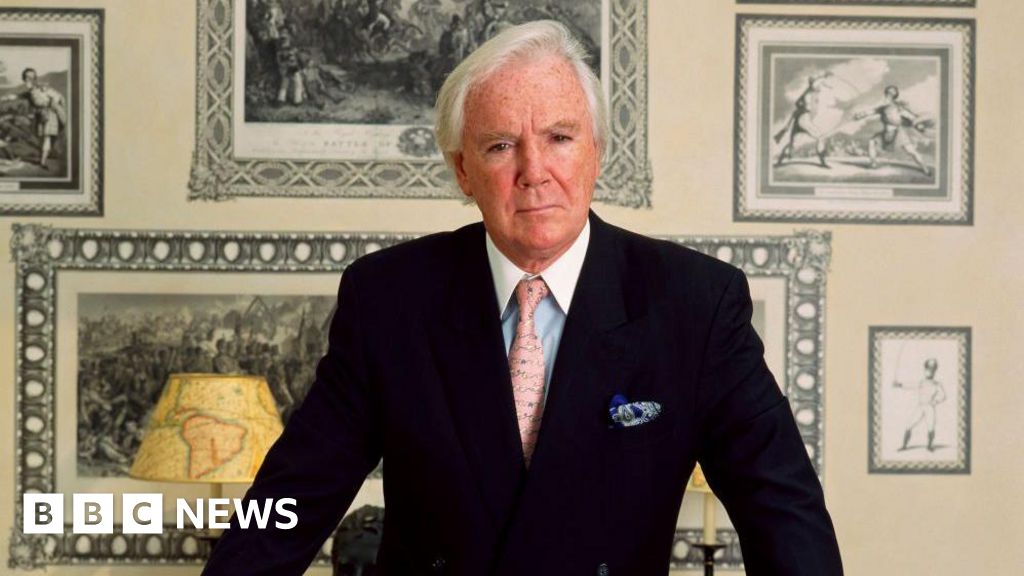

Sir Anthony O’Reilly, who has died at the age of 88 after making and losing one of Ireland’s biggest fortunes, was a rugby star who became one of his country’s most celebrated businessmen, philanthropists and raconteurs.

He first came to prominence in the business world as the creator of the successful Kerrygold marketing campaign for Irish dairy products in the early 1960s. But he was already a familiar figure from his dazzling performances on the rugby field. He was capped 29 times for Ireland between 1955 and 1970 and also played for the British Lions.

O’Reilly, who was better known as Tony even after being knighted in 2001 for his services to Northern Ireland, was born in 1936, the son of a senior civil servant. He had a conventional Irish middle class upbringing in Dublin, but it took an unconventional turn when, towards the end of his schooldays, he discovered that his parents were not married to each other. His mother had simply taken O’Reilly as her surname by deed poll. There being no divorce in Ireland, his father was still legally married to another woman by whom he had three children.

After this information became public in a 1990s biography, some speculated that O’Reilly’s unusual background could have driven him to achieve the success that he found in both sport and business.

Whatever the mainspring of his talents, O’Reilly deployed his unusual qualities of intelligence, determination and stamina, coupled with humour and charm, to considerable effect. He began his business career as a management consultant with clients including a maker of garden gnomes whose problems later provided him with a rich store of anecdotes for the many after-dinner speeches he was invited to give.

His first executive role was in Dublin in the early 1960s when he was put in charge of An Bord Bainne, a new government organisation for promoting Ireland’s dairy industry. O’Reilly created a viable production and marketing strategy and, aged 26, propelled Irish butter and cheese into international markets with the launch of Kerrygold.

When a board member protested that there were “no cows in Kerry”, O’Reilly replied, by his own account, that the British housewives the brand was targeting did not know that.

The acclaim for this achievement prompted the Irish government to ask him to take on the job of rescuing the state-owned Erin Foods, which was making heavy losses in the mid 1960s. He prudently refused to do so unless he could also run Erin’s profitable parent company, Irish Sugar.

Erin was to be the key to the next three decades of his business life. Looking for an international partner to improve its distribution and credibility in the UK, O’Reilly set up a joint company with Heinz. The US ketchup maker soon asked O’Reilly to become its UK managing director.

Over the next two decades, O’Reilly rose to the top of Heinz, becoming chief executive in 1979 and, in 1987, its first non-family chair. He transformed the company’s sales and profits, and became its largest individual shareholder, but its stock was falling by the time he retired in 2000 as consolidation among rivals left Heinz in the industry’s second tier.

His early success at Heinz had given O’Reilly the financial resources and contacts required to launch an investment company in Dublin in 1971. Through this he was able to pursue a parallel business career in Ireland as he shuttled between Heinz’s Pittsburgh headquarters and Castlemartin, the art-filled stately home on the River Liffey where Nelson Mandela and Bill Clinton were among his guests.

The most successful of his ventures was the newspaper group, Independent News & Media, where he bought effective control for £1mn in 1973 and which developed extensive interests in the UK, France, Portugal, South Africa, New Zealand and Australia.

O’Reilly bought Waterford Wedgwood in 1990, refinancing and restructuring the Anglo-Irish crystal and china company and hailing Waterford crystal as one of the four great Irish brands, alongside Guinness, Bailey’s Irish Cream and Kerrygold.

In 2000 he told the Financial Times of his ambition to build Waterford Wedgwood into a global luxury goods group to rival Gucci or Richemont. He poured much of his fortune into the effort, only for the indebted group to fall into receivership in 2009.

That same year he lost a fierce battle for control of INM to Denis O’Brien, the Irish telecoms tycoon, costing him the dividend income his newspapers had once provided. Pursued by creditors, he sold Castlemartin and other prized assets but by 2015 the man reputed to have been Ireland’s first billionaire was declared bankrupt.

It was a jarring fall for someone once known for his philanthropy. Most notably, O’Reilly had created the Ireland Fund which became a major conduit for channelling finance into constructive community projects on both sides of the Irish border.

O’Reilly was married twice. He had six children by his first wife, Susan. His second wife, Chryss, whom he married in 1991, was a member of the leading Greek shipping family of Goulandris. A noted horse breeder, she died last year.

On Saturday night, Simon Harris, Ireland’s taoiseach, described O’Reilly as “a giant of sport, business and media” who left “permanent legacies in all three”.

O’Reilly himself was fond of quoting the sportsman CB Fry’s dictum: “It is incumbent upon you to be a whole man, to be an all-rounder”. It was an epithet he lived up to.

Credit: Source link