The Internal Revenue Service and its Security Summit partners at state tax authorities and tax prep companies issued a warning Thursday about a new scam email this tax season pretending to come from tax software providers asking for the preparer’s Electronic Filing Identification Number.

The scammers ask for EFIN documents from practitioners, claiming they’re a required verification to transmit tax returns. The thieves then try to steal client data and tax preparers’ identities, creating the potential for them to file fraudulent tax returns for refunds.

To protect tax professionals, the IRS is hosting a special series of educational webinars aimed at the tax community. The sessions will start Feb. 12 and run each day next week.

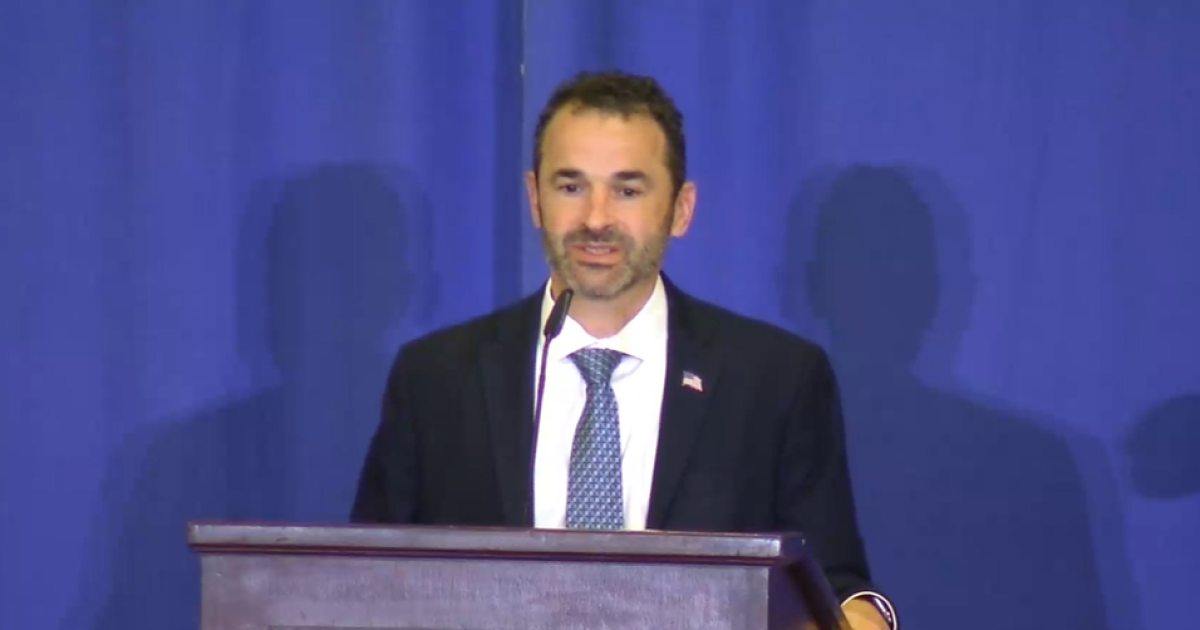

“With filing season underway, scammers use this time of year to target tax professionals as well as taxpayers in hopes of stealing information that can be used to try filing fraudulent tax returns,” said IRS Commissioner Danny Werfel in a statement Thursday. “The IRS and the Security Summit partners have noticed a new surge of an EFIN scam email that targets professionals. This scam serves as a powerful reminder that tax professionals should ensure strong security at their practices, including reminding employees to be careful with any emails coming in that could be posing as an official communication. A little extra caution can mean a world of difference for tax professionals during this busy period.”

The IRS said it’s already gotten dozens of reports about the scam targeting tax pros. The scam email includes a U.S.-based area code for faxing EFIN documents and also has instructions on obtaining EFIN documentation from the IRS e-Services site if the number is unavailable. Scam variations being seen use different fax numbers for software vendors. Other warning signs of a scam include inconsistencies in the email wording and a German footer in the email.

The IRS said tax professionals who receive the emails shouldn’t respond to them, nor proceed with any of the steps displayed in the email. The body of the fraudulent email says:

Dear [recipient_email_address],

Help us protect you.

Because many Electronic Filing Identification Numbers (EFINs) are stolen each year and used to file fraudulent tax returns, the IRS has asked software vendors, such as Software A, to verify who the EFIN owner is by getting a copy of the IRS issued EFIN document(s). Our records show that we do not have a document for one or more of the EFINs that you transmit with.

What this means for you: Until your EFIN is verified, you will be unable to transmit returns. Please provide a copy of your EFIN Account Summary from IRS e-Services, with a status of ‘Completed’, to Software B for verification.

To send us your EFIN Summary document:

1. Fax to Software B at 631-995-5984

PLEASE NOTE THAT YOUR PREPARER TAX IDENTIFICATION NUMBER (PTIN) APPLICATION CANNOT BE USED AS DOCUMENTATION FOR YOUR EFIN.

If you do not have the above documentation you can get a copy of your IRS Application Summary from IRS e-Services by following the below steps or call the IRS e-Services helpline at 866-255-0654.

1. Sign in to your IRS e-Services account

2. Choose your organization from the list provided and click Submit

3. Click the Application link to access your existing application

4. Click the e-File Application link

5. Select the existing application link that applies to your organization

6. Click the Application Summary link for the area of the application you wish to enter

7. Click the Print Summary link at the bottom of the summary presented on the screen

If you have any questions please contact the Compliance Department at xxx-xx-xxxx for assistance.

Thank you for your business. We look forward to serving you this coming season. Software B (edited)

Webinars planned

To respond quickly to the scam, the IRS will be providing special webinars next week for tax professionals where agency cybersecurity experts will share information.

To register for a session, tax professionals can click on the date/time below. Space is limited; continuing education credits will not be offered:

Monday, Feb. 12, at 12 p.m. Eastern │11 a.m. Central │10 a.m. Mountain & Arizona│9 a.m. Pacific│8 a.m. Alaska │7 a.m. Hawaii-Aleutian.Tuesday, Feb. 13, at 1 p.m. Eastern │12 p.m. Central │11 a.m. Mountain & Arizona│10 a.m. Pacific│9 a.m. Alaska │8 a.m. Hawaii-Aleutian.Wednesday, Feb. 14, at 2 p.m. Eastern │1 p.m. Central │12 p.m. Mountain & Arizona│11 a.m. Pacific│10 a.m. Alaska │9 a.m. Hawaii-Aleutian.Thursday, Feb. 15, at 3 p.m. Eastern │2 p.m. Central │1 p.m. Mountain & Arizona│12 p.m. Pacific│11 a.m. Alaska │10 a.m. Hawaii-Aleutian.Friday, Feb. 16, at 3 p.m. Eastern │2 p.m. Central │1 p.m. Mountain & Arizona│12 p.m. Pacific│11 a.m. Alaska │10 a.m. Hawaii-Aleutian.

Credit: Source link