Victims of severe storms, straight-line winds and tornadoes in Oklahoma on April 19 and 20 now have until Aug. 31 to file various federal individual and business returns and make tax payments.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency. Individuals and households that reside or have a business in McClain and Pottawatomie Counties qualify.

Certain deadlines falling between April 19 and Aug. 31 are granted time to file through Aug. 31. Affected individuals and businesses will have until Aug. 31 to file returns and pay any taxes that were originally due during this period.

That August deadline also applies to any payment normally due during this period, including the quarterly estimated tax payment normally due on June 15 and the quarterly payroll and excise tax returns normally due on May 1 and July 31. Penalties on payroll and excise tax deposits due on or after April 19 and before May 4 will be abated as long as the tax deposits are made by May 4.

If an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date that falls within the postponement period, they should call the telephone number on the notice to have the IRS abate the penalty.

The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at (866) 562-5227 to request this tax relief.

Individuals and businesses in a federally declared disaster area who suffered uninsured or unreimbursed disaster-related losses can claim them on either the return for the year the loss occurred or the return for the prior year. They should write the FEMA declaration number (4706-DR) on any return claiming a loss, as well as the Disaster Designation, “Oklahoma, severe storms, straight-line winds and tornadoes,” in bold letters at the top of the form.

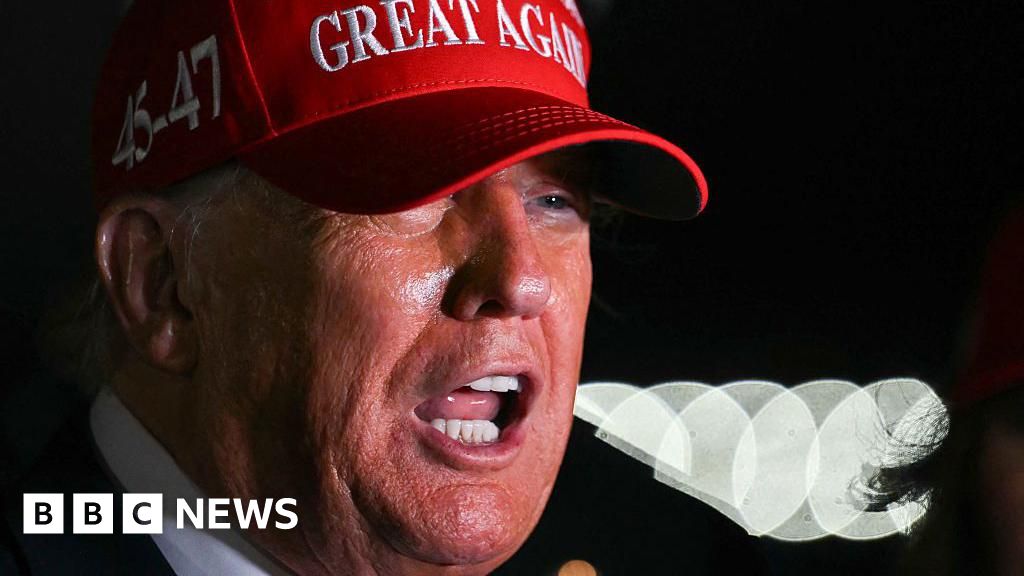

Scott Olson/Photographer: Scott Olson/Getty

The IRS waives the usual fees and requests for copies of previously filed tax returns for affected taxpayers. Taxpayers should put the above assigned disaster designation in bold letters at the top of Form 4506, “Request for Copy of Tax Return” (PDF), or Form 4506-T, “Request for Transcript of Tax Return (PDF),” and submit it to the IRS.

Affected taxpayers contacted by the IRS on a collection or examination matter should explain how the disaster impacts them so that the IRS can provide appropriate consideration.

More information is available on this page of IRS.gov.

Credit: Source link