The Internal Revenue Service reported progress Friday on its efforts to increase its audits of large corporations, complex partnerships and high-income individuals, collecting over half a billion dollars from millionaires who didn’t pay their taxes.

The agency said it’s also been making steady improvements in taxpayer service and technology, including for tax professionals, ahead of the

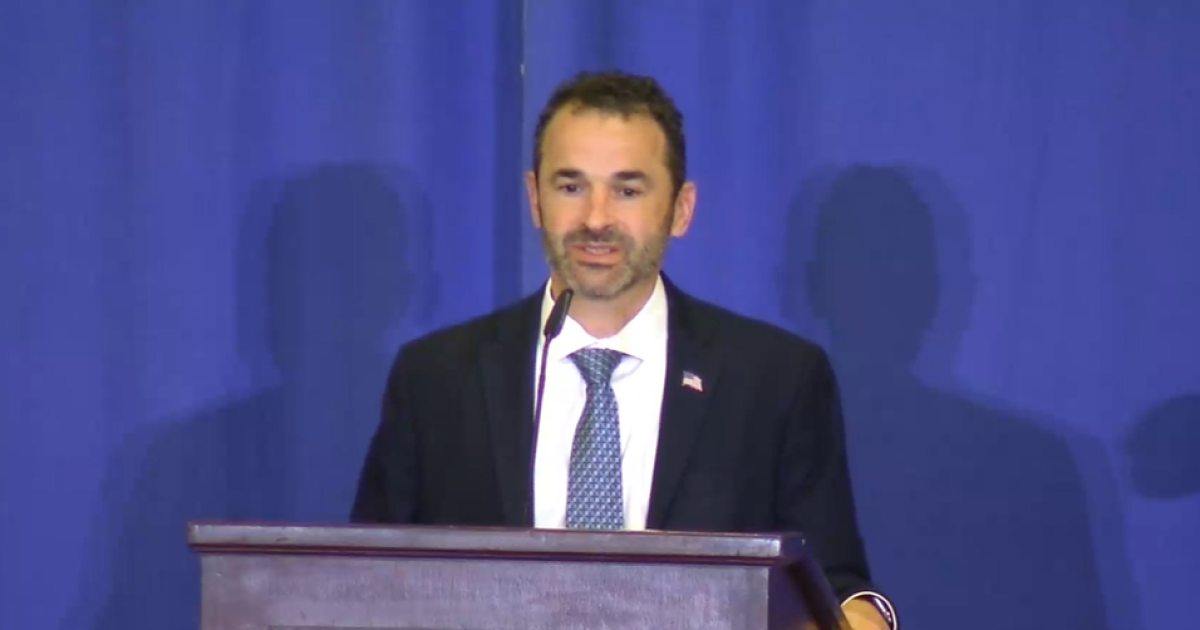

“We’ve been working hard to ensure the 2024 tax-filing season, which begins on January 29, builds on the accomplishments of last year,” said IRS Commissioner Danny Werfel during a conference call with reporters. “We know we need to do more. We remain focused on improving service to hardworking taxpayers, offering them more in-person and online resources as part of our efforts to deliver another successful tax season this year. This filing season, taxpayers and tax professionals will see additional improvements in our operations and service that will make it easier for them to prepare and file taxes.”

The IRS is going after millionaires who haven’t paid hundreds of millions of dollars in tax debt, with an additional $360 million collected on top of the

“On the compliance side, as part of our transformation efforts, we’ve continued to increase scrutiny on high-income taxpayers as we work to reverse the historically low audit rates for large corporations, complex partnerships and high-wealth individuals that existed since before the Inflation Reduction Act was passed,” said Werfel.

He summarized the IRS’s approach this way: “If you are low or middle income or any income category, you will see improved service,” said Werfel. “If you are wealthy, there will be increased scrutiny if there are tax issues. And we remain committed to following the Treasury Department’s directive not to increase audit rates relative to historical levels for small businesses and households earning $400,000 per year or less.”

