Policy and analysis correspondent, BBC Verify

Getty Images

Getty ImagesThe US Court of International Trade on Wednesday struck down President Donald Trump’s tariffs imposed under the 1977 International Emergency Economic Powers Act (IEEPA).

The court ruled IEEPA did not give the president the authority to impose certain tariffs.

This affects the “fentanyl” tariffs imposed by the White House on Canada, Mexico, China since Trump returned to the White House. These tariffs were brought in to curb smuggling of the narcotic into the US.

It also affects the so-called “Liberation Day” tariffs announced on 2 April, including the universal 10% baseline tariff on all imports to the US.

However, the ruling does not affect the Trump administration’s 25% “sectoral” tariffs on steel and aluminium imports and also his 25% additional tariffs on cars and car part imports, as these were implemented under a different legal justification.

A US federal appeals court decided on Thursday night that Trump’s global tariffs can temporarily stay in place while it considers the White House’s appeal against the trade court’s judgement – but the future of the President’s tariff agenda remains in the balance.

How much impact could this have on US trade?

Data from US Customs shows the amount of revenue collected in the 2025 financial year to date (ie between 1 October 2024 and 30 April) under various tariffs.

The data gives an approximate sense of the proportion of tariffs struck down and unaffected by the trade court’s ruling.

It shows the tariffs imposed under IEEPA on China, Mexico and Canada in relation to the fentanyl smuggling had brought in $11.8bn (£8.7bn) since February 2025.

The 10% reciprocal tariffs – also justified under IEEPA – implemented in April had brought in $1.2bn (£890m).

On the other side of the ledger, the tariffs on metals and car parts – which are unaffected by this ruling – brought in around $3.3bn (£2.4bn), based on rounded figures.

And the biggest source of tariff revenue for the US in the period was from tariffs imposed on China dating back to Trump’s first term in office, which raised $23.4bn (£17.3bn). These are also not affected by the court ruling, as they were not justified by IEEPA.

However, this is a backward looking picture – and the new tariffs were expected to raise considerably more revenue over a full financial year.

Analysts at the investment bank Goldman Sachs have estimated that the tariffs the trade court has struck down were likely to have raised almost $200bn (£148bn) on an annual basis.

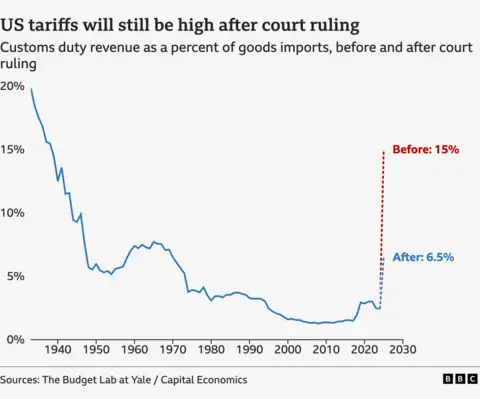

In terms of the overall impact on Donald Trump’s tariff agenda, the consultancy Capital Economics estimates the court ruling would reduce the US’s average external tariff this year from 15% to 6.5%.

This would still be a considerable increase on the 2.5% level of 2024 and would be the highest since 1970.

Yet 15% would have been the highest since the late 1930s.

What does this mean for any trade deals?

Trump had been using his tariffs as negotiating leverage in talks with countries hit by his 2 April tariffs.

Some analysts believe this trade court ruling will mean countries will now be less likely to rush to secure deals with the US.

The European Union (EU) intensified negotiations with the White House last weekend after Trump threatened to increase the tariff on the bloc to 50% under IEEPA.

The EU – and others, such as Japan and Australia – might now judge it would be more prudent to wait to see what happens to the White House’s appeal against the trade court ruling before making any trade concessions to the US to secure a deal.

What does it mean for global trade?

The response of stock markets around the world to the trade court ruling on Wednesday suggested it would be positive.

But it also means greater uncertainty.

Some analysts say Trump could attempt to reimpose the tariffs under different legal justifications.

For instance, Trump could attempt to re-implement the tariffs under Section 301 of the Trade Act of 1974, which empowers the U.S. Trade Representative (USTR) to address foreign practices that violate trade agreements or are deemed “discriminatory”.

And Trump has also threatened other sectoral tariffs, including on pharmaceuticals and semiconductors. Those could still go into effect if they are not justified by IEEPA.

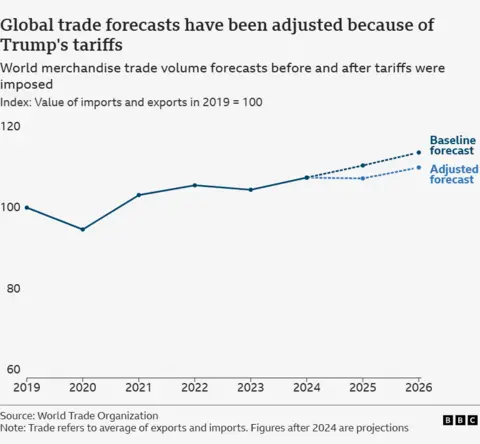

Last month the World Trade Organization (WTO) said that the outlook for global trade had “deteriorated sharply” due to Trump’s tariffs.

The WTO said it expected global merchandise trade to decline by 0.2% in 2025 as a result, having previously projected it would grow by 2.7 per cent this year.

The trade court ruling – if it holds – might help global trade perform somewhat better than this.

But the dampening impact of uncertainty regarding whether US tariffs will materialise or not remains.

The bottom line is that many economists think trade will still be very badly affected this year.

“Trump’s trade war is not over – not by a long shot,” is the verdict of Grace Fan of the consultancy TS Lombard.

Credit: Source link