Key Takeaways:

- KuCoin’s mandatory KYC rollout triggered a 77% plunge in its Bitcoin reserves, as privacy-focused users rapidly withdrew funds rather than comply.

- The dramatic outflow shows how sensitive crypto users remain to compliance shifts and regulatory crackdowns.

- KuCoin’s experience exposes the trade-off exchanges face between regulatory alignment and user retention in an era of tightening global AML standards.

KuCoin, one of the world’s largest cryptocurrency exchanges, has seen a dramatic drop in its Bitcoin reserves since mid-2023, when it announced a mandatory Know Your Customer (KYC) requirement.

Since that period, the exchange has seen a dramatic 77% decline in its Bitcoin reserves.

KuCoin’s BTC Reserves Have Dropped from 18,300 to 4,100 since 2023

According to the data compiled by Onchain School, KuCoin’s BTC reserves dropped from 18,300 BTC to just 4,100 BTC between June 5 and June 28, 2023.

The outflow totaling over 14,000 BTC correlates closely with the timeline of KuCoin’s announcement to tighten its KYC procedures.

The sharp decline began after rumors of a KYC overhaul surfaced on June 5, 2023. The outflows intensified following KuCoin’s official announcement on June 28, confirming that all newly registered users would be required to complete KYC verification starting July 15.

The exchange stated that existing users must also complete KYC to access key services, including new deposits. However, these users retained limited access to features like withdrawals and redemptions on staking products.

Though declining exchange reserves have been a broader trend in the industry, KuCoin’s case stands out for its speed and scale.

“The timing and magnitude of this outflow strongly correlate with the enforcement of KYC,” Onchain School noted, adding that it highlights “how sensitive users remain to compliance-related changes, especially when privacy is perceived to be at risk.”

KuCoin’s KYC upgrade was part of its effort to align with global anti-money laundering (AML) practices. The exchange cited anti-money laundering obligations and global compliance standards as reasons for the shift.

“Due to the restrictive environment of global regulation and anti-money laundering practices, KuCoin is going to conduct mandatory KYC,” the company stated at the time.

Mounting legal pressure in the United States, however, was behind this policy change. In 2024, the U.S. Attorney’s Office revealed that KuCoin and its parent company, PEKEN GLOBAL LIMITED, had violated U.S. anti-money laundering and KYC regulations.

As part of a settlement, KuCoin agreed to pay a $297 million fine and exit the U.S. market for at least two years.

Federal prosecutors alleged that KuCoin failed to register as a money services business with FinCEN and deliberately avoided implementing basic AML safeguards.

According to the indictment, KuCoin allowed billions of dollars in suspicious transactions to pass through its platform.

“KuCoin served as a vehicle for laundering the proceeds of criminal activities,” said U.S. Attorney Danielle R. Sassoon.

The indictment further claimed that KuCoin had no meaningful KYC or AML program in place for years, despite serving over 1.5 million U.S. customers and collecting more than $184 million in fees since 2017.

Internal procedures were either absent or ignored, and customer identities went largely unverified until mid-2023.