He noted that the IRS is making progress in pursuing noncompliance among people using partnerships to avoid paying self-employment taxes. “This is aimed at partners who try to evade self-employment tax by using an exemption that applies specifically to limited partners, even though they don’t qualify as such. Our work in this area using new IRA funding has helped us increase our efforts, which now includes more than 80 audits.”

He noted that the IRS has been helped by a recent

“Cracking down on these high-wealth tax evaders is especially important because self-employment taxes help fund Social Security and Medicare,” said Werfel. “The average worker has these taxes automatically taken out of their paycheck, but people who are self-employed, and in this case high wealth, are supposed to pay these taxes when they file their federal return.”

Partnership audits

The IRS is also continuing to scrutinize large partnerships closely to understand the complex tax structures and tax issues they present with the help of advanced technology.

“It’s been exciting to see experts in data science and tax enforcement apply cutting-edge technology, including artificial intelligence, to identify potential noncompliance among these taxpayers,” said Werfel.

As of December, the IRS has opened audits of 76 of the largest U.S. partnerships. “They represent a cross-section of industries that include hedge funds, real estate investment partnerships, publicly traded partnerships, large law firms and other industries,” said Werfel.

The IRS is finding plenty of accounting issues there. “Also in the partnership area, we are discovering that many entities have multimillion-dollar balance sheet discrepancies,” said Werfel. “That’s important because such discrepancies are an indicator of potential noncompliance with their tax responsibilities. Our focus here is on partnerships with more than $10 million in assets. The number of these discrepancies has been increasing, with many taxpayers not attaching required statements of explanation.”

At the end of October, the IRS sent 480 compliance alerts to taxpayers where it found such discrepancies.

Along with partnerships, large corporations have been another big focus of the IRS’s compliance efforts using funding from the Inflation Reduction Act. That includes U.S. subsidiaries of foreign companies that distribute goods in this country, but leverage transfer pricing to reduce taxes on the profits generated from their U.S. activity.

“These foreign companies improperly use transfer pricing rules year after year to report losses instead of an appropriate amount of U.S. profit,” said Werfel.

To crack down on this strategy, the IRS sent compliance alerts to more than 180 subsidiaries of large foreign corporations to remind them of their U.S. tax obligations and encourage self correction.

Hiring accountants

The IRS is also expanding its compliance efforts related to the biggest U.S. corporations, including hiring accountants. “Inflation Reduction Act funding is helping us expand our large corporate compliance program, which covers entities with average assets of more than $24 billion and an average taxable income of about $526 million per year,” said Werfel. “Hiring new accountants has allowed us to open up 60 new audits of taxpayers in this group. As with partnerships, we’re selecting these corporations for audit using a combination of artificial intelligence and subject matter expertise in areas such as cross-border issues, corporate planning and transactions.”

The IRS is using the direct hiring authority it recently received to bring on board these accountants sooner than it could do under the old hiring rules, Werfel explained in answer to a question from reporters.

“What we can do with the direct hire authority is establish essentially a fast track to get qualified in this case, qualified accountants, on board at the IRS more quickly,” said Werfel. “That doesn’t mean that we don’t follow all the due diligence, the appropriate background and suitability reviews. We have just engineered a process where because of how we’re getting the applications in, doing the background checks and the suitability reviews, we can condense the resume review, the interview, the validation of salary and salary expectations, and get the hiring letter out if if everything lines up dramatically more quickly than under the traditional approach. These programs have been highly successful in getting talented people that want to be a part of public service.”

High-income individuals are another major target of the IRS’s compliance efforts. “We have dozens of revenue officers focused on these high-end collection cases,” said Werfel. “These efforts are concentrated among taxpayers, with more than $1 million in income and more than $250,000 in recognized tax debt. Last fall we began contacting up to 1,600 taxpayers in this category that owe hundreds of millions of dollars in taxes. We’ve assigned over 900 of these 1,600 cases to revenue officers, with over $482 million collected so far in this effort. This brings the total recovered from millionaires through our new initiatives to $520 million.”

Taxpayer service

The IRS has also been making improvements to taxpayer service while increasing its enforcement efforts.

