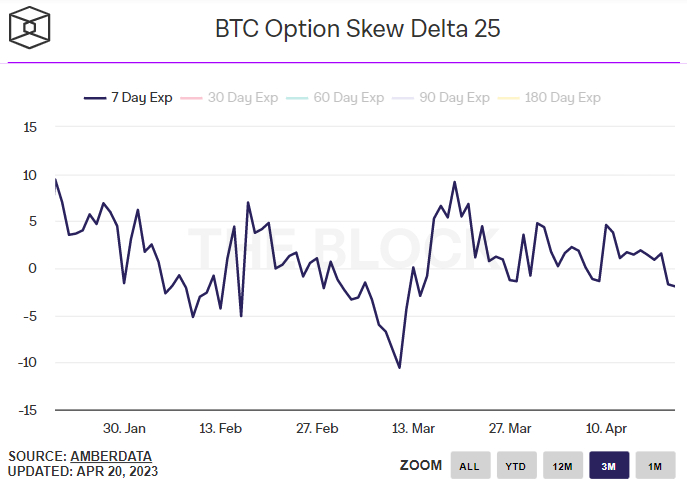

Investors have turned their most bearish on Bitcoin’s short-term price outlook in more than one month, according to options market data presented by crypto data analytics website The Block.

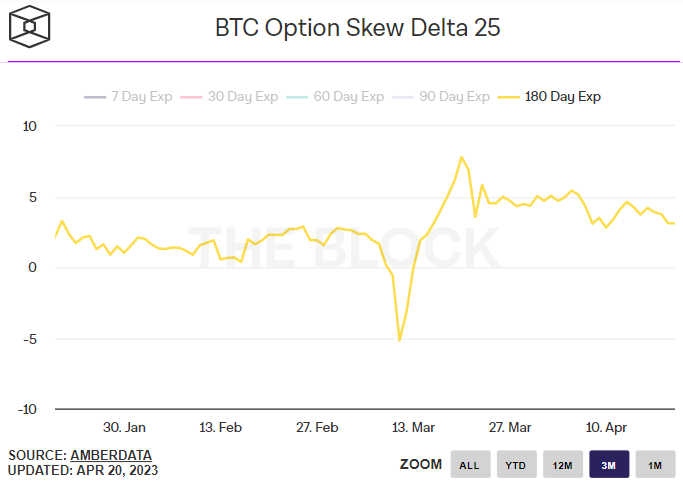

However, at the same time, investors seemingly remain confident in BTC’s longer-term outlook.

The 25% delta skew of Bitcoin options expiring in seven days fell to around -2 on Friday, its lowest level since the 14th of March.

A 25% delta skew of below zero means that bearish Bitcoin put options expiring in seven days are trading at a premium versus equivalent bullish call options, suggesting investors disproportionately demand the former.

The increase in demand for short-term downside protection (which put options provide) comes as Bitcoin falls into the low $28,000s.

At current levels around $28,200, BTC is down around 9% versus the multi-month highs it hit earlier in the month above $31,000, is below its 21-Day Moving Average (which seemed on Thursday to provide resistance) and is below an uptrend that had been supporting the price action in late-March/early-February.

With Bitcoin below some key short-term support levels, risks of an extended correction to support in the $26,500 and $25,200-400 zones have risen.

Investors Remain Bullish on Longer-term BTC Price Outlook

Despite the 7-day 25% delta skew weakening to its lowest level in over a month, the 180-day 25% delta skew remains at fairly elevated levels of above 3.

That means that bullish Bitcoin call options expiring in 180 days are trading at a premium versus equivalent bearish put options, suggesting investors disproportionately demand the former.

And confidence in Bitcoin’s longer-term price outlook makes sense when you consider macro factors, on-chain trends and medium to long-term technical indicators.

While significant uncertainty remains about how many more times the US Federal Reserve will lift interest rates and when it will start cutting them, one thing seems certain – the end of the Fed’s tightening cycle looks to be close as US inflation and economic growth decelerate.

That implies that unfavorable changes to financial conditions are unlikely to return as a major headwind to crypto markets in 2023, as was the case in 2022.

Meanwhile, Bitcoin is likely to continue to derive tailwinds from key recent technical developments including 1) Bitcoin’s spectacular bounce from its 200DMA and Realized Price in mid-March and 2) Bitcoin’s “golden cross” (when the 50DMA went above the 200DMA) in early February.

Elsewhere, a litany of on-chain and market cycle indicators are screaming that last year’s lows marked the end of the crypto bear market. Many investors will remain confident that Bitcoin’s 2023 bull market will alive and well.

As such, expect bargain hunters and dip-buyers to be waiting eagerly on the sidelines to jump in each time Bitcoin posts significant price dips, just as was the case during mid-March.

Credit: Source link