Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

US investors in Chinese venture capital funds are racing to comply with new rules that ban them from backing companies that develop artificial intelligence and other advanced technologies used by the People’s Liberation Army.

Measures by the Biden administration, which come into force on Thursday, impose civil and criminal penalties for US entities that invest in Chinese companies involved in semiconductors, quantum computing or AI systems that could be used by China’s military.

The rules introduce a hefty due diligence burden on US investors. Institutions with money tied up in Chinese investment funds must secure “binding contractual assurance” that their cash will not be used to buy companies that violate the rules.

Some large investors have secured such assurances from their Chinese fund managers in recent weeks, but requests from others have been refused, according to people advising large pension and endowment funds on compliance planning.

Many investors have responded by cutting back or pausing new investments in China amid growing tensions between Washington and Beijing. Silicon Valley venture firms Sequoia Capital and GGV Capital separated from their Chinese entities in 2024.

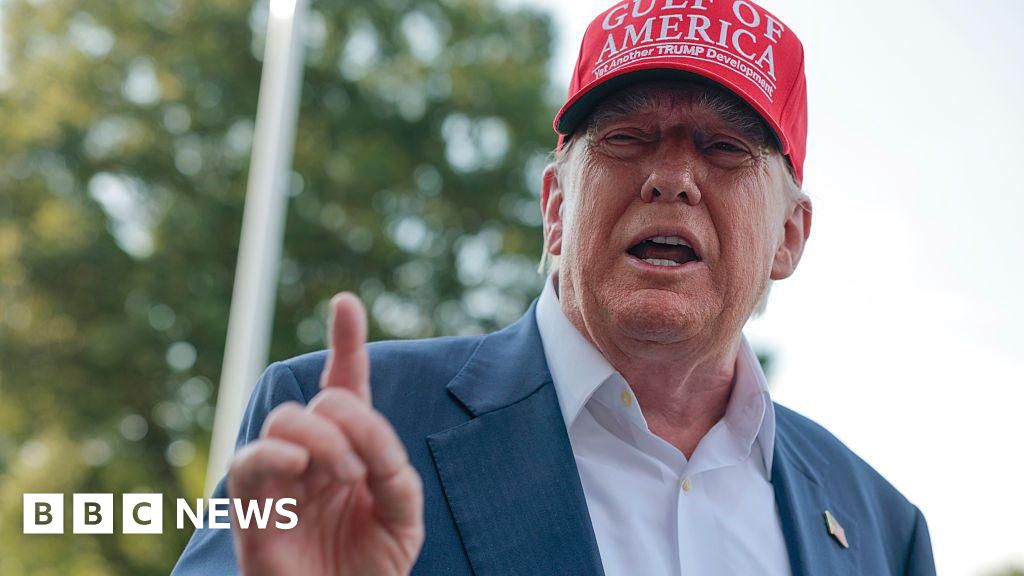

The rules come into effect at a time when US-China ties could be further strained by the return to office of president-elect Donald Trump, who has vowed to increase tariffs on Chinese imports, highlighting the risks for US groups of investing in the world’s second-largest economy.

They also follow a period of growing bipartisan consensus in Washington that the US has to do more to prevent China from getting ahead in key technologies, particularly militarily sensitive ones.

A report by the US House of Representatives China committee in February said American venture capital firms had invested more than $3bn into technology companies that directly fuelled China’s military advancement.

Investors granted assurances will have to perform due diligence to ensure the rules are being followed by their Chinese funds. This is a particular concern since the country’s laws empower the government and private individuals to take countermeasures against “discriminatory” foreign sanctions by other states.

“The problem is that US investors are signing binding contracts with some entities that may be otherwise bound to violate it,” said Phil Ludvigson, a partner at law firm King & Spalding, who advises on national security risks related to foreign investment. “It puts everyone in a tough spot.”

The new rules could also reduce investing in non-prohibited sectors in China because of the wide use of AI.

“US dollar foundations are done committing to China, period,” said an executive at a large American endowment fund. “The hurdle for making new commitments on the private side is 50,000 feet high.”

China reported its smallest annual foreign direct investment since the 1990s in 2023, while foreign capital in China’s VC industry plunged 60 per cent in 2023 to $3.7bn, according to Dealogic.

By contrast, over the past decade Silicon Valley venture capitalists, wealthy family offices and public pension and endowment funds across the US — known as “limited partners” — invested billions of dollars in China’s technology sector.

HongShan, Sequoia Capital’s former China business, raised nearly $9bn in 2022, with about half coming from US LPs.

Hillhouse, which launched in 2005 with a $20mn investment from Yale University’s endowment fund, where its founder Zhang Lei had studied, has grown into a $65bn tech investing powerhouse.

Other big US investors in China include the $460bn California Public Employees’ Retirement Fund and the $260bn New York State Common Retirement Fund, both of which have between 1 per cent and 3 per cent of their portfolios invested in the country.

The 72 largest US public pension funds pumped $68bn into China between 2020 and 2023, according to a report by the Future Union think-tank.

Credit: Source link