Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

The Nasdaq Composite is on course for its best first half of the year since 1983, after investors flocked to companies in the tech-heavy index that they expect will benefit from the growth of artificial intelligence.

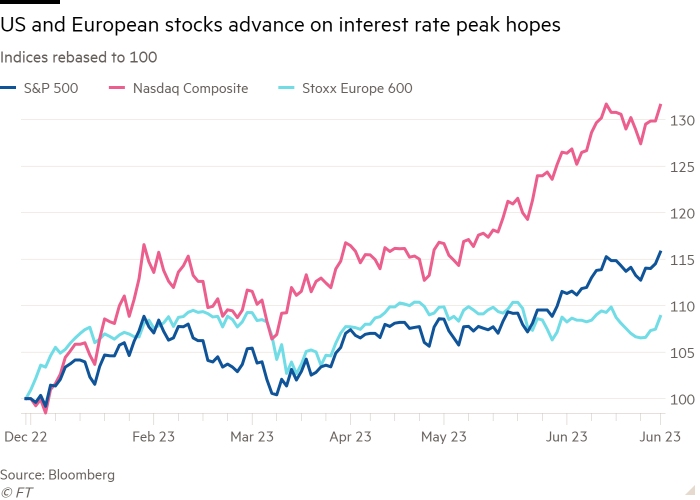

The index had gained 32 per cent for the first six months of 2023 as of mid-afternoon on Friday, the last day of June. For any half year, first or second, the Nasdaq was set to record its strongest performance since the peak of the dotcom bubble in the second half of 1999.

US stock markets have powered past a series of challenges since January including turmoil among regional banks, brinkmanship over the government debt ceiling and higher interest rates engineered by the Federal Reserve.

The biggest contributors to the market rally have been a handful of large tech companies: Apple, Amazon, Microsoft, Nvidia, Alphabet, Meta and Tesla. Apple on Friday hit a new record high, valuing the company at more than $3tn, while chipmaker Nvidia has almost tripled in price since the start of the year.

The Nasdaq has risen twice as much as the 16 per cent rise in the broader S&P 500 index since the start of the year, highlighting the effects of large tech groups. If all the stocks in the S&P 500 were weighted equally, the index would be up a much more modest 5 per cent for 2023.

“We’ve had some moderation on inflation which is clearly supportive for equities, and clearer messaging from central banks. That increased certainty has helped enormously . . . but in the US in particular it has really been that ‘Magnificent Seven’ that has driven most of the gains,” said Sinead Colton Grant, BNY Mellon Asset Management head of investor solutions, referring to the seven large tech groups.

The lack of breadth in the rally has left some analysts and investors sceptical that the gains will continue, particularly given concerns that the Fed’s ongoing efforts to bring down inflation will push the economy into recession.

“If you believe that the Fed will be successful in slowing the economy down, it’s hard to justify where the equity market is,” said Greg Davis, managing director and chief investment officer at Vanguard. “Right now, something is a bit out of whack.”

In its first-half review earlier this week, asset manager BlackRock said the recent performance of US equities had been “unusual”, but that did not mean a reversal was inevitable.

Tony DeSpirito, BlackRock’s chief investment officer for fundamental equities, contrasted the recent enthusiasm around AI with the hype regarding previous new technology.

“The demand is really real. You can contrast what is going on in AI versus [enthusiasm for] the metaverse or virtual reality a year or two ago. The orders are really there. The earnings growth is coming,” he said.

Markets were helped on Friday by a decrease in the core personal consumption expenditure price index, the US central bank’s preferred inflation gauge. The S&P and Nasdaq were up 1.3 per cent and 1.5 per cent for the day, respectively.

European blue-chip indices also made gains in the first half of the year, as investors bet that inflation would slow and the European Central Bank’s historic tightening campaign would peak. The pan-European Stoxx 600 closed the half almost 9 per cent higher, including a 1.2 per cent gain on Friday.

France’s Cac 40 and Germany’s Dax gained 14 per cent and 16 per cent during the first half, respectively, though the UK’s FTSE 100 has trailed behind with a 1 per cent gain. The FTSE has been weighed down by the UK’s stubbornly high inflation and the index’s disproportionate exposure to falling oil prices.

Encouraging inflation data released on Friday helped eurozone stocks end the quarter on a high. The headline rate of price rises across the currency bloc eased more than expected to 5.5 per cent in June, stoking optimism that the ECB could halt its programme of interest rate rises sooner than expected.

However, core inflation — which strips out volatile energy and food prices — ticked up, which BNY Mellon’s Colton Grant said was a concern.

“We’re constructive on US stocks, we like the inflation moderation . . . and are increasingly confident that the likelihood of recession is falling . . . [but] we’re much more cautious about Europe, particularly [the eurozone]. That view is driven by sticky inflation, and the fact the ECB will need to hike more.”

Credit: Source link