XRP has surged to $2.41, gaining nearly 30% in the past week as bulls push for a breakout above the critical $2.25 resistance.

This rally comes amid rising optimism over a potential settlement between Ripple Labs and the U.S. Securities and Exchange Commission (SEC), which could redefine XRP’s regulatory status in the United States.

Currently, XRP is trading around $2.37, with a robust 24-hour trading volume of $5.03 billion, reflecting strong market interest.

Legal Developments and ETF Speculation Fuel Rally; XRP Supported

The SEC vs. Ripple case remains a major catalyst for XRP’s price action. Recent court documents reveal that the SEC has requested Judge Analisa Torres to reconsider a prior ruling, a move that some analysts see as a potential sign of settlement discussions.

If resolved, this two-year legal battle could remove one of the biggest regulatory overhangs for XRP, possibly clearing the way for broader institutional adoption.

Adding to the bullish momentum, rumors of an XRP ETF launch in 2025 have further stoked market enthusiasm.

According to reports, this potential ETF could significantly boost institutional inflows, similar to the impact seen with Bitcoin ETFs, which collectively added over $1 billion in net inflows last week.

If approved, an XRP ETF could provide a more accessible investment vehicle for institutional investors, further supporting XRP’s price growth.

Recent Key Developments:

- XRP up nearly 30% in the past week

- SEC’s letter to Judge Torres hints at possible settlement

- Rumors of XRP ETF in 2025 fuel institutional interest

Whale Accumulation Signals Institutional Confidence

In addition to legal optimism, large-scale XRP transactions suggest growing institutional interest. On May 9, Ripple-affiliated whales moved a staggering 370 million XRP, worth approximately $782 million.

These transfers included a 70 million XRP transaction ($148.3 million) and a 300 million XRP transfer ($633.7 million), according to Whale Alert data.

Such large movements often indicate strategic positioning by institutional investors, possibly in anticipation of a favorable legal outcome or a major market event.

On-chain metrics further support this narrative. According to Santiment, the share of XRP held by whales (addresses with between 1 million and 10 million XRP) has risen from 8.24% to 9.44% over the past three months, reflecting a significant accumulation phase.

This trend suggests that large investors are increasingly viewing XRP as a long-term bet, reinforcing the bullish case for the token.

Whale Activity Highlights:

- 370 million XRP moved on May 9, worth $782 million

- Whale-held XRP share increased from 8.24% to 9.44% in recent months

- Large-scale transactions signal growing institutional confidence

Ripple’s Strategic Moves: Expanding XRP Ecosystem and Halting Quarterly Market Reports

Apart from this, Ripple has made important moves to grow the XRP ecosystem. Ondo Finance plans to launch a tokenized U.S. Treasury fund on the XRP Ledger, which is seen as a major development.

This fund will give institutional investors access to U.S. government-backed assets through blockchain technology, using Ripple’s RLUSD stablecoin for minting and redemption.

This could make XRP more attractive to institutional investors.

Moreover, Ripple has decided to stop releasing its quarterly market reports, raising concerns about transparency.

This decision follows worries that the reports were being used in its ongoing legal battle with the SEC and ends an eight-year tradition.

- Ondo Finance to launch U.S. Treasury fund on XRP Ledger, attracting institutions.

- Ripple’s RLUSD stablecoin used for minting and redemption in the fund.

- Ripple halts quarterly market reports, raising transparency concerns.

Technical Outlook: Bulls Aim for $2.48

From a technical perspective, XRP price prediction is bullish as it’s trading around $2.3748, consolidating just below the 23.6% Fibonacci retracement level at $2.3890.

This level, which aligns closely with an ascending trendline, serves as a critical support zone. If bulls can defend this area, the immediate upside target is the recent high at $2.4762, followed by the psychological $2.50 level.

However, the MACD is showing early signs of a bearish crossover, suggesting a possible short-term pullback.

Traders should watch for a potential drop below $2.3351, which could expose XRP to deeper losses toward the 50% Fibonacci level at $2.2915.

Trade Setup:

- Buy Above: $2.3350

- Take Profit: $2.4760

- Stop Loss: $2.2915

Strategy: Consider buying above $2.3350, targeting the recent high at $2.4760. Use a tight stop below $2.2915 to manage downside risk, as a break below this level could trigger a deeper correction.

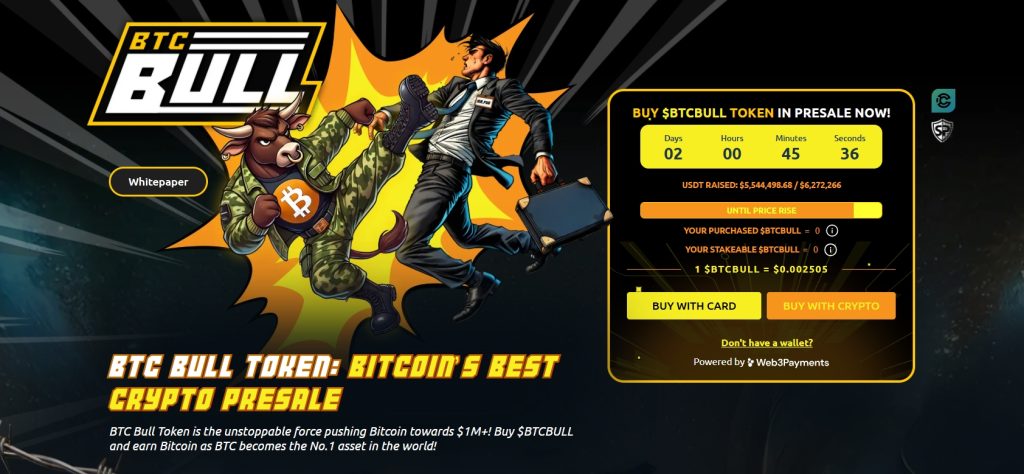

BTC Bull Token Crosses $5.58M as Flexible 78% Staking Yield Draws Investors

BTC Bull Token ($BTCBULL) continues to gain traction, crossing $5.58 million in funds raised as it nears its $6.27 million presale cap.

Priced at $0.002505, the token has positioned itself as more than just a meme coin—offering real utility through flexible, high-yield staking.

Utility-Driven Tokenomics Fuel Demand

Unlike typical meme tokens, BTCBULL blends crypto culture appeal with tangible staking rewards. Investors can currently earn an estimated 78% APY while keeping their tokens fully liquid—unstaking is allowed at any time without penalties or lockup periods.

This model has resonated with investors who seek yield without sacrificing access, especially in a volatile crypto environment.

Current Presale Stats:

- USDT Raised: $5,581,603.93 of $6,272,266

- Current Price: $0.002505 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% annually

With less than $690K left before the next milestone, the presale window is narrowing fast. For investors chasing high yields with exit flexibility, BTCBULL is becoming an increasingly compelling contender in the 2025 crypto cycle.

The post XRP Price Prediction: Ripple Surges to $2.41 as Bulls Eye Breakout Above Critical $2.25 Resistance – Crypto Summer Ahead? appeared first on Cryptonews.

Credit: Source link

Marco Ħ (@MarcoSalzmann80)

Marco Ħ (@MarcoSalzmann80)