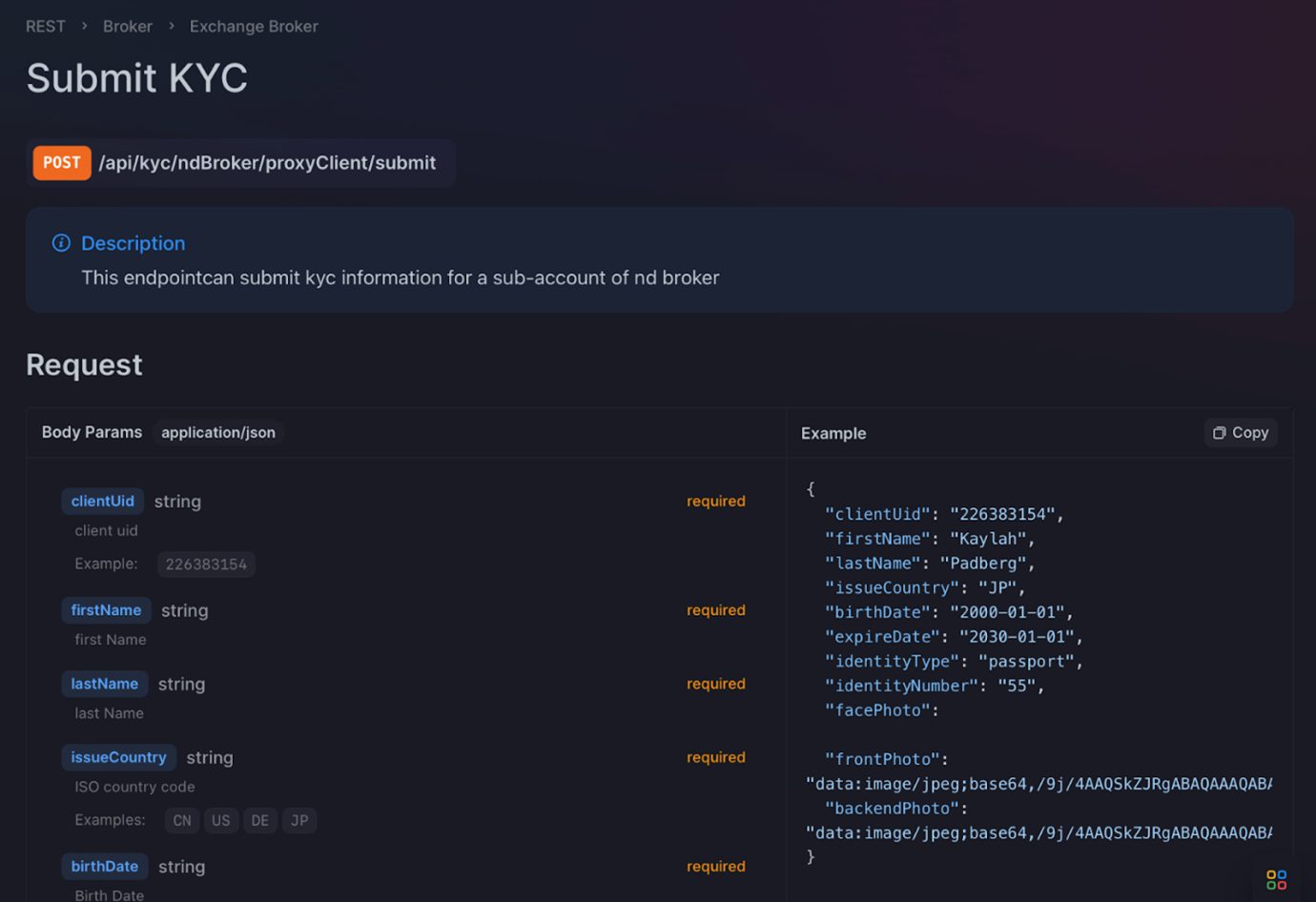

KuCoin Users Exit En Masse as KYC Rules Extend to Broker Accounts

Though the platform began introducing KYC for new users in July 2023, existing users could still trade or withdraw without verification until much later. The abrupt shift to mandatory checks for all exchange broker sub-accounts in early 2024 surprised many.

Currently, KYC for broker sub-accounts must be submitted through KuCoin’s API, as there is no web interface. Users are also required to verify only once per account.

KuCoin has stated that regular sub-accounts created under a master account remain unaffected by the KYC rule.

Still, the damage appears done. The substantial outflow of BTC suggests that a large portion of KuCoin’s user base, particularly those valuing anonymity, chose to withdraw funds rather than comply.

The post KuCoin BTC Reserves Collapse 77% as 14k Coins Flee, Liquidity Squeeze Looms appeared first on Cryptonews.

Credit: Source link