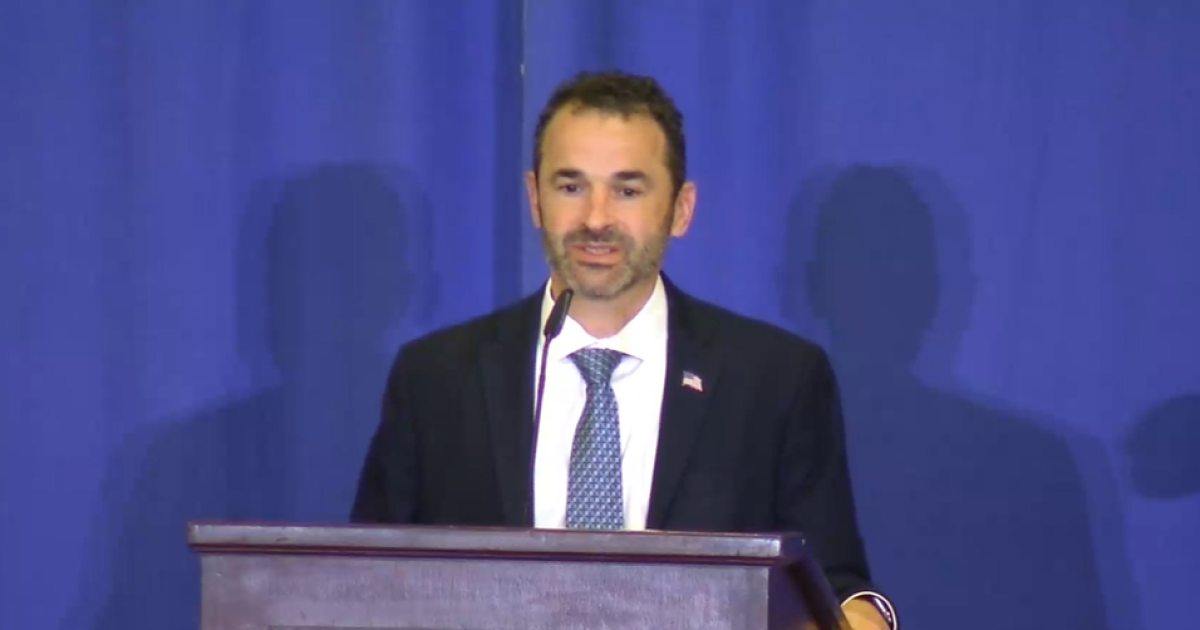

Internal Revenue Service commissioner Danny Werfel and National Taxpayer Advocate Erin Collins discussed the enhancements the IRS has been making thanks to the additional billions of dollars of funding it’s receiving under the Inflation Reduction Act during an AICPA tax conference Tuesday.

“Going back to what an underfunded IRS versus a funded IRS means, an underfunded IRS is on its heels,” said Werfel at the AICPA & CIMA National Tax and Sophisticated Tax Conference in Washington, D.C. “The best we can do is potentially tweet out a warning. A funded IRS can be proactive, step in, lean in and disrupt scams, give taxpayers new tools, so that they can have visibility into when they’re being scammed or not.”

He noted that the IRS can do more aggressive outreach and community-based partnerships when it sees tax scams and send alerts. If someone is unfortunately victimized, the IRS can support tax scam victims and do what is needed to hold the perpetrators accountable. The remarks came as IRS funding was recently targeted for cuts by House Republicans (see story).

“I think more people need to hear this basic choice that we have: the choice between an accessible IRS, the choice between an IRS that can figure out the balance due on our complicated returns, the choice for an IRS that can lean in and be proactive in disrupting scams and protecting victims,” said Werfel. “These don’t seem to me to be overly political objectives. This does not in any way seem to be, in my opinion, a nefarious agenda. It’s a good agenda, and it is our agenda.”

He pointed to recent improvements at the agency in its phone lines, but acknowledged the IRS has more work to do. “The question should not be: ‘Can the IRS improve with these funds?’ The question should be: ‘Can the IRS continue to improve’ because we’re already showing improvement,” said Werfel. “There are certain parts of our phone line, in particular the 1040 line, that have shown dramatic improvement with a much higher level of service.”

He acknowledged that there are certain parts of the phone line that the IRS still has to work on, but he is encouraged by the hiring of 5,000 customer service reps last year to work the phones. “They were new, and when you’re a new employee, you’ve got a lot to learn,” said Werfel. “These 5,000 customer service reps now have a full filing season under their belt, I would anticipate we’re going to be even better and more productive this year.”

