Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Nvidia’s revenue more than doubled in the past quarter to continue its run of blockbuster growth, but its shares fell as the US chipmaker failed to top the highest expectations for what has become one of Wall Street’s most closely watched companies.

The Silicon Valley-based company sought to reassure investors that it would see “several billion dollars” in revenue this fiscal year from the next generation of its powerful artificial intelligence chips, despite hitting production problems. Nonetheless, Nvidia’s outlook for the current quarter fell shy of analysts’ most ambitious forecasts.

Revenue in the three months to July 28 was $30bn, up 122 per cent from a year ago. Analysts had expected $28.7bn. Nvidia is expecting $32.5bn in revenue for the current quarter, plus or minus 2 per cent, only just ahead of analysts’ consensus expectations. It also authorised another $50bn in share buybacks.

Some investors had been looking for an even higher revenue forecast in the run-up to Wednesday’s report. Its shares fell in after-hours trading by as much as 8 per cent following a call with investors, potentially wiping more than $200bn off its market capitalisation.

Nvidia’s latest numbers had been hotly anticipated by investors for signs of how the AI boom that has gripped the tech sector was faring.

Nvidia has taken on an outsized importance in US stock markets, after a blistering rally pushed its shares up about 160 per cent in the year to date, giving it a market capitalisation of $3tn. Its growth has driven more than a quarter of the year-to-date gains on the S&P 500.

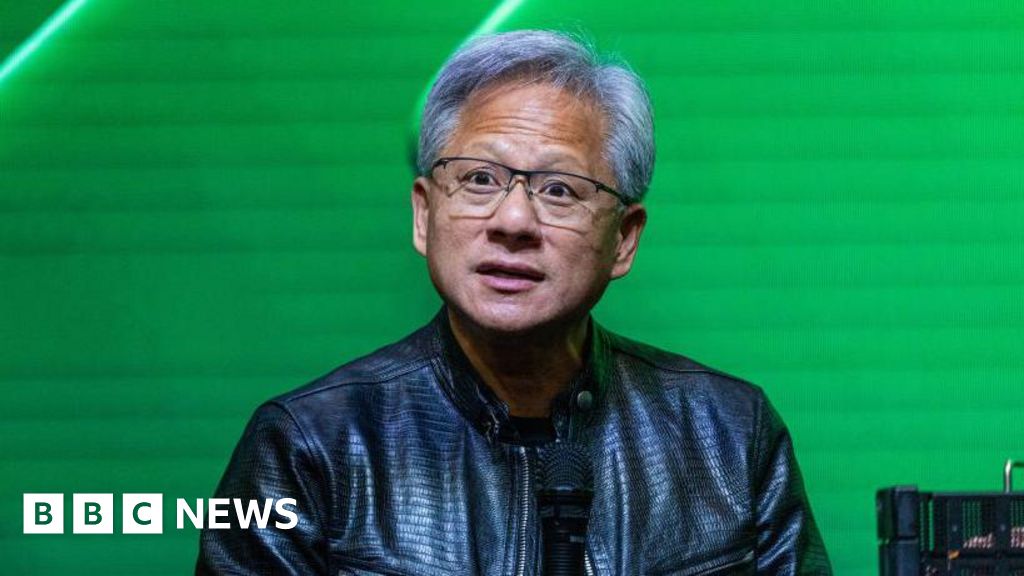

Asked whether he felt the weight of those expectations, Nvidia chief executive Jensen Huang told the Financial Times: “Not until you brought it up just a second ago. We can only do our job. We can only do what we can do.”

He added: “Everybody’s racing to the future . . . It is our responsibility to help the world get there.”

While its year-on-year growth drove another record quarter for Nvidia, its pace was far less than the 262 per cent jump in revenue it had reported in the prior quarter. Earnings per share were 68 cents, versus estimates for 65 cents, with net income of $16.6bn. Its gross margin hit 75.1 per cent, compared with analysts’ expectations for 75.5 per cent.

Earlier this month, a delay to its next generation of chips, known as Blackwell, emerged as a potential hurdle to Nvidia’s breakneck growth. Huang had previously said Blackwell would generate “a lot” of revenue this year.

Finance chief Colette Kress addressed the delays on Wednesday, saying that Nvidia — which works with Taiwan Semiconductor Manufacturing Company to build its chips — had made changes to how Blackwell was produced to improve manufacturing yield.

She added: “Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue.”

Huang added that demand for its current-generation Hopper chips “remains strong”.

On a call with investors, Huang did not detail the extent of the Blackwell delay but said the change to the design was complete and “there were no functional changes necessary”.

The latest quarterly results from Google, Microsoft, Meta and Amazon have shown the size of Big Tech’s spending spree to build the infrastructure to train and run AI models. They are also among Nvidia’s biggest customers, and the earnings report was expected to offer a temperature check on the broader mood around AI.

Regarding the massive spending on AI infrastructure, “we are seeing the momentum of generative AI accelerate”, Huang said. The company expects its data centre revenue, which hit $26.3bn in the past quarter, to grow “quite significantly next year”.

Daniel Newman, chief executive of Futurum Group, described it as a “solid quarter, but anything less than a guide to the top of estimates would likely be met with some consternation”.

“I think we are seeing a peak of expectations and there is so much buying into [Nvidia] that it really had no upside, barring a ridiculous guide or a surprise announcement,” he said. “Hopper demand should allow the company to safely beat its [guidance], which was ahead of consensus but still conservative in my view.”

Credit: Source link