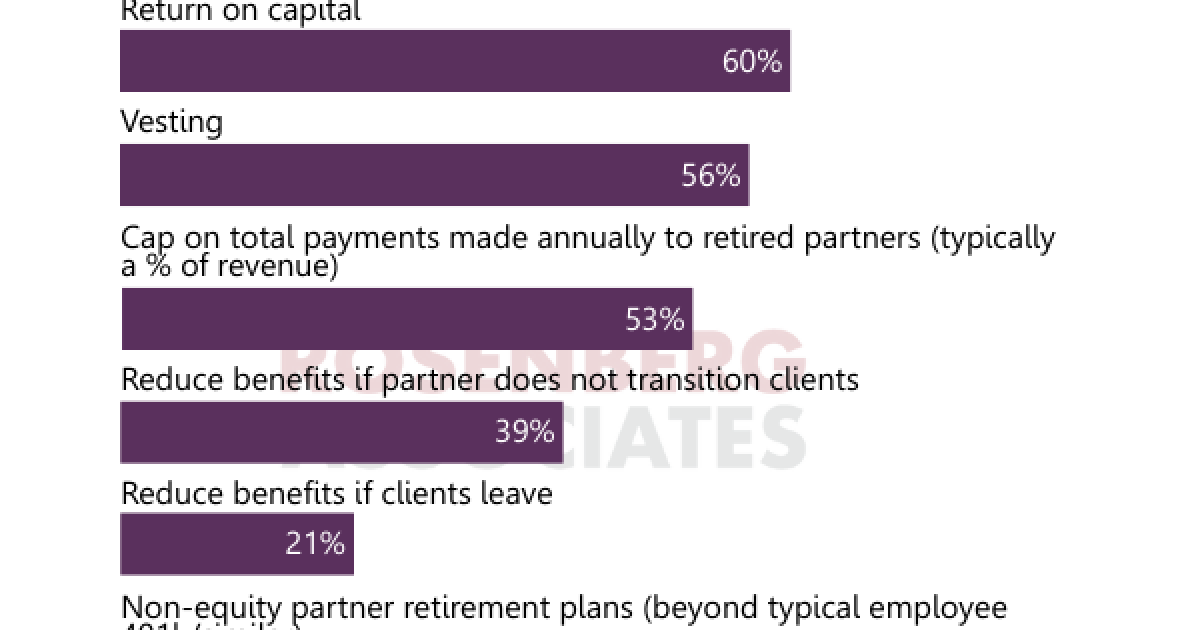

The number of respondents with a clawback provision currently in place was only 14%, representing an opportunity to increase as an industry. Other buyout features that are currently in place in respondent plans are listed in the following chart.

Contemplated future buyout changes

Forty percent of our respondents are considering retirement plan changes in the future, and about 71% of those indicated their potential updates are due to PE’s deeper involvement in the industry. Changes some firms are contemplating other changes:

- “We are looking at the steep discount of the buy-in relative to PE multiples and are considering increasing deferred comp benefits and/or accrual basis buyout (or a combination of the two).”

- “It is possible we will look at the PE effect, but the multiple we would receive from PE would really drive up the retirement payouts, and we’re not sure we would like to do that from a long-term viability standpoint.”

- “Undetermined [on changes], but the difference between external market valuations and the partner retirement structure is too wide to ignore.”

- “Having more correlation between value creation and capture. Taking over a book of business is not creating value.”

- “Clarifying how the calculations are done. Perhaps reducing the amount slightly. We are committed to remaining independent.”

- “Clawback and considering slightly higher retirement payouts.”

Evaluating your position

Retirement plan changes for your firm should be driven by strategy. What is the health of your firm now? How profitable is it? How is succession planning looking? What are the financial and legacy goals of nearer-term retirees?

The best choices are those grounded in your values and preferences. PE may offer the highest economic value for a firm, provided the firm is well suited to a PE buyer and vice versa. Many firm owners, however, feel a strong loyalty to their clients and their team — loyalties that they feel can’t be replicated by selling.

The decision to change your firm’s buyout plan isn’t an easy one, given the diversity of exit strategies and practices. Making a thoughtful, informed decision will provide the best outcome for your practice and your future.

Credit: Source link