Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

If Carlson Tong is lucky, he may just have picked the right time to take over as chair of the Hong Kong stock exchange and try to revive animal spirits in the city that likes to bill itself as Asia’s financial centre.

In the week in which the board endorsed his appointment, Hong Kong’s benchmark Hang Seng index rose 8.8 per cent, its best weekly performance since late 2011.

On Tong’s side is the promise of further help from Beijing for the territory’s stock market. China’s securities regulator, announcing the moves earlier this month, underlined the importance of Hong Kong as a financial centre.

Support is sorely needed for the market. Despite this week’s rally, which was driven by mainland investors, the Hang Seng index has fallen more than 43 per cent from early 2021, while the Hong Kong Exchanges and Clearing’s share price dropped more than 51 per cent over the same period.

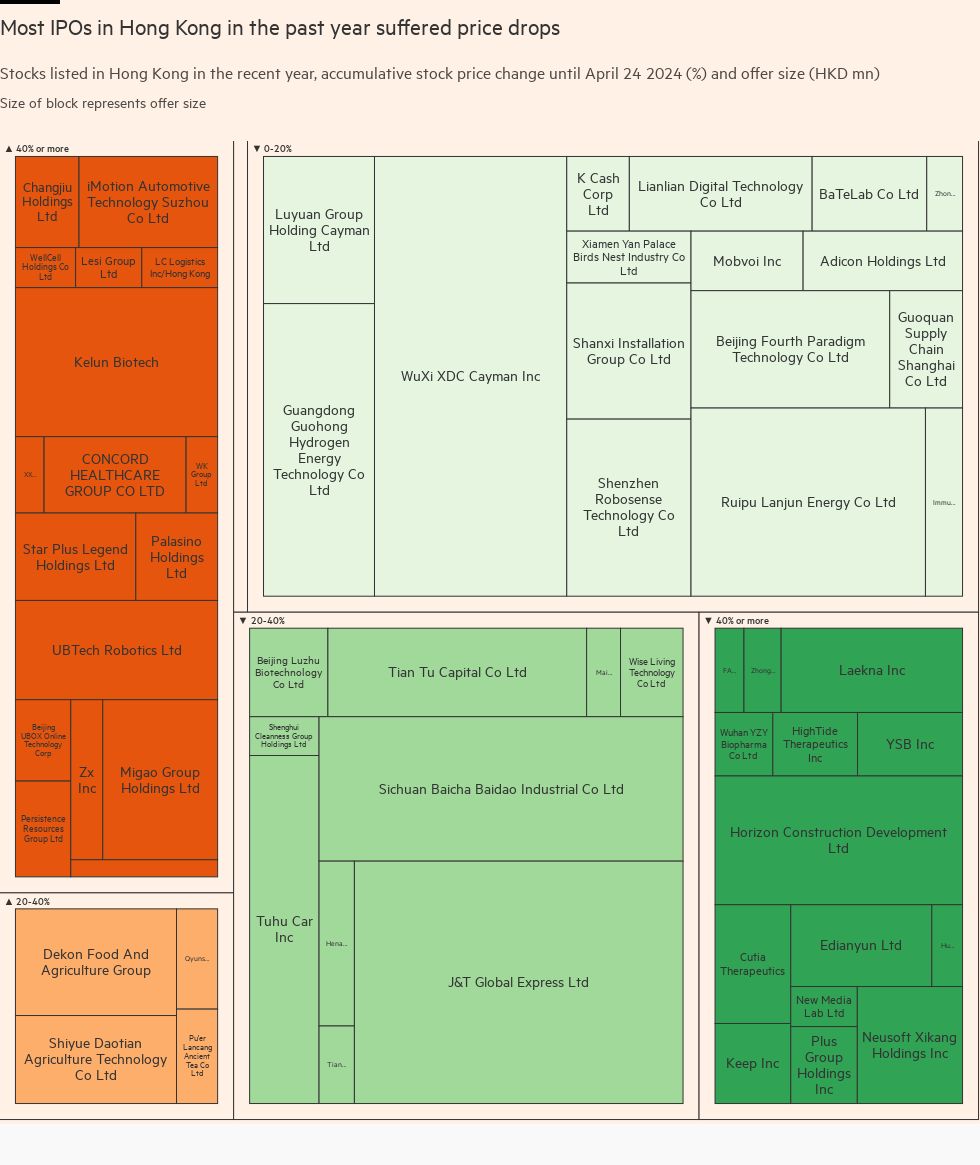

The problems faced by the exchange were underlined this week when a string of initial public offerings — including the city’s biggest this year — sank on their first day of trading.

