It’s been a volatile few years for HR and organizational leaders, but people analytics has proven to be a beacon of information and clarity in uncertain times. As 2023 rolls out, we find technology vendors battening the hatches and refining their approach but still very much prepared to continue to light the way through rough waters.

A tight labor market, turnover, inflation and concerns about engagement, wellness, workplace safety and hybrid work have put unprecedented pressure on organizations seeking to win and keep top talent. More than ever before, they are leaning on software vendors and advanced people analytics to give them the insights that can guide their decisions.

A thriving market protects against recession

In our People Analytics Technology Report: State of the Market 2023, which was released last month, RedThread Research has found that a maturing people analytics technology marketplace is more than up to this task. Vendors in this space are thriving. And though the market has changed over the last few years, vendors are continuing to adjust their products and go-to-market approaches to meet changing times—and evolving customer needs.

Overall, this year’s report finds the people analytics technology (PAT) market is thriving, reaching $5.6 billion in 2022—a 41% growth rate since 2021 and a 50% CAGR over the past three years (Figure 1). The study, which is based on three quantitative surveys and more than 20 vendor briefings—and which is available to RedThread members with an expanded vendor breakdown—finds the PAT market stronger and more mature as more companies rely on technology to make their people decisions.

Figure 1: PAT estimated market size 2016-2022 | RedThread Research, 2023

At the same time, with fewer mergers and less investment in 2022, we are seeing this market settle into a more mature posture—confident and largely optimistic, but cautious.

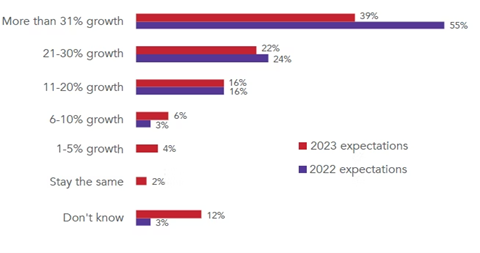

Vendors have scaled back on the aggressive growth plans we have seen in prior years and are instead trimming costs, refining their technology offerings, increasing integrations and increasing partnerships. Only 39% of vendors expect more than 31% growth for 2023, much lower than what they expected for 2022 (Figure 2). About 12% of vendors expect less than 10% growth, and another 12% are unsure or don’t know how much growth they might experience in 2023.

Figure 2: Percentage of vendors with revenue growth expectations for 2023 vs. 2022 | RedThread Research, 2023

There are a couple of reasons for this. Clients are asking HR teams to tighten their budgets and reduce investments to protect against uncertainty—resulting in longer sales cycles and lower conversion rates. Similarly, layoffs could result in a reduction within HR and people analytics, lowering the size of deals or renewals.

People analytics tech vendors pivoting to new offerings, price models and segments

Rather than the broad expansion we have seen over the past years, companies are now focusing on maturing and exploring depth in their existing product offerings and go-to-market strategies to drive growth in 2023. This includes opening up new markets for existing products and rethinking pricing and subscription models—including targeting customers in small and mid-sized markets.

See also: Major tech leaders discuss key capability for people analytics teams

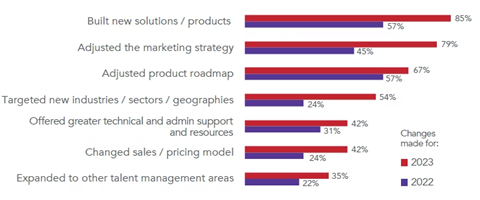

Specifically, vendors are making changes to their business approach in 2023 by (Figure 3):

- Building new solutions or products: 85% of vendors built new solutions/products for 2023, compared to 57% that did the same in 2022.

- Adjusting their marketing strategy: Almost 80% of vendors said they have adjusted their marketing strategy for 2023, compared to 45% in 2022.

- Targeting new industries and sectors: 54% of vendors targeted new industries and sectors compared to almost half that did the same in 2022.

- Changing their pricing or sales model: 42% of vendors changed their pricing or sales model, compared to 24% in 2022.

Figure 3: Percentage of vendors that made changes to their business approach for 2023 vs. 2022 | RedThread Research, 2023

For potential technology buyers, these business changes could mean:

- More solutions will be targeted for specific industries than before.

- More solutions will cater to specific workforce needs and use cases.

- Pricing models could be more favorable compared to before.

- Greater technical and administrative resources than before.

- Products might be positioned differently.

Zeroing in on top customer issues with people analytics

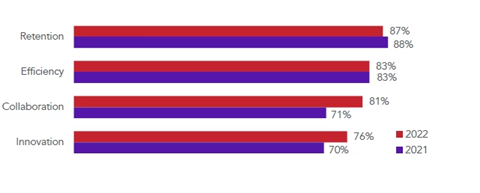

As they focus their product offerings, PAT vendors are also paying close attention to the issues that are most important to customers, the foremost of which are (Figure 4):

Retention: Most vendors (87%) reported their solutions positively impact retention, similar to 2021. The tight labor market has made employee retention a top priority for companies.

Efficiency: The majority of the vendors (83%) said they drive efficiency, the same percentage as in 2021. Companies are increasingly focused on improving efficiency as they strive to do more with fewer resources in the current economy.

Collaboration: While 71% of vendors said their solutions impacted collaboration in 2021, the number rose by 10% in 2022. Hybrid work has made collaboration a top priority for companies.

Innovation: Seventy-six percent of vendors said they have solutions that help drive innovation significantly or to a very great extent, compared to 70% in 2021.

Figure 4: Percentage of vendors that reported their solutions impacted business and talent outcomes to a “significant” or “very great” extent in 2022 vs. 2021 | RedThread Research, 2023

One area that few PAT vendors are focused on is upskilling/reskilling, as it requires significant investment in data structuring and integration capabilities—though more vendors did say their solutions drive skills development in 2022 than in 2021.

Vendors taking a consultative approach with customers

With technology changing so rapidly and growing demand from customers for help in talent strategies and planning, companies are also taking a more hands-on approach and providing more technical and administrative resources to clients, including increased check-ins.

These supports do not come without a cost, as vendors are charging for consulting services. Customers should be sure to calculate these costs into their budgets on top of the initial implementation and subscription charges.

The road ahead for people analytics

Overall, our 2023 report found the PAT market in a very strong position, buoyed by strong recent growth, and falling back to a defensive stance in the face of possible future disruption. As it looks to reinforce and protect recent growth, the industry is focused on maturing existing products and markets, and its more cautious approach is tempered by a high sensitivity to customer needs—something that stands to benefit both PAT vendors and their clients over the next year and beyond.

*

To learn more about 2023 PAT trends and market forces, you can join our free webinar on June 29 or download the executive summary for this year’s report. If you would like access to the full report, the vendor breakdown and more analysis, consider joining the RedThread community at www.redthreadresearch.com.

Credit: Source link