Millions of Americans have student loan payments starting to come due this week, after a three-year pause during the pandemic and the Biden administration’s attempt to forgive the majority of student debt. In response—and in an effort to attract and retain workers—more employers are providing student loan repayment support, a new study shows.

About a third of employers (34%) currently offer some form of student loan repayment support, according to the study released this week by the Employee Benefit Research Institute (EBRI). That’s up from a quarter of employers last year and 17% in 2021. EBRI surveyed 252 U.S. companies with 500 or more employees.

Expert Craig Copeland of EBRI believes more employers should be offering this benefit to employees in order to keep their workforce stable amid rising inflation, the threat of a recession and continued labor challenges. In fact, earlier this year, he forecast that closer to 40% of employers would provide some support over the next couple of years after the Supreme Court nixed Biden’s relief program. But increasing recession concerns have held down the number, he says.

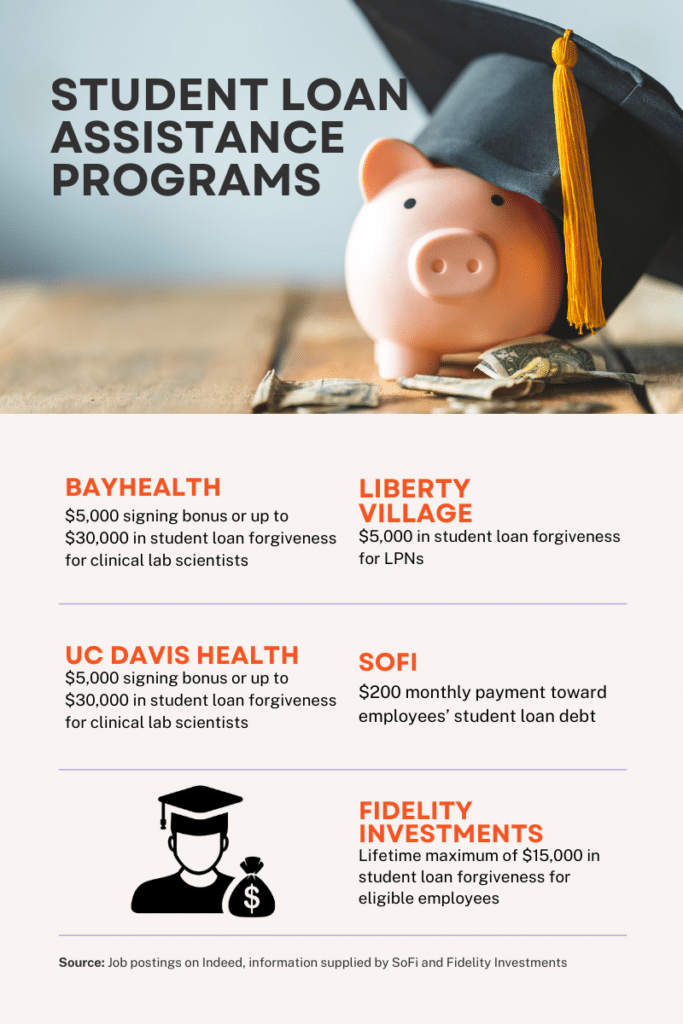

How employers help college debt holders

Those organizations that are offering student loan assistance, which ranges from debt counseling and consolidation to direct cash subsidies, gain a recruiting and retention advantage, experts say, particularly as the tight labor market persists. Seasonally adjusted weekly unemployment figures dropped to a new eight-month low last month, for example, keeping the pressure on employers to hold onto their workers.

A number of options are available to support the financial crunch their employees face with the restart of student loan payments, says Copeland, director of wealth benefits research for EBRI.

These include working with lenders to refinance student loans at a lower interest rate by bringing a group of employee borrowers to the lender and, like UC Davis Health in California, offering debt counseling or application assistance for federal student loan forgiveness programs available to some government and nonprofit employees.

“Nonprofits, most likely, are not able to give large direct payments because of their limited resources, so this is one way they can really help their employees and garner more loyalty,” Copeland says.

And some employers are offering direct support for payments. Bayhealth in Delaware, for example, offers new hires the choice of a signing bonus or a much larger student loan repayment. According to a recent job posting, clinical lab scientists can choose between a $5,000 signing bonus or up to $30,000 in student loan forgiveness.

Such direct student loan payments, which usually have a lifetime cap on the amount, are also uncommon, with just 10% of employees offering them in 2023, according to the EBRI study.

Given their high cost and risk of stoking resentment among employees without significant student debt, such payments can be more challenging for employers, Copeland says.

“I am increasingly hearing that direct subsidies are rather expensive and are very political,” he says. “Any recession or pullback in the economy is likely to keep this number lower.”

Resentment risks, however, typically can be managed with alternative offerings, he says. These could include payments for children’s college funds or other voluntary benefits offered by the employer.

An uncertain future for student loan benefits

Although employers are moving slower than expected in providing student loan repayment relief, that could change quickly.

Next year, under the Secure Act 2.0, which aims to entice people to save for retirement and make it less costly for organizations to set up retirement plans, employers can incentivize their workforce to pay off their student loans by matching employee payments with a contribution to their 401(k) plan.

Many employers have already embraced this approach despite some administrative challenges, which Secure 2.0 is designed to solve. Currently, 42% of employers offer a 401(k) student loan match, with another 23% expected to offer it in the next year or two, according to the EBRI report.

“It will be interesting to see if it really drives people to participate in the program or has an adverse effect where they are just making the minimum student loan payment and not contributing to their 401(k),” Copeland says.

The uncertain economy and continued talk of a looming recession, however, could limit participation and hold back their student loan repayment support from ever reaching his forecast of 40% of employers providing assistance.

“If we hit a recession and the unemployment rate goes up, employers may think a student loan repayment program would be easy to cut,” Copeland says. “They may say, ‘I’m sorry, it was one way that I can make sure everyone can still work and not have to take a pay cut.’ ”

Credit: Source link