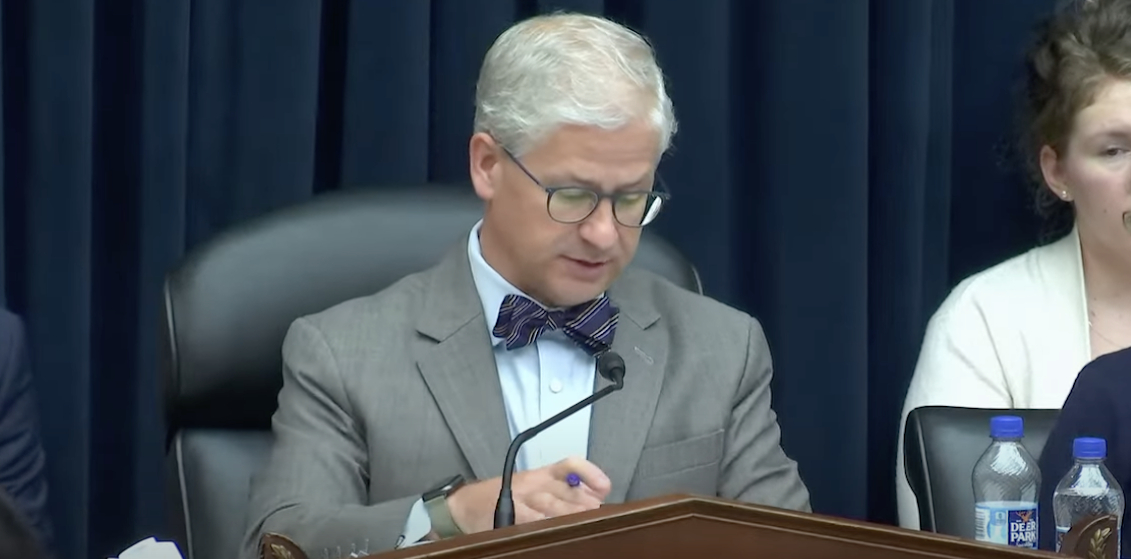

House Financial Services Committee Chair Patrick T. McHenry accused US Securities and Exchange Commission Chair Gary Gensler of avoiding requests for information about cryptocurrency-related matters, going so far as to threaten a hearing if they don’t hear back soon.

Reps. McHenry, R-N.C. and Bill Huizenga, R-Mich., sent a letter to the SEC Chair this week demanding responses to questions about former FTX CEO Sam Bankman-Fried and about the process of digital asset exchanges registering with the regulator.

The House Financial Services Committee, which oversees the SEC, has held several crypto hearings this year — including one about stablecoins slated for next week.

Gensler appeared before the committee on April 18, which got heated when McHenry asked the SEC chair whether ether was a security or a commodity, which he said depended on certain circumstances.

Now, McHenry and Huizenga want Gensler to respond to their questions by May 19.

If not, they said they plan to schedule testimony.

“We are tired of the stonewalling from @SECGov. During a @FinancialCmte hearing, @GaryGensler said he respects the role of congressional oversight. If Chair Gensler won’t live up to his own standard and answer our questions, we’ll make sure someone from his staff does for him,” Huizenga tweeted on Thursday.

The requests

Huizenga and McHenry said they asked about the charges against Bankman-Fried back in February to which Gensler produced 232 pages of documents.

All of those were publicly available, they said.

Later on, in March, SEC staff sent a general briefing about the agency’s enforcement division, they said.

“While informative, this briefing was not responsive to the February request,” the Republican lawmakers said.

Ultimately, SEC staff said they were “not in a position to produce anything further at that time,” they wrote.

The committee also sent a letter asking for a list of digital asset entities that have tried to register since Gensler became chair, as well as how that process works.

McHenry and Huizenga said they didn’t get a response.

“To date, your responses to our requests have been wholly inadequate.”

The SEC did not immediately respond to a request for comment.

Credit: Source link