“As these initiatives to improve compliance among high-income individuals, complex partnerships and large corporations ramp up, the IRS is continuing its work to improve customer service and modernize core technology infrastructure,” said Laurel Blatchford, the Treasury Department’s chief implementation officer for the Inflation Reduction Act, during the same press conference. “Treasury and the IRS are focused on achieving near-term service improvements and longer-term modernization and continue to expand Taxpayer Assistance Center operations.”

Currently, the IRS has opened or reopened 54 in-person Taxpayer Assistance Centers since the passage of the Inflation Reduction Act, including four since November in Bellingham, Washington; Eau Claire, Wisconsin; Washington, Pennsylvania; and Media, Pennsylvania.

“We remain focused on helping taxpayers to get it right the first time, both claiming the credits and deductions they are eligible for, and avoiding back and forth with the agency when errors arise,” said Werfel. “We want taxpayers to be able to interact with us in whatever way works best for them, whether that is on the phone, in person or online. Our goal is to meet taxpayers where they are, especially those underserved and rural communities. To enhance in-person service, we continue to expand help at our Taxpayer Assistance Centers, or TACs, across the country. IRA funding has allowed us to now open or reopen 54 Taxpayer Assistance Centers, including four since November. For the 2024 tax-filing season, our goal is for all of our TACs to collectively offer 8,000 more hours of in person assistance than they did last filing season. To get us there, we have increased staffing. As of the end of December, we brought on 858 new TAC employees, a net increase of 410 compared to fiscal year 2022, and we will continue hiring to replace departing staff. These employees, available under Inflation Reduction Act funding, are helping more and more taxpayers across the country.”

The IRS hopes to avoid the funding cuts that Congress seems to be threatening on a constant basis.

“The IRS needs to constantly balance the day to day of running the tax system with instituting longer-term improvements to service and technology that are going to pay dividends for taxpayers decades down the road,” said Blatchford. “This is why ensuring a sufficient annual budget for the IRS is so critical. Achieving the long-term goals of the Inflation Reduction Act resources depends on robust yearly budgets to fund basic operations like answering taxpayer phone calls. While the framework announced last weekend does not impact near-term plans for Inflation Reduction Act investments, an annual appropriations bill that allows the IRS to fund its day-to-day operations is essential. Delivering the service to American taxpayers this year and delivering the service American taxpayers deserve 10 years from now requires annual long-term funding working in concert. The bottom line is that Inflation Reduction Act resources are working. Services have significantly improved. New high-end enforcement initiatives are bringing in revenue and technologies are being upgraded with new tools and features being rolled out. The IRS was underfunded for decades, so much work remains to realize the full potential of these resources, but what we’ve been able to achieve in the last 18 months shows how the IRA is paying off for taxpayers and the country.”

Technology improvements

Werfel pointed out that the IRS is also using the extra funding from the Inflation Reduction Act to enhance online assistance as well as in-person help.

“Taxpayers deserve the same functionality in their online accounts that they experience with a bank or other financial institution,” he said. “We’re making progress toward our five-year goal of giving taxpayers the ability to securely file all documents and respond to all notices online and securely access and download their data and account history.”

The IRS made several updates to the Individual Online Accounts that taxpayers can access. “Taxpayers can now save multiple bank accounts, validate bank account information and display their bank name,” said Werfel. “They can also schedule and cancel payments and expand and revise payment plans.”

The IRS has also improved its recently introduced Business Tax Accounts as well as Tax Pro Accounts. “We launched the second phase of the Business Tax Accounts that expands its online capabilities, as well as the types of entities that are eligible to use this tool, and we’ve made several enhancements to the Tax Professional Account,” said Werfel. “For example, we’ve given tax pros the ability to view their individual and business clients’ tax information, including business balances due, and canceled and return checks for individuals.”

The IRS is also seeing increased usage of its Document Upload Tool, which enables taxpayers to respond to IRS notices online and avoid paper correspondence when they don’t have a filing or payment requirement. “Throughout 2023, we added different types of notices and letters to the Document Upload Tool that can be used,” said Werfel. “As of December, we have received more than 45,000 responses to notices via this tool.”