He noted that the IRS has also been investing in technology in its call centers. “That means it’s not just about hiring people,” said Werfel. “We went out early in my tenure and benchmarked what other contact or call centers are doing. They’re doing chatbots via voice recognition. They are predicting call volume. They have a lot of data, and we have a lot of data too, and with all that data, you can start to predict with 90% accuracy what the call volume is going to be on Tuesday afternoon versus Wednesday morning, and the type of calls you’re going to get. And if you’re good at a 90% level, then you can start to staff and prepare for what a Tuesday afternoon is going to look like versus a Wednesday morning.”

Now that the IRS has the extra funding, it’s starting to leverage that technology. “Because we have the funds now, we could now do what we need to do to gather all the data that we had that was just sitting there idle,” said Werfel. “Now we’re gathering the data, putting it in a format where it can be evaluated, and we’ve now deployed the predictive model and we’ve been testing it for the last several months. And guess what? We’re getting about a 90% accuracy rate just like the private sector does. Now that’s a new tool that’s going to allow us to be more efficient.”

He noted that the IRS has also been making improvements in its online accounts for tax professionals as well as online accounts for individual taxpayers.

“We’re making improvements to the tax pro online accounts so that you can view payment activity and taxpayer balance due,” said Werfel. “We have an individual online account. We’re trying to make advances there. Each filing season, you and others should come back to the IRS and say, it’s different. It’s better, it’s improving. On the individual online accounts, we want taxpayers to have the ability to view payments. We have launched a business online account. We started the launch with sole proprietors. Do we have a lot more work to do? Of course, but it’s like brick by brick, laying the foundation, taking these critical modernization funds, and investing in them. In some cases, things can be done big and dramatic, like bringing in 5,000 customer service reps, and immediately turning around some of those statistics. But in some cases, the funds take a while, and the bricks go slow, but they do move forward.”

IRS processing challenges and delays

National Taxpayer Advocate Erin Collins, who heads the Taxpayer Advocate Service, discussed some of the challenges she has been seeing as well and what she thinks the IRS still needs to address.

“We’ve all struggled in the last three years — your clients, taxpayers, practitioners, IRS employees, and even my TAS employees,” she said. “It has been a tough three years. I don’t think we have to tell anybody how difficult all your struggles have been. But I do appreciate what you have done. Most people are familiar with the IRS because of the filing season. And that is one main interaction that they have with the IRS. And unfortunately, that was the most painful thing for the last three years, and for good reason. But that doesn’t help your client. It doesn’t help taxpayers understand when they’re not getting their refund timely. Or they weren’t getting their phones answered. It caused a lot of frustration for people, so the good news is IRS today is in a much better place than it was over the last three years. The not so good news is we still have a long way to go.”

She believes the paper backlog was one of the main challenges for the IRS. “Paper was not the IRS’s friend,” she said. “Paper was a real challenge on filing, and because of that, refunds were delayed.”

However, she sees a decrease in the backlog of returns this year to a more typical timeframe, with paper-filed returns being processed in about six weeks and the backlog down to about 200,000 paper returns. However, the IRS has been running into delays on processing the 1040-X amended returns, she acknowledged.

“About 18 months ago, the IRS allowed taxpayers to electronically file 1040-X’s,” said Collins. “That was a really good thing. The challenge, though, is the back-end process is still manual.”

She has also seen improvements in phone service. Approximately 282 million calls came in about two years ago, then dropped down to 172 million calls. This year, it was at a more normal level of around 90 million calls. However, because many of the customer service reps were also assigned to process returns to reduce the backlog, that led to longer wait times in some areas. While the IRS was able to meet Treasury Secretary Janet Yellen’s goal of answering 85% of calls, that didn’t happen with the Practitioner Priority Service phone line.

“As many of you experienced, that goal was not set for the practitioner priority line, and that’s the number you all call,” said Collins. “I think this last fiscal year it was closer to 35 to 40% level of service, with a lot longer wait times. I think sometimes it was frustrating for practitioners to hear the IRS talk about how they achieved the 85% service on their main lines for account management, which they did. But that’s not necessarily the line that you’re calling. Sometimes there was a disconnect and frustrations that I heard when I went out and spoke to focus groups and individuals so that’s been a real challenge. The other challenge is in order to reach that 85% level of service, they were unable to multitask. You weren’t having them process the paper. Hence right now, we have an accumulation of returns that still need to be processed. Right now it’s around two and a half million.”

Credit: Source link