A Hong Kong-based lPO lawyer described the market environment as “brutal” as everyone was “fighting for their own survival”.

“The amount of IPOs and the proceeds raised is just so bad and the sentiment is weak. It’s very hard to find investors,” the lawyer said. “Other than China money, [at present] very few investors are really super interested in the Hong Kong and mainland China markets.”

HKEX’s weak financial results reflect the gloom: profits sank 13 per cent in the first quarter with average daily turnover for equities falling 22 per cent year on year. The decline in revenues was partially offset by rising income from the London Metal Exchange, owned by HKEX. Still, the bourse now ranks only 10th globally in IPO volumes so far this year, trailing behind the likes of Athens and a clutch of regional rivals.

Hong Kong IPOs have raised $604mn in the first three months of this year with 12 deals — the majority of which originated from mainland China — against $851mn for 17 deals in the same period a year earlier. “Things are obviously not going well,” said Dickie Wong, executive director of research at Hong Kong-based Kingston Securities.

Turning this around is the challenge for Tong, an accountant and former chair of the city’s market regulator, and Bonnie Chan, the former co-chief operating officer at the bourse who was appointed chief executive last month, replacing Nicolas Aguzin.

Tong told the Financial Times in November that it was important to “continue to promote the city as an international financial centre” and to “make sure the city could play to its strengths [as] a super connector for China to the rest of the world”. HKEX has opened offices in London and New York in recent months.

For the new leadership team, the key is looking for “considerable opportunities to connect with the fast-growing capital hubs of south-east Asia and the Middle East”, Chan said this week. HKEX would also continue to “capitalise on the long-term growth of China”.

Earlier this month, the China Securities Regulatory Commission announced plans to encourage major mainland enterprises to list in the city and expand the scope of products for the city’s Stock Connect schemes, which connect Hong Kong and mainland China’s financial markets. “Xi Jinping has clearly stated . . . it is necessary to consolidate and enhance Hong Kong’s status as an international financial centre,” the announcement said.

“That’s a big lift for the market,” said Robert Lee, a Hong Kong lawmaker. “There’s a market expectation for more measures to come out.”

But a mainland Chinese brokerage chief executive based in Hong Kong remains sceptical. “I don’t think [Tong’s] appointment would actually change anything. The appointment speaks to the tendency of HKEX’s operation going forward, the old-fashioned locals would lack the motivation to change or pursue reforms.”

Industry insiders are also not very optimistic that overseas investors will return.

“Will foreign investors come back to Hong Kong’s stock market 100 per cent? Maybe not,” said Kingston Securities’ Wong. “With the US election looming, China-US tensions will be ongoing and continue to cast a shadow on Hong Kong, especially for foreign investors.”

In this environment, banks including HSBC and Morgan Stanley are cutting jobs. Law firms including Kirkland have also cut jobs. HSBC declined to comment on reports of job cuts but a spokesperson said the bank was “continuing to invest and grow our business”. Morgan Stanley and Kirkland declined to comment.

“Everyone was geared up for China business,” said the Asia-Pacific head of investment banking for a western bank. “[But] all the China guys are now trying to do south-east Asia or Japan.”

For this week’s three IPOs, demand was clearly weak.

Raising nearly HK$2.6bn (US$332mn), Chinese bubble tea chain ChaPanda was the biggest Hong Kong IPO so far in 2024. But the chain, also known as Chabaidao, dipped as much as 38 per cent from its listing price at HK$17.50 on its first trading day.

Shares in Mobvoi, a Chinese artificial intelligence group that counts Google as its early backer, dropped about 21 per cent on its trading debut on Wednesday. Construction services provider Tianjin Construction Development, meanwhile, closed 39 per cent lower on its first trading day.

It is clearly time for Hong Kong’s stock exchange to “reset”, said Sally Wong, chief executive of the Hong Kong Investment Funds Association.

“As we are currently in transitional period and as [Hong Kong] is repositioning . . . With a more diversified investor base, there are still plenty of opportunities ahead,” Wong said.

Credit: Source link