During filing season 2023, taxpayers could respond to 10 of the most common notices for credits like the Earned Income and Health Insurance Tax Credits online. By last July, taxpayers had the option to respond to 61 IRS notices and letters, and by October 2023, taxpayers can now respond to all notices and letters that do not have a filing or payment action.

The IRS has also enhanced two other widely used online tools,

The IRS has also been using the Inflation Reduction Act funds to add new scanning and mail-sorting equipment. “Modernizing our operations is the key to meeting many of our transformation goals and we’re making progress here as well,” said Werfel. “IRA funding has helped us replace old out-of-date scanning equipment and mail-sorting machines. That has greatly streamlined the process of opening, sorting and scanning mail. We also continue improving our ability to digitalize paper returns and forms. During calendar year 2023, the IRS scanned more than 1.5 million pages. That includes more than 484,000 Forms 940, more than 907,000 Forms 941 and more than 111,000 Forms 1040. It’s exciting to see how far we’ve come over the past few months in this area, and I look forward to seeing this progress continue.”

Avoiding funding cuts

The IRS hopes to preserve its funding, despite the possibility of budget cuts by Congress this year or after the elections in November.

“It’s clear Inflation Reduction Act funding is making a difference for taxpayers, and we will build on these improvements in the months ahead,” said Werfel. “I will just remind everyone that for this progress to continue, we must maintain a reliable, consistent annual appropriation for our agency, as well as keeping Inflation Reduction Act funding intact. With adequate resources, we will be able to continue transforming the agency during 2024, and in the years to come.”

Last weekend, House Speaker Mike Johnson, R-Louisiana, and Senate Majority Leader Chuck Schumer, D-New York, agreed to

“The impact of the rescission that’s being discussed as part of the current budget deal will not impact our efforts until the later years,” he responded. “If we end up with $60 billion in modernization funding rather than $80 billion, we have the ability to still spend that $60 billion over the next 10 years, and our intent is to spend the money to have maximum impact in helping taxpayers in the areas that we’ve describing, to spend the money to have maximum impact now and in the immediate future, on allowing taxpayers have better access either in person, on the phone or on the web, to use that money to continue the tremendous momentum we’re having in finding areas where wealthy taxpayers are shielding their income and collecting from them what is owed, and a whole variety of other areas. The concern about the budget would be in the later years. My hope is that as we demonstrate the positive impact that IRA funding is having for all taxpayers, that there will be a need and a desire amongst policymakers at that time to restore IRS funding so that we can continue to maintain the momentum that’s having a very positive impact, not only on on taxpayers having an easier time navigating the complex tax laws, but ensuring there’s equity in our compliance with our tax laws.”

Government shutdown

In case a budget deal can’t be reached and there is a government shutdown, the IRS is prepared, although it could disrupt some operations during tax season. Werfel was asked about the impact of that as well.

“Shutdowns are highly disruptive,” he responded. “And although we have the ability under the law, to carve out certain activities, and preserve them as ongoing operations during a shutdown, and maintaining the filing season, we’ll have a variety of different carveout elements that will allow us to maintain operations, it will increase the risk that we don’t have as smooth a filing season as we intend to have. We have experienced shutdowns before. We have not experienced a shutdown in the middle of filing season, so there’s some uncertainty there. Of course, we will do everything in our power to minimize the disruptions that a shutdown would have on filing season. But as many of us have experienced who have been through government shutdowns before, and as you’ve seen, if you’re outside the government looking in, they can be very disruptive and very chaotic, and so I worry about the risks that the shutdown presents on all IRS operations.”

Tax extenders

Congress has also been

Werfel was asked about how the IRS would handle such a change with tax season about to start. “In terms of tax packages that occur late in the year for us, which means right before filing season starts or right after, the IRS is no stranger to these types of late-breaking changes to the code that impact either the imminent filing season or the filing season that we’re in,” he responded. “As we’ve done in previous years, we’ll review the legislation, roll up sleeves and get the job done. It’s hard for me to fully comment until we see the details of any tax package, but just based on precedent and prior years, the IRS has shown a resiliency and an ability to quickly turn around these types of packages.”

Credit: Source link