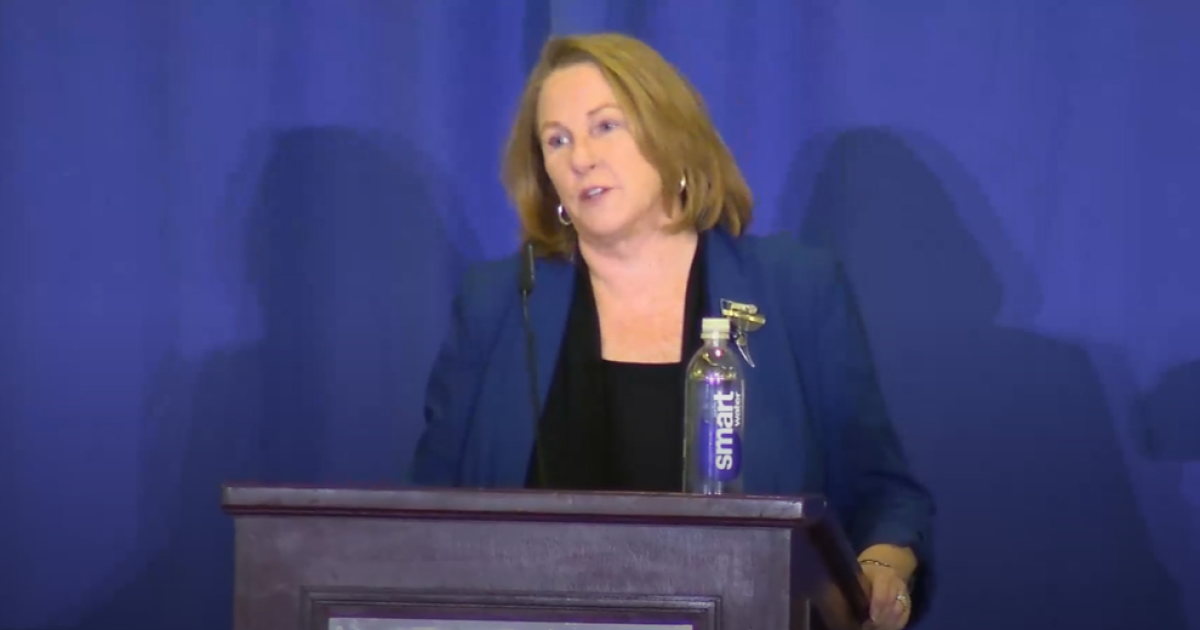

National Taxpayer Advocate Erin Collins is objecting to proposed regulations that would enable the Internal Revenue Service to shorten its third-party notice requirements to as little as 10 days, saying they would unfairly erode the taxpayer notice requirements.

In a

In 2019, the Taxpayer First Act strengthened 1998 law’s taxpayer third-party contact protections, substituting the “reasonable notice” requirement for a 45-day notice requirement before contacting a third party. Collins noted there are three statutory exceptions to this 45-day notice requirement:

- When the taxpayer authorizes the contact;

- If the IRS determines for good cause a notice would jeopardize tax collection or may involve reprisal against any person; or,

- If the contact is made with respect to any pending criminal investigation.

However, the proposed regulations that the IRS posted this spring would implement exceptions to the 45-day notice requirement, allowing the IRS to shorten the statutory 45-day notification period to 10 days when there’s a year or less remaining on the statute of limitations for collection and certain other circumstances exist. That includes when the case involves an issue where the IRS would have the burden of proof in a court proceeding, and the IRS has requested but the taxpayer has refused to extend the statute of limitations by agreement. Or, the 45-day notice requirement could be reduced to 10 days if there’s a year or less remaining on the statute of limitations and the IRS intends to ask the Justice Department file suit to reduce assessments to a judgment or to foreclose a federal tax lien.

Those exceptions could unfairly punish taxpayers for the IRS’s own delays, according to Collins.

“The IRS typically has three years to assess additional tax and ten years to collect unpaid tax,” she wrote. “The Taxpayer Bill of Rights includes the taxpayer’s right to finality — meaning, the right to know the maximum amount of time the IRS has to audit a particular tax year or to collect a tax debt. The statute of limitations is an important component of the right to finality because it sets forth clear and certain boundaries for the IRS to act to assess or collect taxes.”

She believes the IRS could find itself trying to assess or collect taxes within one year of the statute of limitations for a number of reasons that have nothing to do with the actions or events controllable by the taxpayer. Collins called on the IRS to reconsider the proposed regulations and said Congress should consider enacting additional taxpayer protections for third-party contacts.

Credit: Source link